![]()

There’s an old saying; A picture is worth a thousand words. Pie charts will likely never be confused with great art in terms of story telling, but they have a way of making complicated issues clear. Income taxes are one of those things that are naturally difficult to grasp and the issue is made that much more opaque because liberals love to obscure the facts.

One of the shibboleths of the left is that the rich don’t pay their fair share of taxes. One of the more amusing segments of the 2008 Presidential campaign involved Neal Boortz asking then Democrat hopeful Dennis Kucinich two simple questions:

- What percentage of total income is earned by the top 1% of income earners?

- What percentage of total federal income taxes are paid by the top 1% of income earners.

of all of the federal income taxes – according to Congressman Kucinich answered: He thought the top 1% of income earners earned 60% of the income and paid about 15% of the taxes. He was a little off. In fact, the top 1% of income earners earn approximately 17% of all the earnings in the country. That’s certainly higher than the 1% they represent of the population but a far cry from Congressman Kucinich’s 60%. More astounding however, is that they pay fully 39% a 2009 Congressional Budget Office report. The below chart demonstrates clearly the absurdity of the notion that the rich do not pay their fair share of taxes.

of all of the federal income taxes – according to Congressman Kucinich answered: He thought the top 1% of income earners earned 60% of the income and paid about 15% of the taxes. He was a little off. In fact, the top 1% of income earners earn approximately 17% of all the earnings in the country. That’s certainly higher than the 1% they represent of the population but a far cry from Congressman Kucinich’s 60%. More astounding however, is that they pay fully 39% a 2009 Congressional Budget Office report. The below chart demonstrates clearly the absurdity of the notion that the rich do not pay their fair share of taxes.

The first chart shows that the rich do indeed pay far more than their oft cited “fair share” of income taxes. Not only that, it also shows that the bottom 40% of wage earners actually have a negative tax rate and get money back from the government in the form of income tax credits!

Another of the left’s arguments is that the lower income wage earners pay a disproportionate amount of the Social Security / Medicare tax. That too is false. The second chart states that the top 10% of wage earners pay 43.5% of all social insurance taxes while the bottom 40% pay just 15%.

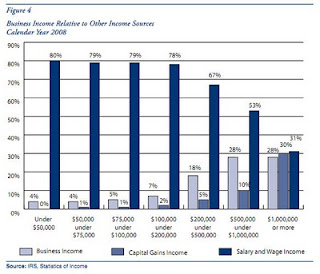

Why does any of this matter in the first place? The third chart (taken from a 2010 report from the Tax Foundation) demonstrates why…Jobs. It compares wage & salary, capital gain, and dividend income for all income earners. As you can see, for the 80% of income earners below $200,000 per year, wages (i.e. a job) make up almost their entire incomes. Without jobs that someone else creates they would have no income… except government transfer payments.

Why does any of this matter in the first place? The third chart (taken from a 2010 report from the Tax Foundation) demonstrates why…Jobs. It compares wage & salary, capital gain, and dividend income for all income earners. As you can see, for the 80% of income earners below $200,000 per year, wages (i.e. a job) make up almost their entire incomes. Without jobs that someone else creates they would have no income… except government transfer payments.

At the $200,000 and above level, business and dividend income starts to take off and by the $1,000,000 and above level the three are almost equivalent. Those are the telltale signs of success. Those people earning those $200,000 and above incomes are the people creating the jobs that employ most of the remaining 80% of the population.

Put another way, jobs are not created by wage earners. Jobs are created by entrepreneurs risking their capital to start businesses… And those entrepreneurs are the usually found in that $200,000 and above group. The businesses they start generate 65% of all new jobs created in the United States.

While the first two charts debunk the myth that the rich do not pay their “fair share” the above chart demonstrates why it matters: The rich are the ones starting small businesses and creating jobs and prosperity.

While the first two charts debunk the myth that the rich do not pay their “fair share” the above chart demonstrates why it matters: The rich are the ones starting small businesses and creating jobs and prosperity.

Myths die hard, particularly when their proponents willingly ignore the facts. The myth that the rich don’t pay their fair share should soon be headed the way of the global warming hoax. Clearly it is the people at the upper end of the income spectrum that are being treated unfairly. They are not paying their fair share… They are paying more. Not only are they responsible for 2/3 of all new jobs created, but in return they are rewarded with being allowed to keep even less of their income as they become more successful. Perhaps as more Americans examine and understand what it takes to generate and sustain a dynamic and growing economy the “tax the rich” cries will begin to fall on deaf ears. That’s exactly what America could use right now, a reinvigorated entrepreneurial class striving to put more money in their pockets… and generating millions of jobs in the process.

See author page

Great thread, thank you Skookum, johngalt, chipset, antics, Aqua, gregory dittman, Nan, Josh, Hankster, Randy, Vince, OT, Ukraine Train and, never thought I would have Michael Moore to thank for anything, but exceptions to every rule, thank you Michael Moore.

Outstanding commentary, you all combined to made the topic so very easy to understand, that is, if one actually read your comments. Thumbs up to you all!

Welcome Ukraine Train, salute!

You are missing the point, JC. Without capital, there’s no job to be had.

Look at the wealthiest people right now.

1. Carlos Slim – Telephone company.

2. Bill Gates – Created a company that minted a ton of millionaires

3. Warren Buffet – Bought a company based upon investment that employ hundreds of thousands of employees.

4. Larry Ellison – created a company that has minted millionaires.

5. Paul Allen – co-founded MS and owns a lot of other organizations

Should they not be compensated for creating wealth for others?

If Bill Gates didn’t save his money (he’s incredibly frugal and last I heard still flies coach) and spent all the money as he earned it, he’d be like the masses of “rich” people who are broke, living paycheck to paycheck.

So, I ask you.. What do you think a proper compensation is if you create 1,000 millionaires?

@ JC

Where in this thread did you see anyone disrespecting the “wage-earner?” If you want to know why it is so tough to eek out a living, turn your eyes away from the rich and look towards D.C. Every single time they try to make things better for the “working man” it has blown up in “our” faces.

Where did Slim and Bill get their money, Chip? Did God give it to them? Or was it millions of working people buying Microsoft products and telephone services? They get their money from consumers. Consumers are also workers. You are the one missing the point. Bill Gates knows that he has more money than he will ever, ever need. He had a great idea, and now he can have anything he needs, and anything he wants. That’s great. But he will tell you that he doesn’t need it all, and taking it out of circulation hurts his ability to sell the next crappy Windows product to new customers, who have to have the money to keep upgrading if he is going to continue to sell his product. If there are 400 rich families and 155 million poor ones, he’s not going to sell too many copies. If there are 400 rich families, and 155 million middle class families, he will sell many more copies, and the rich people will still be rich, and Bill will be richer. As more people fall into poverty, these guys lose customers. Get it?

Of course smart, productive people should make a lot of money. And lazy people don’t become millionaires. So what? That doesn’t take away the fact that consumers are required to make the system work, and if wages are stagnant, consumers can’t purchase. So then the vultures came in, and created payday loans so that the poor people could pay them exorbitant interest for borrowing small sums of money. Yeah. That used to be called a loan shark. Stop defending looters and pirates. Read the article I have linked below. Look at the increase in wealth at the top. You people used to argue that it would trickle down. Ha. You don’t even TRY to do that now, you just defend the wealthy as if they are so much better than the rest of us, we should all eat dirt while they wine and dine. Don’t they have a responsibility to the society that allowed them to become rich? That built the highways that transport their goods? The workers who created the goods? Or are they just shamans, who magically make money out of thin air, and owe nothing to anyone?

http://finance.yahoo.com/tech-ticker/the-new-robber-barons-all-politicians-%22in-the-hands-of-the-super-wealthy%22-sachs-says-536034.html;_ylt=AowNFYBh6yOmwmVvX6PNL9Vl7ot4;_ylu=X3oDMTEzN3RibTMyBHBvcwMxMwRzZWMDYXJ0aWNsZQRzbGsDdGhlbmV3cm9iYmVy?tickers=MUB,^DJI,^GSPC,TBT,XLF,XLV,GLD

Disrespect = denying them a living wage. Telling someone who works 40 hours a week that they don’t deserve to be able to go to the doctor. That is the greatest disrespect of all.

JC,

Who prevents anyone from going to a doctor? A typical doctor visit to my doctor is about $85. So, who prevents them from going to the doctor?

But, many of those same people can afford a cell phone, something that wasn’t available to the last generation. Or two cars. Etc.

And if someone creates a product that no one can afford, they aren’t going to get wealthy, are they? It’s again called, “Supply and Demand”.

And so what if someone has something they’ll never be able to use? Is it a resource to be shared by all? What about your salary? I am willing to bet I gave more to charity than you did last year. And I certainly gave more than Biden.

You believe that you should have control to the means of production and wealth. Until you put your capital on the line, don’t blame those who did.

As for Gates and Slim making money.. They made money because people felt the product was worth their money. And if people didn’t think it was worth their money, they would pirate the software.

As for payday loans, the market was created because some people can’t make decisions on how stretch their paychecks. Anyone who does a loan like that should know better… but, and here’s the kicker, if there weren’t people willing to take the loans, they’d be out of business. They are giving money to people who have a high likelihood of non-repayment. Are you going to loan a stranger money with little likelihood of being repaid without appropriate compensation. Do you think the people who run those businesses are “Wealthy”? More than likely, they are getting a minor profit off the loans due to delinquencies and non-repayment.

Tell you what.. I want you to loan me $100,000,000 and I will give you $100 in return for your risk. Deal?

So a person who works for minimum wage has to work more than 10 hours to pay for that Dr. appointment. That seems fair, yes? Oh, but I hope they are not diagnosed with anything that requires tests, drugs, or god forbid, any other treatment.

Workers have to have discretionary income if they are going to purchase a product from Bill Gates. You love to accuse them of irresponsibility. That is a deflection from the discussion of inequality. The solution to poverty in our country, in your mind, is for the poor to have less. But that doesn’t help the rich or the poor, which is my point. Anything they might have you decry as evidence of their unworthiness, and anything they don’t have is also evidence of their unworthiness. While all the possessions of the rich are evidence of their superiority.

You’re pretty full of yourself. You just continue to ignore the “demand” part. I will just keep posting facts.

http://www.livingwage.geog.psu.edu/counties/06037

Where do I disparage the worker?

The demand must be there, or the rich wouldn’t be selling their product. Hence the demand. If I supply a product and there’s no demand for it, then it doesn’t matter what the supply is.

The marketplace will determine the winners and losers.

It’s not that I am against workers or for rich people. You are projecting. I am telling you how it is. There’s a difference.

Okay, so let’s have some balance. I am not against rich people, but saying that it is okay to get rid of the middle class by suppressing wages and distributing money upwards is economic suicide for us all. When you increase the wages of working people, they spend the money, ergo almost all of it will go into the economy, and the capitalists see a return on their money. If you continue to distribute upwards, you kill demand, because demand is created when working people can survive, and moreover, can afford the occasional trip to Disneyland.

And I would also point out that you bring up capitalists who made their money from creating real products or providing tangible services. You cite the same two or three guys over and over. Small club. But the ones who are making the real money, on Wall Street, are not making money from either of those things, but from manipulating, and gambling on, and skimming profits from the transactions of people making real products and providing real services. For example, how many of those new millionaires made their money betting on an increase in Foreclosures?

Oh, and it is disrespectful to working people to say that they must work an hour in order to buy a gallon of milk and a loaf of bread. That is devaluing them as human beings. It is unsustainable as a society. It drives people to desperation and deprivation. And that makes us all poorer.

JC,

One, I don’t care how people make their money. If I invest in a property, a stock or gamble on futures, that’s all legal. Manipulation is not.

I bring up Gates, Slim, Ellison, Buffet. Should we also bring up Soros who made his money in speculation?

You say the “ones making real money”, as if those mentioned aren’t making “real money”. Hmm. Interesting. Oil speculators get burned when things don’t turn out the way that want it to.

Here’s a little tip: Do you know what happens when the people at the top spend their money? they go bankrupt. How many people can they employ.

The simple fact of the matter is, people develop wealth by spending less than they make. Simple as that. And that means that money is working for them.

So, my question to you, JC, is how would you fix the problem that people are keeping their money?

Oh, and your example of going to Disneyland… It makes a profit that employs people and someone is going to save that money (which creates wealth).

So, HOW WOULD IT WORK IF IT WERE UP TO YOU? I am genuinely interested.

Study shows who bears Minnesota’s biggest tax burden:

http://www.startribune.com/politics/local/118136484.html

You didn’t answer my question…

Spending less than you make? So if I make $300 per week, and I save $10 bucks a week, I will get wealthy? Unless I get sick, that is, or lose my job. Such is the life of a wage earner.

Here’s how I think it should work. It’s basically addressing the ratio problem. Here are some stats: “S&P 500 chief executives last year received median pay packages of $7.5 million, according to executive compensation research firm Equilar. By comparison, official statistics show the average private sector employee was paid just over $40,000.”

http://www.startribune.com/politics/local/118136484.html

Now, you can live pretty luxuriously on 7.5 million per year, even if your taxes went up. Even if they went up to 40%, you still have 4.5 million to live on. Set your thermostat wherever you want it. Buy a tan. You’re not bankrupt.

But the truly responsible thing to do would be for the shareholders to demand that the CEO be paid 3 million, and that the wages of those at the bottom, 40k, be increased. So the CEO ends up making maybe only 150x as much as the average laborer. If corporations and shareholders gave a crap about the overall health of our economy or our society, they would do that. They have not traditionally been willing to do that without government intervention, in the form of taxes or minimum wages, or in response to collective actions by workers. And in the last several decades, they have run amok, hoarding money, creating giant ponzi schemes, and all the while taking taxpayer subsidies.

If you have another idea on how to make them more responsible, I’d like to hear it. As for the irresponsibility of the poor, let’s face it, what’s their motivation? To stop being poor. If working doesn’t get you out of poverty, then why bother? And why can’t you see that it goes both ways?

Sure, bring up Soros. What does that prove?

Is wealth really more concentrated among the wealthy in recent years than in previous?

Billionaires Own as Much as the Bottom Half of Americans?

JC…. who do you think you are?? You said this……”””Bill Gates knows that he has more money than he will ever, ever need. He had a great idea, and now he can have anything he needs, and anything he wants. That’s great. But he will tell you that he doesn’t need it all, and taking it out of circulation hurts his ability to sell the next crappy Windows product to new customers, who have to have the money to keep upgrading if he is going to continue to sell his product.””””

SO?? It’s HIS money, to do with as he wants?? Who the hell are YOU to demand he turn loose of it?? LOL!! By the way, if you knew anything, you know Gates has given away TONS in charitable donations… and has SAID he’ll be shed of most of it by the time he dies, his kids will get a MINIMAL inheritance. So you don’t even know the goings on of the guy you use as an example… Jealous or something???

Then you said….””””A long time ago that was me, working for minimum wage, and you know what? 30 years ago, it was almost enough to survive. Nowadays, I know it is not. Yet I know how hard that person works, and what a valuable service they perform. Why should they live in constant stress, trembling at the thought of a dental emergency, or a car repair? Why do we not value their work enough to reward them with a living wage?

So your solution is “Big Brother” telling you how much money you can have?? How much you can keep???

You DO realize, there are LOTS of nations around the world, where the Gov puts a Microscope up your butt, and regulates you like a puppet! Why do guys like YOU, always insist WE have to turn into a country like that?? America must CHANGE, to please YOU! Why don’t YOU go to a place that runs, the way you want things run?? MUCH SIMPLER FIX for you… and leaves the REST of us alone! Now, as to the Comment above, Minimum wage was NEVER to “make a living on”…. it was the BASE PAY a KID entering the market place of labor HAD to get. STARTER wage… if you try living off it, well, you’re just not very smart…Having said that… WE are living right now, on about 12,000 a year. 1/5th of what the best I have made was..BUT, I saw this coming… My cars, Home, etc are all paid for. All I have to do is eat, keep the lights on, etc. And we’re doing well. Not as good as i’d LIKE, but well. New business venture is just about to lift off next month, so I expect to be back in the game SOON! LOL! Point is, you whine haw BAD it is, I say if you are smart and careful, it’s NOT so bad! I imagine many of the type people you cry about above… were living “above their means”….. then YES, you WILL be on the verge of losing it all, is the wind blows! What do you think caused the Housing market to CRASH????? Rich guys? Or STUPID PEOPLE??

Your focus is on the wrong thing. Another thing you should ask.. is WHY is everything so expensive?? I can remember, as a kid, my dad Bringing home like 160 a WEEK! we had a good home, a car, all we needed… today, people bring home (average guy) what, 4 times that week?? And he has.. THE SAME STUFF! No better off, yet he, and others have “went on strike” for more pay etc…. and all that’s been done, is to drive the cost of everything UP! But, what did they GAIN in the end?? NOTHING, still at the same “plain” in life…. house, car, food etc… people cannot want “more, and next year, more still… at some time, you reach a plateau where you cannot go any higher”… you “max out”…… only those with exceptional ideas etc go beyond… case in point… the KID who came up with the idea, of FACEBOOK! Now one of the wealthiest people in America! All he had, was an idea…. perhaps, if you’d moan about how much you were so “down trodden” LESS, and applied your mind MORE.. it COULD have been YOU!

Sorry, but tired of whiners at this level. Are there BAD people with money?? YEP! But then, who elected the people in DC who ALLOW it, and SET IT UP?? You’re barking at the wrong crowd….. See ya!

Oh, and Soros?? A RICH guy, who uses his money to FUND EVIL, and HAS used it numerous times, as a WEAPON!! Funny, how you seem “protective” of HIM!! Hmmmmm………

Yes, wealth is more concentrated. More facts:

http://www.datapointed.net/2011/03/relative-us-income-taxes-1913-2011/

Let’s also not forget the regressive payroll taxes. Worker who make under about 80k pay SS taxes on every dollar, while those who make more than 80k only pay on the first 80k.

@johngalt: @JC:

You can’t convert the greedy. In their mind .. it’s theirs ..they have a right to it..so screw everyone else. How many of the wealthiest Americans actually made their own wealth? How many inherited? How many just shuffled money around and profited from it, without producing anything tangible? The people here always seem to name 2 or 3 as self-made. They never mention the “inheritance billionaires” or the manipulators.

Now, what is so wrong with the rich being required to part with a little bit more of their immense disposable income, to take some of the pressure off the middle class? I’s part of living in a nation .. and contributing to its general wellness (& that of it’s citizens).

But, there will always be the ideologues, who believe that the rich have no responsibility for anyone else and that the poor, and middle class, should be turned into slaves, or left to wither and die.

Inherited Billionaires vs Self Made:

You tell me.. which one is more? People who inherited or those who made it themselves?

And let’s talk millionaires:

http://www.smartmoney.com/spending/rip-offs/10-things-millionaires-wont-tell-you-23697/

Hmmm.. Seems a strong correlation to earning versus inheriting. I’m just saying.

Now, what is so wrong with the rich being required to part with a little bit more of their immense disposable income, to take some of the pressure off the middle class?

Lets alter that question a bit…. Why not ask the “poor” to do some work for the Government CHECK they get?? Ask that, and see the responses you receive….

Now I WILL agree, that if you are “rich enough… you should forgo the Social security check… SS was implemented to make sure people had “something” to fall back on it retirement, not to BE your total retirement! Hence, I don’t see a “foul” in cutting the well off,off, from the SS check, if they do not NEED the “help”….. THAT would be honest, fair and in keeping with the original design of the program….

Also of note, on the link chipset provided.. seems the good old USA ALLOWS more OPPORTUNITY for people to get and BE rich than anyone else!!! Now if the Gov would go back a bit, and get off of, and out of the way of, “business opportunity to GROW, I think we’d see things take off…. Problem NOW is, Obama has no plan, and is unpredictable! Hated Bush tax cuts, then was in favor, etc etc etc… no one wants to wager BIG money investments, when the Guy in charge, is both wishy washy, and unpredictable! Monday you invest.. Wednesday Obama changes his mind… you’re broke! STABILITY in leadership, and policy is KEY to investors laying the cash on the line…… With Obama at the helm forget it!

Hankster #72 AGREED. Happy St.Pat’s Day to all!

Dang!! that’s TWO!! LOL!! Are we “on a roll”????

@JC:

You have made so many comments here, and most of them are not based on fact or reality.

-Those “rich” people you so earnestly speak of include many small business owners that file their business taxes using personal income tax forms. On paper, they receive, or take in, enough to comfortably put them in the top tax bracket. However, after all the outgoing funds are distributed to things like any type of employee wages, stock replacement, and hundreds of small costs associated with running a business, they are left with middle class take-home pay or less. When their taxes are raised, it affects them more deeply than the CEO’s, or the truly high wage earners. Enough so that any employees they might have get less hours or laid off.

-The CEO’s you speak of receive their pay at a board’s discretion. Do some of them make well over what they should for their performance? Sure. But there are many others who, even while earning multi-million dollar salaries, bring the companies they run into higher profitability, which allows for more expansion and more lower wage jobs to be created. It is none of your business, unless you happen to be a shareholder of the company, what their salary and benefits are, nor should you or anyone else not associated with the company, and that includes the government, have any say in what anyone makes.

-Wages are entirely dependent on market forces. As the minimum wage is artificially raised, so is every other wage adjusted upward. This increases the cost of goods and services, and like I’ve told Greg numerous times, those making minimum wage end up in the same boat, or worse, when all is said and done.

-Those who gain large amounts of wealth from high incomes do not “sit” on their money. It isn’t taken out of circulation. They don’t bury old coffee cans full of money in their back yards, or keep stacks of cash under their mattresses. Their money is invested in things like real estate, stocks, bonds and the like. Their money goes back into circulation, to work for them and add to their wealth, and at the same time, it is put to work for others. Companies gain more capital for expansion, new products gain capital to increase their own market share, real estate is improved. All of that leads to more and more jobs for people, and not just minimum wage jobs but good paying ones. Bill Gates’ billions are working right now to not only make himself more, but by the companies he invests in. The same with Warren Buffett and any other super-wealthy person you can think of.

It’s not up to you, or anyone else to make anyone “responsible” in the arena of wages and benefits. The market corrects itself. If a CEO is very highly paid, but does a lousy job, then they are ousted and someone else brought in. If they do a good job, the employees working for the company benefit in higher wages and benefits, along with those who’ve invested in the company allowing them to invest more in that company, bringing more capital to the business, allowing for the prospect of further successes, and on, and on, and on. CEO’s are paid based on what the board thinks they can do for the company, and their performance in the job, and as incentive to do a good job for the company.

Your idea is to limit the ability of a company to provide incentive for it’s executive officers. That isn’t your business to do so. That rests solely on the company, and it’s board and shareholders.

The free-market, a truly free-market, is a wonderful thing. It self-corrects, punishes those who perform badly while rewarding those who perform well. It keeps wages from increasing astronomically, for a company paying wages well-above the market ranges prices itself out of competition in the market. It also keeps wages from being unusually low, for a company paying wages well-below the market ranges soon finds itself wanting for good employees(and that includes the executive officers).

Government intrusion into the market place artificially affects the market in areas, sometimes forcing companies to price themselves out of the market, either high or low. The free-market, when government intrudes, does not work well, either for business owners, executive officers, and those laborers who make the products and provide the services.

It is amazing to me that those with so little business background, or acumen, feel it necessary to want to force their will on businesses, and artificially affect the market, most oft-times to the detriment of the market.

@Hankster:

A lot of the poor are working, and paying taxes. Who is cashing government checks? Elderly people, rich and poor, who collect social security and medicare, people with disabilities, etc. It’s so convenient to imagine them all as caricatures, living so high on the hog with 100 bucks a month in food stamps, but that ain’t the reality.

And thanks Anit-Wacko, I realize the futility of arguing with those who won’t look at facts.

If a CEO is highly paid, and does a poor job, they get ousted (with a HUGE ASS compensation package) and then they run as a Republican (Meg Whitman, anyone?) Every asshole banker on Wall Street?

@JC: You said:

And your answer to this is to raise their wages? Okay fine. But when they work at a furniture store for minimum wage and you raise that wage, what do you suppose the owner of that store then has to do to the prices of his inventory?? Do you expect him to eat that increase in the cost of doing business?

It is clear that you have no concept of how the market place truly works.

Above all else, this taxing the “rich” talk and all the other talk needs to take a backseat to the overspending by the government.

Is their any reason why the federal budget this year should be as high as it is? $3.8 TRILLION. Think about that for a moment. Bush’s last full federal budget was $2.9Trillion, while the government revenues were $2.7Trillion.

Estimated government revenues for this budget year are $2.2Trillion or so. Out of that, just over $1Trillion will come from individual income taxes. Even if the highest tax rates were increased to pre-Bush years, it’d still only be about $1.1Trillion, or, a $100Billion increase. And our deficit? Still well over $1Trillion.

This tax talk is meaningless at this point in time. Government spending is the real culprit to both our current budget problems, and the unfunded liabilities to come due in the near future.

@anticsrocks:

Neither him, nor Greg, understand the workings of business and how the market system works. This is why they continue to espouse their views of evil “rich” people taking advantage of the “poor”. They lean towards social systems that do not work, have never worked, and will not ever work, and denounce free-market principles that do work, have always worked, and will continue to work.

The artificial effects they wish to impose on business, and the free-market, cause disruptions in the market itself, most oft-times to it’s detriment, which they then point to and claim the free-market does not work. In short, they cause the very issues they complain about.

Common sense left their minds a long time ago, leaving bitter, jealous people who’s only answer to everything financial is to take more and more from those who have it.

@johngalt, #76:

Aren’t costs such as employee wages, stock replacements, business equipment, etc, generally subtracted before the small business owner finally gets down to the “taxable income” line?

If what they’re left with after operating costs have been subtracted out is a middle class income, their attitudes about progressive taxation might have a lot more in common with the middle class working person’s than with earners whose income falls into the top 10 percent.

I think the great majority of small business owners actually are part of the beleaguered middle class. Those who speak loudest about small business often aren’t “small” in the average small business owner’s usual sense of the word.

This isn’t to say that there’s no legitimate reason for complaint about the overall complexity of tax law for average small business owners. That’s a separate issue from progressive taxation rates.

JC,

I guess working hard and trying to improve yourself doesn’t count. You see, by your definition, I should be poor with nothing to show for my effort.

Are you saying if the following happens to a person, there’s no way they should ever achieve anything?

1. Mother spent a fair portion of her adult life on welfare.

2. Father figure spent most of his life in prison.

3. Biological father not around, never provided child support.

4. When parents did work, the children had to assist to make ends meet.

5. Grew up in public housing/section 8 housing

6. When not in public housing, the apartments were appalling.

That was me. I didn’t blame anyone for my plight in life. My mother made her choices. I didn’t make mistakes like having children at 17/18 years old. I got a job and paid my way through college. By my mid 20s, I was making more than anyone else in my entire family. Work ethic, dedication and education got me where I am today.

I got an up close education on what government assistance does to people. It makes people yearn not to work, but to complain about their government checks. With those government checks come strings. There’s a fine line between working and collecting a government check for roughly the same amount. For those who don’t look at the big picture, they see the effort as not worth it.

You say that someone shouldn’t earn more than a given amount of money. Your 7.5 million dollar figure for example, is only the beginning. You see, they typically won’t spend the entire salary and they will invest it. After a couple years, they can make a substantial portion of money simply off the earning of their money. What are you going to do about that? And what about the jobs that money creates by investing in other businesses? Should that money be taken away.

You see, I have been on the very poor spectrum. Spending nights in shelters. Holidays in prison visiting rooms. Being forced to go to the store to buy a package of ramen on food stamps so the change could be used to buy cigarettes. Never being truly hungry, but never having new clothes, a nice place to live, or even a new car. My mother made those choices.

So, when I see what someone can do to bring themselves out of the poorest ranks, I know what doesn’t work. Giving someone something for nothing only buys you another beggar in a different form. And taking from those who produce to give to those who don’t is simply going to grow more open hands. At some point, someone will say the effort just isn’t worth the extra effort for diminishing returns.

This is the real world. Learn about it.

@Greg:

Not all of outgoing payments are tax deductible, nor is all that is deductible entirely deductible.

Have you ever owned and/or ran a small business? If you had, I seriously doubt you’d be claiming what you do about taxation. Progressive taxation is rooted in socialist philosophy, Greg, and has nothing whatsoever to do with “fairness”.

As for our tax system itself, it is overly burdensome to all who pay any type of income taxes. It is the epitome of something that is not “fair”. I state this, and I haven’t made over $100k a year in my life yet.

The amount of government revenue gained from personal income taxes, is getting smaller and smaller percentage-wise, as compared to the outgoing government payments from the treasury. Even at a 90% clip for the highest bracket, our deficit would still be well over $1Trillion on the year. Taxation is dumb to discuss in the face of a government spending not only the money we currently don’t have, but also the monies our children and grandchildren don’t have.

The fact that you and JC and airheads like Moore are even talking about raising taxes at this time shows your ignorance to the actual financial problems our country is facing right now.

@johngalt, #80:

How can it be meaningless? The result we get by by subtracting the total amount being spent by the government from the total amount of taxes being collected by the government is what tells us if the budget is balanced or not. Each figure is an equally important half of a problem that comes down to simple arithmetic.

Arguing this to be meaningless tends to distract us from the fact that we had tax cuts that are disproportionately weighted in favor of those having the highest incomes in place for 8 years, that we have just extended them in spite of our deficits, and that those who have most benefitted from them are strongly pushing to make such tax cuts permanent and even greater.

It seems to me that we’ve got to deal with both factors.

@JC: People get paid for the amount they can contribute. If a person has no skills, should he get paid as much as person who has developed skills? Was Joe Namath worth the $500K he was paid back then? Is Manning worth $20millionn per year. The answer is yes if they can produce add value to something. You want everyone to get paid a living wage for doing nothing to enhance their skills. The, you fail to determine what a living wage is. Should a living wage include payments on a flat screen TV with HD cable? How many car payments should a family be allowed and still be considered as living wage? You want people who make poor decisions in life to be equal to those who actually created something. People who had an idea and made it reality. I think it is time to move on from this thread. Greg and JC have no idea what they are talking about. What they need is to spend some time in a socialist country and really see how well distribution of wealth really works! Good luck guys.

@JC: IN 1972, I had $.50 in my pocket and a full tank of gas in my moter cycle. I bought two hamburgers and found a minimum wage job a few days later. I didn’t have health insurance. I lived in an old trailer paying $100 per month. I didn’t feel that I was disrespected, I felt I had made some poor decisions and vowed not to make them again. Right now, I am considered the “rich” by you lefties. I did that by saving my money, working hard, improving my education and forgoing things many of the poor in this country can not do with out. )TV, cell phone, New car, microwave, etc.) The difference is that you do not want to take responsibility for your poor decisions and to do anything about it except try to take money from others who earned it.

@JC: Wrong again JC. Don’t you get tired of being wrong. You are still spewing the Carter spin. If you are going to be respected here, you need to get your facts straight!

Wrong again JC. Don’t you get tired of being wrong? You are still spewing the Carter spin. If you are going to be respected here, you need to get your facts straight!

“”Snicker Snicker”….. 😉

I read Chipsets last post above, maybe you two clowns should too!! He’s a guy who DID IT RIGHT! He started out at the bottom, and educated himself out of there….. Case Closed! those who WANT out, can do so! We need to get the Business sector going again, so they will have a place to move up TOO!! It would go faster, if Class/Rich envy guys like you would stop blocking the road with fiscally irresponsible “dreams”… and GET REAL!

If you’re not part of the SOLUTION, you are part of the PROBLEM!

@Greg:

You talk about a tax cut that even the dems claim as $600Billion over 10 years. That runs to $60 Billion a year, roughly, using their own math. Now, their figures are wrong because they don’t take into account any effects on job creation or deletion and the added tax revenue due to that, nor the expansion/or lack of expansion of businesses by continuing the tax cut or ending it.

But to get back to the dems own numbers, that $60Billion is only 3.75% of the projected deficit, or 1.5% of the total projected budget for this year. We’re not talking about something that would even come close to balancing the budget, and the negative effects of tax increases on the economy are not understood by the liberals, and nor do they care to understand the negative effects. My guess is that their $600billion number doesn’t take any realities into consideration.

As I said before, any talk of tax increases on the “rich” is meaningless at this point when our federal government is spending much, much more than the “rich” could ever hope to make up for, even at highest tax rates the country has ever seen.

So, not only is your talk about taxation on the “rich” continually and absolutely wrong, but you are missing the forest for the trees. The highest priority of our President and Congress right now should be the budget deficits and their negative impact on the economy. Instead, they continue to ignore the problem to the detriment of us all. The next president of our country will have an even larger problem on his/her hands than the current one. What are we to do? Keep kicking the can down the road? What your insisting on is akin to having a bill for $100 dollars with only $60 in your pocket, and yet you are more concerned about picking up the few pennies on the ground instead of why you have a bill for $100 in the first place.

1.Someone who is born into a rich family and has loving parents that are willing to spend top$$ for private schools is going to end up being more successful then someone who was born into a family of abusive crackheads.

2. Someone who is born in north korea or Iraq isn’t going to have the same opportunities as someone born in lets say london or the U.S.A.

3. Someone who kisses ass and plays golf with the boss is probably going to get the promotion before the guy that doesn’t.

4. My friend who’s entire family works for verizon got him a union job right out of high school and look what he gets because he was juiced in.

.80,000 a year

. Full free medical(top of the line ppo plan)

. 4 weeks paid vacation.

. 3 weeks paid sick days.

. 401k with a huge company match.

He didn’t even go to college and just got out of rehab for drugs and is a lazy bastard but has it better then the majority of americans. DID HE WORK HARD FOR WHAT HE HAS OR DID HE JUST GET LUCKY?????????????????? EXACTLY I REST MY CASE. The majority of rich people are lucky and should pay way more in taxes considering it was LUCK that got them there wealth anyway.

OK, we play your little game then. Take the money from the rich and plop it into your lap. Guess what, you’re now rich which means that money will now have to be gutted out from your ownership and then spread evenly again. Wealth will only gravitate towards people who operate in a market and away from those refusing to operate.

We all operate in the market. Money is supposed to circulate – that’s the idea. There will always be some disparity. That’s okay.

But in the U.S., wages for working people have been stagnant for three decades, while the rich have increased their holdings exponentially. Take a look at the heydey of the unions, when the blue collar workers were making a decent wage. The savings rate was much higher. Why? Because they could feed their families and still have a little left over. Industry boomed, because there were more consumers who were able to purchase goods in the market.

You only see two possible conditions: Rich and poor. But most of us are happiest somewhere in between. Working, feeling productive, and making enough money to take care of our needs and a few desires.

It’s about what we value. Do we value work? Then work should pay a living wage. Very simple. Does your heroic capitalist value the work of the employees who make his company operate? The smart ones do.

@Hankster:

Don’t worry, my self-esteem doesn’t come from arguing with you punks. I was born between a factory and a railroad track. I have hung out with the destitute and desperate, the rich and famous, and the learned and powerful. I worked my way, by myself, from welfare mom to PhD. Got that? It was hard, almost killed me. I got nothing for free. I worked shitty jobs of all sorts, including wiping butts in a nursing home for minimum wage, selling auto parts, etc. None of those jobs came with health care. I have a pre-existing condition (diagnosed during childhood) and for some reason, the wonderful free market doesn’t want me as a customer, and won’t sell me health insurance for any price. But I didn’t get bitter, I got busy. And you know what? I have compassion for those who, like me, are trying to work their way out of poverty. And I respect those people who work their asses off, even when work doesn’t really pay. I respect them more than those who come from privilege. And I pity those who inherit their money, and don’t have a chance to really test their own mettle.

And remember, when you judge the working poor who have credit card debt and don’t save, remember that like me, they may have had to charge a bottle of insulin, or a doctor visit, and they will pay usurious interest rates for that.

I just think this country works best when people like Chip and me have the opportunity to achieve whatever we are motivated to achieve. Hard work should get you out of poverty. That is the point I am making. Otherwise the American dream is dead.

Besides, Bush cut taxes on the rich a decade ago. Why didn’t that create jobs? Why didn’t that increase revenue? Your whole approach has already been debunked.

@Life is all luck.: You are a moron. According to you, the only way someone gets wealth is because they are lucky?

I call bullshit on that statement.

A small, small partial list of immigrants to the United States that did NOT inherit their wealth:

Levi Strauss, founder of Levi Strauss & Co. – first maker of blue jeans

Sergey Brin – co founder of Google

Lewis Prang – father of the modern Christmas Card

Arnold Schwarzenegger – body builder, actor and politician

Hyman Rickover, Admiral – father of the modern Nuclear Navy

Madeline Albright – former US Secretary of State

Joseph Pulitzer – journalist and publisher, Pulitzer prize named after him

The list goes on and on, this is just a few that I know of off the top of my head.

A study of New Yorkers that are children of immigrants are much more upwardly mobile and have better educations than their immigrant parents. – Source

Your jealousy of those “evil rich people” is pitiful.

@JC: You said:

Sorry JC. You are the one that is wrong on this. Maybe you should do some reading before you speak next time. Here, let me do the work for you…

Hmmm, let’s see. The effects of the Bush tax cuts on employment? Jobs went from a net loss of 267,000 to a net gain of 307,000 NEW jobs.

Sorry JC, but thanks for playing.

@ JC

Carlos Slim:

http://www.businessweek.com/magazine/content/07_10/b4024065.htm

Bill Gates: Just see for yourself – http://www.gatesfoundation.org/Pages/home.aspx

I read your story, very inspiring. I say that with zero sarcasm. The problem is, you see our stance as greedy and without compassion. I see your stance as wanting to take something from someone that you haven’t earned. You say you don’t know the people with a lack of desire I speak of, but I see them all the time. I have some that work for me. They do not want added responsibility, they don’t want to be put on an on-call rotation, they don’t want to go to COMPANY PAID TRAINING, or they just don’t want to move out of their comfort zone. Oh, they want more money. They want to be paid just as much as those that do take on the added responsibility. So don’t tell me people like that aren’t out there.

I think I read that you are a teacher. I don’t know if you are in a union or not, public school/university or private. Why would teachers not want competition? The public is held hostage by the education system because we pay the taxes for public education, whether you have kids or not. I say hostage because the only alternative is to pay extra for private school. If the money it costs to send a kid to public school was given to the parent at the beginning of the year in the form of a voucher, how many would continue to send their children to public schools? I believe the first year it would be around 25%. Once the private sector saw the possibilities that number would grow every year. Private schools would begin to recruit the best teachers and pay them accordingly. Would the very rich be at an advantage to send their kids to better schools? They already are. It would give the rest of us the same choices they have now. But liberals don’t want choice. They want to everyone to receive the same thing. They don’t want you to be able to fire a crappy teacher, because that teacher has the right to a “living wage.” So your kid suffers, thank you teacher’s union.

Not defending crappy teachers. I work with some and they should get out of the business. Just like there are crappy people in any profession. And I assure you, there are plenty of crappy teachers in private schools, which are motivated by profit, and have their own ways of shortchanging students and their educations.

But, why is it that everyone understands “you get what you pay for,” except when it comes to education? How can we demand excellence and not reward it? I am an excellent professor, I get nominated for awards, I get excellent reviews, and my students go on to be quite successful, but after five years on the job, I have not had one raise. Why? Because there are cuts to education every year. My employer says, yes you are good, and productive, you are valuable, and you make less than the market rate, but we can’t pay any more, because our Governor is trying to eliminate the corporate income tax. If you are the parent of a student, is that how you want your child’s teacher to be treated? And yes, I am in a union, and believe me, they are not as powerful as you think they are. In fact, they are kept so busy trying to stave off pay cuts and layoffs that negotiating increases is not on the agenda.

If I were motivated by money I would not have chosen education as a profession. But the price of survival has gone up substantially in the past few years. Food, gasoline, utilities, everything. Wages, however, have not risen, and income has only increased for those at the very top. Is this because they are working harder? I think not. It is because policies favor them, including things like payroll taxes, which are the bane of wage earners but barely noticeable for those at the high end of the scale.

Most of the rich people I know (many of them friends of mine) would be happy to pay a bit more in taxes to maintain the kind of society they want to live in. They know that their lifestyle would not be substantially affected by a 5, or even 10% increase. They know that a country full of desperately poor, poorly educated, sickly people is not a nice place to live. Most people, rich or poor, would agree that the American dream is built on 40 hours a week being enough to provide a basic standard of living.

Since you decided not to even address my comments that set you straight on the Bush tax cuts, here is a question for you, JC.

Let’s say that you write a book this year and it becomes a best seller, gets on the NY Times Best Seller List and you make $10 million dollars.

How much should you pay in taxes on that income? 30%? 40%? 50%? 60%? 70%?

How much of your hard earned income should your government confiscate??

@anticsrocks: You should have add “and piss away” to the last sentence!