![]()

There’s an old saying; A picture is worth a thousand words. Pie charts will likely never be confused with great art in terms of story telling, but they have a way of making complicated issues clear. Income taxes are one of those things that are naturally difficult to grasp and the issue is made that much more opaque because liberals love to obscure the facts.

One of the shibboleths of the left is that the rich don’t pay their fair share of taxes. One of the more amusing segments of the 2008 Presidential campaign involved Neal Boortz asking then Democrat hopeful Dennis Kucinich two simple questions:

- What percentage of total income is earned by the top 1% of income earners?

- What percentage of total federal income taxes are paid by the top 1% of income earners.

of all of the federal income taxes – according to Congressman Kucinich answered: He thought the top 1% of income earners earned 60% of the income and paid about 15% of the taxes. He was a little off. In fact, the top 1% of income earners earn approximately 17% of all the earnings in the country. That’s certainly higher than the 1% they represent of the population but a far cry from Congressman Kucinich’s 60%. More astounding however, is that they pay fully 39% a 2009 Congressional Budget Office report. The below chart demonstrates clearly the absurdity of the notion that the rich do not pay their fair share of taxes.

of all of the federal income taxes – according to Congressman Kucinich answered: He thought the top 1% of income earners earned 60% of the income and paid about 15% of the taxes. He was a little off. In fact, the top 1% of income earners earn approximately 17% of all the earnings in the country. That’s certainly higher than the 1% they represent of the population but a far cry from Congressman Kucinich’s 60%. More astounding however, is that they pay fully 39% a 2009 Congressional Budget Office report. The below chart demonstrates clearly the absurdity of the notion that the rich do not pay their fair share of taxes.

The first chart shows that the rich do indeed pay far more than their oft cited “fair share” of income taxes. Not only that, it also shows that the bottom 40% of wage earners actually have a negative tax rate and get money back from the government in the form of income tax credits!

Another of the left’s arguments is that the lower income wage earners pay a disproportionate amount of the Social Security / Medicare tax. That too is false. The second chart states that the top 10% of wage earners pay 43.5% of all social insurance taxes while the bottom 40% pay just 15%.

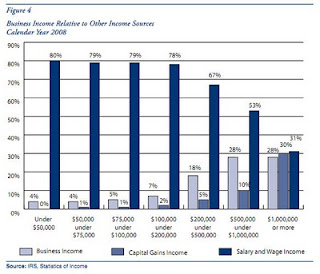

Why does any of this matter in the first place? The third chart (taken from a 2010 report from the Tax Foundation) demonstrates why…Jobs. It compares wage & salary, capital gain, and dividend income for all income earners. As you can see, for the 80% of income earners below $200,000 per year, wages (i.e. a job) make up almost their entire incomes. Without jobs that someone else creates they would have no income… except government transfer payments.

Why does any of this matter in the first place? The third chart (taken from a 2010 report from the Tax Foundation) demonstrates why…Jobs. It compares wage & salary, capital gain, and dividend income for all income earners. As you can see, for the 80% of income earners below $200,000 per year, wages (i.e. a job) make up almost their entire incomes. Without jobs that someone else creates they would have no income… except government transfer payments.

At the $200,000 and above level, business and dividend income starts to take off and by the $1,000,000 and above level the three are almost equivalent. Those are the telltale signs of success. Those people earning those $200,000 and above incomes are the people creating the jobs that employ most of the remaining 80% of the population.

Put another way, jobs are not created by wage earners. Jobs are created by entrepreneurs risking their capital to start businesses… And those entrepreneurs are the usually found in that $200,000 and above group. The businesses they start generate 65% of all new jobs created in the United States.

While the first two charts debunk the myth that the rich do not pay their “fair share” the above chart demonstrates why it matters: The rich are the ones starting small businesses and creating jobs and prosperity.

While the first two charts debunk the myth that the rich do not pay their “fair share” the above chart demonstrates why it matters: The rich are the ones starting small businesses and creating jobs and prosperity.

Myths die hard, particularly when their proponents willingly ignore the facts. The myth that the rich don’t pay their fair share should soon be headed the way of the global warming hoax. Clearly it is the people at the upper end of the income spectrum that are being treated unfairly. They are not paying their fair share… They are paying more. Not only are they responsible for 2/3 of all new jobs created, but in return they are rewarded with being allowed to keep even less of their income as they become more successful. Perhaps as more Americans examine and understand what it takes to generate and sustain a dynamic and growing economy the “tax the rich” cries will begin to fall on deaf ears. That’s exactly what America could use right now, a reinvigorated entrepreneurial class striving to put more money in their pockets… and generating millions of jobs in the process.

See author page

@anticsrocks LOL your moron insult just shows how immature you are you pathetic piece of trash. Life is all luck and if you haven’t figured that out yet your living in a dream world kid.

@Life is all luck.: It is evident that you have no interest in honest debate. Should I have called you a moron? No. But I did and it stands, get over it.

Now that the petty insults are out of the way, I noticed you completely glossed over the points I made. Your inability to bring forth a reasoned argument about your assertion that all rich people inherit or fall into their money by luck is sad, really.

Come on now, what are you afraid of? I gave you a small, partial list of successful people who got that way by hard work, not luck. And you gave what back? Insults? Ignoring the issue?

You’ll have to do better than that here at FA, if you want to be taken seriously.

@Randy: Amen! 😀

@anticsrocks:

Great comment about the mobility of Americans from poor to middle class to rich.

I’ve seen it over and over in hubby’s family as well as some of my family.

(I have a flaky bro and a late sister who never wanted more than to hunt and gather, so that’s what they did.)

I have also seen it among neighbors, especially their children.

They grow up, get married, are fairly poor but struggle to finish school and LO & BEHOLD get quite well off.

Poverty is not a straight jacket in the USA like it is in, say, Muslim countries where you cannot take out loans.

But one thing I really had hope for with Obama was that he’d get America’s black youth to stop thinking that getting ahead by studying and working hard was ”acting white.”

He’s had 2+ years and nary a dent in that.

It is really too bad.

@anticsrocks:

Even at 70% I am richer than most Americans. That’s my point. Three million would support my modest lifestyle for the rest of my life.

These taxes have traditionally been higher, and have never stopped people from wanting to get rich. The recent argument was over raising them to 38%.

Oh, and here are some facts for you: http://money.cnn.com/2011/03/18/news/economy/obama_budget_cbo/index.htm?source=cnn_bin&hpt=Sbin

@JC: Okay, you are happy with $3 million. Fine.

Now let’s suppose that you take that 70% tax bracket and apply it to yourself and let’s say you own a small store. You work 7 days a week, most days you put in 16 hours and at the end of the year, your income is $300,000.00 dollars. (still in the top tier tax brackets) After what you consider to be a fair tax amount, you are left with $90,000.00.

Yes, $90,000 bucks.

You also have business expenses, salaries, etc… that come out of this $90,000 and after that you made $15,000.00 dollars if you are lucky. Still sound fair to you?

As for your link, well you read into it what you want. Bottom line is that under Obama, the economy will not prosper as he is so very anti-business. Oh he may call for a freeze in discretionary spending, but that is only AFTER he raised it 24%! If you include the stimulus, which as we are finding out isn’t a “one time thing” like he promised, then he raised it a whopping EIGHTY FOUR PERCENT!!

That is akin to being in a car heading towards a cliff edge, slamming down on the accelerator and then saying that you won’t go any faster!

From the source you cite:

But you go ahead and think it is because Obama is a tax cutter. That is laughable, at best.

@anticsrocks here is a question for you. Do you honestly believe that every person that has more wealth then you has it because they worked harder or they are smarter then you???? or do you believe that every person that has less then you is because they are lazy or dumb???? I can assure you that there are people in this world that are not as smart or as hard working as you and i and have millions more then you or i will ever have because lady luck was on there side. My father probably has a net worth of somewhere between 10-12 million which i’m sure we can both agree is a very nice nest egg for a 62 yr old man but at the same time there are people that make 12 million in one year. Are those people who make 12 million in one year that much smarter then my old man???? even though he has made more then 99.9% of the population with he 10 to 12 million net worth. Luck is a huge factor in life and you need to acknowledge it.

@ JC

Excellent post JC. I recently decided I wanted a Master’s Degree. I had a bunch of college credits and could have finished my BS in something like Telecom Management. But I wanted a Master’s in software engineering. So, I had to take a lot of new classes. I’m almost done and I spend $13,500 a year for college. In one year I have 10 professors, 5 per semester. My classes average 20 students. Let’s say the professor teaches 4 classes. Take half for administrative costs, which in the business sector is insane, (my company figures in 35% for overhead) and you have $54,000 to pay the professor. I figure that’s four hours of classroom work, and another four for building curriculums, grading, test prep, and meeting. And that’s if the professor does not teach summer semester. There is a lot of time off in there for holidays and break, which I begrudge no one. I think the administrative costs are pretty outrageous if it is actually half.

Now move to high schools. The cost per child where I live is $8500 a year. Average class size, 25. High School is different, they have the same teaching team all year, and every teacher teaches all day. So all the teachers have about 25 kids in class at all times. Maybe they have one period off, but for the sake of argument, let’s say they don’t. That’s $246,500 per teacher. Take half for the administrative costs and you are left with $123,250. I’m not getting what I pay for. I would pay more, if I were able to choose the school and the teachers.

As for the governor lowering the corporate taxes, in the long run you will win. I don’t know who your governor is, but it sounds like he or she is trying to lure business back in. When that happens, it will broaden the tax base and there will be more money for schools. Even though I’m not really a fan of the government subsidizing colleges, or agricultur, or anything else. If you can’t pay for it, you should get loans. A person will invest tons of money into their cars and houses, but not themselves? The military pays for college education and you get life experience that is almost impossible for an employer to overlook. My company seeks out veterans for their discipline, leaderships skills, and the technical knowledge they possess. There is Americorps, City Year (or whatever that program is), grants, scholarships, and all kinds of other programs. In Georgia, we have the Hope Scholarship. The lottery funds it but the government runs it, and for a while they were doing a pretty good job. They recently raised the requirements from having and maintaining a 3.0 GPA to a 3.4 GPA. People were outraged. Really? They pay all tuition and books to any college in Georgia. And maintaining a 3.4 GPA is too much to ask for a free college education?

@JC Don’t bother trying to convince these greedy pigs that that the rich don’t pay there far share because there greedy minds can’t comprehend that FACT.

@anticsrocks:

Your calculations are incorrect. Nobody at that income level is actually paying that much, and they are not taxed at 70% for 100% of their income. Not how it works.

Even if it did work that way, 90k is still not jeopardizing anybody’s survival.

@Life is all luck.:

Life, you are right. I’m done with this.

@Life is all luck.:

One more thing, what does the resentment of teachers and other public servants represent except some kind of pathetic class war, where these RWers try to incite the miserable to hate the slightly less miserable?

@Life is all luck.:

Only in most cases.

When we subsidize 35% of our people to sit on their butts and receive a paycheck, we are destroying America.

@anticsrocks:

Liberals are often unwilling to make such a judgment, because, once they get 50%, then they want 60% (and they will use all the same arguments).

As a conservative, I think the total we ought to be taxed is 30%, so once sales taxes and property taxes are figured in to that, the federal government, ought to be taxing us around 20-25%.

EVERYONE should pay taxes. There should not be any class of people who get a free ride (apart from maybe 1% of our population who really are unable to function normally).

I could live with a graduated tax code of 10-25%, as long as no one was excluded.

Those are my ideal markers.

I’m sure that many of us agree that our economy would take off like never before.

@JC:

Not exactly true. Because of property taxes, it is possible for a person to be taxed at over 100% of their income.

@JC:

You worked your way up by working hard, by being willing to do almost any job that needed to be done, and because you are apparently intelligent. This is all good; and it should make you proud to be an American. In most societies, where you started is where you would have ended up.

I hope you thanked God a million times as well.

@Life is all luck.: You said:

Sorry luckless, that isn’t the way it works. I posted a small, partial list of successful HARDWORKING people, who did not fall into their wealth and status. You posited that the only way folks get “rich” is by luck. I call bullsh*t on you and your comments.

Until you back up what you say, you don’t get to ask questions and be taken seriously at all.

Thanks for (not) playing. Have a nice day with your petty jealousy and class warfare.

@JC: You said:

Really?

First of all, YOU chose the 70% tax bracket in the example I gave, not I.

Secondly, the tax bracket for anyone making $300,000.00 is presently 33%, for the $10 million example, it is presently 35%. But give or take 2% they are in the same tax bracket, practically.

So that means that a small business owner very well could end up in the same tax bracket as the millionaire. YOU chose 70%, so that is what I used in the second example.

According to you, a small business owner gets to work his ass off all year, pay his bills, meet his payroll and after taxes he gets to pay himself around $15,000.00.

Wow. And the liberals think they know how to stimulate the economy… LOL

You and luckless can call names all you want, or at least as much as the moderators will allow but it does nothing to change the facts.

You completely ignored it when I destroyed your fallacies on the Bush tax cuts, instead you and your little buddy, luckless chose to call us greedy, when YOU advocate a 70% tax on the wealth creators in this country.

I wonder how it isn’t class warfare to try to incite the public against TEACHERS and their HUGE PAYCHECKS (not)

JC,

Real easy.. It’s not class warfare. It’s economics. With a projected 2+ billion dollar shortfall, people are going to have to make cuts. Are you saying the public sector should be immune from economic changes that the private sector has to deal with?

With the liberal, I am beginning to believe that there is never enough.

They never tax enough; they can always tax more.

For gay issues, they always want more. As I have asserted previously, gay marriage is not the end game but just a secure foothold.

They cannot seem to give out enough free lunches, put enough people on welfare, or give enough stuff away. It just never has a stopping point.

@JC:

This shows a complete misunderstanding of what is happening in WI. Budget shortfalls in the near term, and unfunded liabilities for the state in the long term are what is driving the GOP to limit collective bargaining for public employee unions. The state doesn’t have the money.

You said this:

But before that, just a couple posts up, you said this:

The average high school teacher salary in WI is just over $56k.

http://www.cbsalary.com/state-salary-chart.aspx?specialty=High+School+Teacher&cty=&sid=WI&kw=High+School+Teacher&jn=jn031&edu=&tid=22928

For 9 months of work, that averages to $6,222/month, and extrapolated out to 12 months, equals nearly $75k. And that doesn’t include the benefits packages which are well above what the average wage earner receives in WI. Now, for someone making $90k/year, it averages to $7500/month, or, roughly $1300/month less. But, if the benefits packages are figured in, the figures become much, much closer to one another, particularly as the teachers rarely have to pay anything out of pocket.

So, are the teachers miserable? Or, are they doing well enough for you that they don’t need any more, and in fact, can be limited as to what they make because, paraphrasing your words, they are not in jeopardy of survival?

@Life is all luck.:

There is quite a bit of difference in discussing wealth, and income. They are two, entirely separate, financial entities. Income can add to wealth, and investing wealth wisely can add to income, but they aren’t the same.

You make these statements:

You state that as an absolute, however, I can give you examples of quite the opposite. Because of the inherent wrongness of your statement, I will disregard it.

Last I checked, our income tax code, and the Constitution, applied to those who are citizens in our country. Even though you are correct about the opportunities, it isn’t applicable when discussing the U.S. and how taxes are applied to our citizens.

Personal experience? From either side? Yes, favoritism exists in the workplace, but I don’t believe it’s the norm. And, when discussing small business owners and entrepreneurs, favoritism isn’t applicable to them, as it is they, themselves who are making the decisions for their business, and in large part, determine how successful their ventures are. Also, that statement reeks of jealousy more than anything.

One example does not an argument make. While I agree their are many cases out there like that, there are also many more cases where someone starts out, works hard, invests wisely, and makes themselves very successful despite obstacles thrown their way, yet, I won’t sit here and argue that all who make it big do so by their own hand.

Are they? You don’t know for certain, just as I could not claim as an absolute that everyone who is rich got that way by their own hard work. Does the Constitution state that LUCK should be a determining factor in treatment of individual citizens?

In other words, no citizen shall be treated unequally in regards to the laws of the country, and taking property from someone, just because someone else believes they were “lucky” to get that property, is against the Constitution.

Later on, in another post, you state this:

So now we are greedy pigs? I’d bet if you were to take a poll here that most of us would state net worths many, many times lower than what your father has. It’s hard to be a “greedy pig” when I’m not even in the target group for your hate, and yet, I will defend those you deem a “greedy pig” because what you suggest isn’t what our founding father’s wrote down all those years ago, nor is it anywhere near in the spirit of the Constitution. You have no right to their wealth, nor do you have any right to claim it for the government, regardless of how they came upon it. Whether they received it through “luck”, or hard work, it is theirs, not yours. Our Declaration stated that “all men are created equal” and the right to “pursue happiness.” It never stated that all men were to end up equal. Our Constitution guarantees us equality under the law, and from the government. The Constitution has never allowed the government to take from one and give to another, to engender equality amongst us. That goes against everything our founding fathers fought for.

You may envy those who have more than you. You may even be jealous of them. Neither of those gives you a right to take it away from them.

You and JC need to look long and hard at yourself, and the principles and ideals our founding fathers set forth for us, and decide how and why you have turned away from them, and then decide if that truly is a good thing that you have done so.

@Randy:

JC in his/her last post above, has demonstrated a TEXTBOOK “switch, duck, and spin away” maneuver…something all “Died in the Wool” Liberals know by HEART! When you fight a losing cause, when your opponents have all but handed you your derriere on a platter….. in other words, YOU LOST the argument… bring up an unrelated “hot topic” to divert attention from your failed rants.. and move onto another (albeit also a loser) topic in an attempt to “save face”…… Not surprised here! LOL!!

And it Looks like John Galt has already polished up the NEXT “platter” ready for you! (will they (Libbies) ever learn??) tsk tsk tsk…

“Unknown” once said “If you can’t dazzle em with BRILLIANCE, baffle em with BULLSCHIT”!!

And so it goes…..

and JC.. “PUNKS”??? LOL!! Yeah right. You libs are a never ending source of amusement!

Who is greedy??

http://www.taxfoundation.org/blog/show/27134.html

Oh, and then there is this. Yeah, unions are all about the people.

http://www.businessinsider.com/seiu-union-plan-to-destroy-jpmorgan

Yes, who is greedy?

http://www.economist.com/node/319862

Oh, and just in case you all don’t know, JP Morgan Chase is not the U.S. Government. They plotted to steal from their customers, and now the customers plot their downfall. That’s called capitalism.

Hankster That’s “dyed in the wool” no killing involved.

Lib. subject change. Just picked up “The Best Of Chuck Berry” 11 hits from Maybelline ’55 to No Particular Place To Go ’64. Also S.R.V.’S “Couldn’t Stand The Weather”.5 bucks each at Walmarts. Best to you.

@ Rich Wheeler… Wise guy! LOL! Good scores there… SRV was killer! too bad he had to die so early… no telling where he would have gone/led music wise…

hey, contact me via “daisy-alexander-17@yahoo.com” leaving out the dashes,&leaving no spaces…. have something you might be interested in…. music wise

Here’s another way to look at the fact that America’s rich are already paying more than the rich of most civilized countries:

The top ten percent of American taxpayers pay more to the national government in taxes, both as a percentage of the total taxes collected and in proportion to their share of the national income, than upper-income taxpayers in any other developed country. This chart says it all:

http://www.powerlineblog.com/archives/media/OECDIncomeTaxChart0077.jpg

@ JC

The government is its own worse enemy when it comes to taxes. Every idiot in a committee has to try to find a way to get their people the best deal. What they create is a big bucket of loopholes. Who has the lawyers at their disposal to find those loopholes? Corporations. Can you fault a corporation for taking advantage of a loophole? No. In an effort to “level the playing field,” the US Congress believes some corporations are more equal than others. To take advantage of tax breaks, all you have to do is meet the qualifications of what Congress wants more equal.

Even so, I take it you have no comment on the US having the most progressive tax system in the world? That the top 10% in this country pay more than the top 10% in any other country and this little tidbit:

~snip

JC said:

Seriously? You have a source for that? And now the plan is busted and the guy that plotted it will be getting a pardon from Obama if his corrupt Justice Department will even prosecute.

http://en.wikipedia.org/wiki/Tax_rates_around_the_world

The US corporate tax rate is 0-35%

In fact, most of them pay closer to zero:

http://www.reuters.com/article/2008/08/12/us-usa-taxes-corporations-idUSN1249465620080812

Wikipedia – ROFLMAO!

What a great, credible source…

Yes, I’m sure Reuters is a left-wing source too. When the facts are against you, attack the source.

anticrocks, do you have another source that refutes the 0-36% number that is more credible?

Aqua, there is plenty of evidence that Wall Street, with the wink/nod/lookaway of regulators, set up ridiculous, unsustainable schemes that were destined to fail, but they played them as long as they could for short term gain, at our expense:

Here is the horses’ mouth: http://www.fcic.gov/

And if you all are going to say, “who can blame corporations for exploiting every loophole,” just ask yourselves, who can blame the working man for fighting any way he can for his own survival?

@JC: I am not arguing tax rates. I set up a theoretical question and you took the bait, saying that the top tax rate of 70% is fair.

I took your tax rate and showed how it chokes the life out of small business owners.

Nowhere, at any time have I argued about what the current rates are.

Stop changing the issue, JC. Answer my questions in comment #117.

I never said 70% was fair. Go re-read what I wrote.

I said, if I made 10 million, and was taxed at 70% (even though that ‘s not how it works) I would still have 3 million dollars. I said I could live on that.

Fair is always a relative term, isn’t it? But it sounds so ugly when the very comfortable cry “unfair.”

@anticsrocks ok since you are to much of a turd to answer my question ill end my part of this debate with the following. NO MATTER HOW HARD YOU WORK OR HOW MUCH YOU SAVE I WILL INHERIT MILLIONS FROM MY OLD MAN AND WILL ALWAYS HAVE MORE THEN YOU SO FUCK YOU LOSER HAHAHAHA.

You know, i’ve gotten into several “fights” in here, as well as others to be sure but your Comment there, takes it to the LOWEST level I’ve seen here, that at least I can personally remember! You’re going to be rich?? Well Goody for you! Wonder if you’ll want to give it all away in taxes…..since you seem to want to see others do so! Be sure to LEAD BY EXAMPLE when you get all that dough!! I’m betting you won’t… because you are a fraud….. Now, don’t let the door hit ya in the butt on the WAY OUT!! Because sorry to tell you, it’s YOU, who are the loser, with that last comment. see ya! LOL!

@Hankster: I am with you on that one, Hankster. ‘Ol luckless is one french fry short of a Happy Meal, IMHO.

I did answer the question that was put forth even before luckless posted it. My initial reply to luckless proved him/her wrong. But since I didn’t answer the way he/she wanted, and since I blew him/her out of the water intellectually then insults and vulgarities was all the ammo to be had by ‘ol luckless.

http://blogs.suntimes.com/sweet/2011/03/ten_giant_us_companies_avoidin.html

Who pays their share?

JC… the DEMOCRATS controlled Congress during those Time periods…. so.. why didn’t they “correct” the tax codes to fix this??? Why are you all over the CONSERVATIVES over this??? YOUR GUYS did nothing… so, WHO is the Party of the Rich??? I see GE is missing from that list!! GE paid virtually NOTHING.. and lets see.. WHO in Jeffery Immelt PALS with?? Hmmmm OBAMA! The big Zero even made Immelt a .. well read for your self!”

“Despite $14.2 billion in worldwide profits – including more than $5 billion from U.S. operations –

GE did not pay a dime in taxes in 2010.

Obama said: “Those with accountants or lawyers to work the system can end up paying no taxes at all. It makes no sense. It has to change.”

But in typical Obama fashion of saying one thing and doing the exact opposite, in January Obama named General Electric CEO Jeffrey Immelt to head the President’s economic advisory board focused on job creation. “”

Read it all at…http://www.irishcentral.com/story/news/from-the-right/some-evil-corporations-are-more-equal-than-others-in-liberal-land-118708649.html

Point is, Repubs take the RAP.. but the FACTS of who is “behind the “Evil Rich” not paying taxes” is NOT the Republicans…. so go blow!

Here is the story from 2007. “Democrats took control of the House and Senate after 12 years of nearly unbroken Republican rule.”

http://www.washingtonpost.com/wp-dyn/content/article/2007/01/04/AR2007010400802.html

Cutting taxes for the rich was Bush’s agenda and you know that. You defend it. 8 years of Bush. Democratic congress for three years, Democratic president for three of the last 11 years.

And don’t think I’m defending democrats. They have been enablers. But all these bad ideas

came from your side, my friend. Endless, expensive wars, (Iraq, a total war of choice, was going to pay for itself. How much has it cost?) tax cuts for the rich, etc. Republican ideas. They’ve all sold us down the river, but your guys were plotting the course.

@JC: You said:

Sorry JC, I blew you out of the water on this one way back in comment #96.

The tax cuts Bush imposed helped EVERYONE.

You cannot argue against facts.

@JC: You said:

Really? So Democrats NEVER cut taxes? Only the GOP want tax cuts, huh?

I seem to remember that in 1964, JFK cut taxes across the board. Gee, what Party affiliation did he have? Oh yeah! He was a Democrat.

You also said:

How much has the Iraq war cost?

Less that Obama’s Stimulus Bill, that is for sure. According to the Congressional Budget Office, anyway:

Funny, I don’t hear you complaining about the cost of the Stimulus…

Also you completely discount the number of lives saved by our invasion of Iraq. Saddam was killing over 4,000 people a month. He had used WMD’s on his own people and his sons were just as brutal as he was, so the killing would have continued after he left power, assuming they took his “throne.”

Look, JC it is plain that you have a very Marxist view of wealth distribution and tax policy. But try to stick to the facts when you make a comment.

Its less embarrassing for you that way.

Heaven only knows if JC is still around… altho 34 of the comments in this thread are by him, despite his claim he was “done with this” 34 comments ago. But I guess he couldn’t resist dashing in with revisionist history. What is it about the desperately partisan that insist life began and ended only with Bush the younger’s presidency?

Let’s start the clock with the most expensive of two the “bad ideas” given to us from liberal Democrat Congresses and Presidents… Social Security in 1935. Let’s see… history of control of Congress… control of the nation’s purse strings.

Since the 74th Congress in 1935 – a total of 39 Congressional sessions including today’s 112th – Democrats have held Senate majority 28 out of 39 sessions. One session was a 50/50 split (2001 to 2003). oops… no GOP majority there.

Democrats have held the House for 30 sessions out of 39.

Yet “all the bad ideas” are the fault of a total of 9 GOP majoritys in both Chambers out of all these years? This despite that the largest drain on the US economy is both entitlement programs… SS and Medicare… created by Dems for all the rest of their power hold for decades?

You got chutzpah, dude. Or a very limited view of history. Take your pick.

I doubt your math it better, but you might want to consider that since every Congress increases US debt… despite party rule… the Dems have done far more economic damage to this nation that the GOP simply because of their longevity of control. The trillions added in just two years alone is a record breaker.

So what was that about “bad ideas” again?

Oh yes… would have been very nice had we been able to compete for oil contracts in Iraq, but then all the nanny liberals would have been screaming it was a “war for oil”. oops, they did that anyway, even tho we didn’t have the first crack at that oil. Personally, I would have endured the criticism and built in American priorities for production and purchase of Iraqi oil as a “thank you” for helping Iraq become an Arab democracy of their own elected choice.

Now we’re “not” in another “war for oil” in Libya. Oh wait, it’s “humanitarian”, tho Darfur genocide can just stand by and be ignored. Yet how many use the argument that ensuring the continuance of Libyan crude is an American interest for world pricing for justification? Does that not then become a “war for oil”?

Dancing around “just words” and revisionist history. JC, you and your party peers need to supplement your deplorable public education and get a clue. Your talking points are fish in a barrel around here.

That’s funny. I’m still here, in the water.

Yes, Bush cut taxes for everyone. If you are in the middle 20%, that amounted to $791 in 2010. If you are in the top 1%, that tax cut amounted to 85 THOUSAND dollars.

http://www.ctj.org/html/gwb0602.htm

I’m tired of you — and your kitchen sink. You try to deflect everything. When I point out that the GOP has held congress for the past 12 years, you go back to the 1940s to attack FDR. You seem a bit unhinged. Shall I tell you of the sins of Herbert Hoover?

Call me back when our participation in Libya reaches 1.2 trillion dollars. And several thousand dead Americans. Not that I ever mentioned Libya. Not that I said I supported it. I never said that. You are arguing with ghosts to avoid arguing with me.

I would also point out that many of your Tea Party members are collecting SS and Medicare, both programs that are responsible for keeping many of our elderly from eating dog food for the past five decades.

@Hankster, # 141:

The national debt was $4.7 trillion at the start of the 1994 “republican revolution”, when republicans gained control of both the House and Senate. Republicans retained control for 12 straight years, until the new democratic majority was elected in 2006 . The debt during those 12 years nearly doubled, growing to $8.5 trillion.

The most rapid expansion of the debt during those 12 years–approximately 3/4 of the increase–took place while there was both a controlling republican majority in Congress and a republican president in the White House.

Obama at least has the excuse of having taken office with the worst economic disaster since the Great Depression already underway; federal tax revenues were plummeting, the global economic system was in danger of collapse, and unemployment was rising out of control. Three years later, the U.S. economy is slowly but undeniably recovering. That wouldn’t be happening now without the stimulus spending that was done before.

What’s the republican excuse for their own unprecedented deficit run-up? What did their own deficits achieve? How do they account for the fact that the U.S economy was a total shambles after 12 continuous years of republican tax and economic policies? Basically, all that was accomplished was that the rich became even richer, while everyone else lost ground and lost financial security.

Your observation that democrats didn’t fundamentally alter the federal tax code during their recent 4-year majority is correct. The code as it presently exists isn’t the Obama administration’s doing.

——-

As of 2003, the federal tax code required corporations to pay 35% of their profits in taxes. In reality, the average tax rate the biggest corporations were actually paying 2001 through 2003 was less than 1/2 that.

Obviously the situation hasn’t changed. Witness GE and Exxon’s most recent payments of Zero. Zip. Nothing. Also witness the fact that U.S. corporations have pulled in historically record-breaking profits for each of the last seven consecutive quarters.

In spite of this, one of the most commonly heard refrains on the right is that corporate taxes are too high–the highest in the world–and must be reduced if the U.S. economy is to remain competitive. This, in spite of growing federal and state deficits.

Republican governors are collectively busy at present providing billions in new tax cuts to corporations and wealthy special interests. All the while imposing budget cuts in the name of fiscal responsibility that fall on the middle class, the working class, and the poor–pay and benefit cuts for public employees, deep cuts in public education, the elimination of Medicaid coverage for hundreds of thousands of poor people–280,000 in Arizona alone. In some cases they’re actually imposing new taxes on those same people–Michigan, for example, will begin imposing state income tax on pension payments for retirees.

Apparently we’ve only got class warfare when the working class, middle class, or poor take notice of what’s going on and have the audacity to complain about it.

@MataHarley:

Oh, and you’re right, I can’t resist correcting your wildly inaccurate arguments.

And I’m female.

@JC: What “wildly inaccurate” arguments would those be?

@Greg: And speaking of Marxists, our resident troll, Greggie rears his head. Greggie’s arguments can be boiled down to four little words: “Its all Bush’s fault!” Then the crying ensues about how unfair it is when rich people get richer. Greggie is happier when the poor people get poorer, as long as the gap between them and the rich doesn’t get too “wide.”

Greggie whines about corporations using loopholes in the tax code (that Dem controlled Congresses put there) to pay little or nothing in taxes. But he sits idly by when Jeffrey Immelt from GE gets buddy buddy with Obama and stands to make literally billions from Obamacare.

Boring, but predictable Greggie.