![]()

There’s an old saying; A picture is worth a thousand words. Pie charts will likely never be confused with great art in terms of story telling, but they have a way of making complicated issues clear. Income taxes are one of those things that are naturally difficult to grasp and the issue is made that much more opaque because liberals love to obscure the facts.

One of the shibboleths of the left is that the rich don’t pay their fair share of taxes. One of the more amusing segments of the 2008 Presidential campaign involved Neal Boortz asking then Democrat hopeful Dennis Kucinich two simple questions:

- What percentage of total income is earned by the top 1% of income earners?

- What percentage of total federal income taxes are paid by the top 1% of income earners.

of all of the federal income taxes – according to Congressman Kucinich answered: He thought the top 1% of income earners earned 60% of the income and paid about 15% of the taxes. He was a little off. In fact, the top 1% of income earners earn approximately 17% of all the earnings in the country. That’s certainly higher than the 1% they represent of the population but a far cry from Congressman Kucinich’s 60%. More astounding however, is that they pay fully 39% a 2009 Congressional Budget Office report. The below chart demonstrates clearly the absurdity of the notion that the rich do not pay their fair share of taxes.

of all of the federal income taxes – according to Congressman Kucinich answered: He thought the top 1% of income earners earned 60% of the income and paid about 15% of the taxes. He was a little off. In fact, the top 1% of income earners earn approximately 17% of all the earnings in the country. That’s certainly higher than the 1% they represent of the population but a far cry from Congressman Kucinich’s 60%. More astounding however, is that they pay fully 39% a 2009 Congressional Budget Office report. The below chart demonstrates clearly the absurdity of the notion that the rich do not pay their fair share of taxes.

The first chart shows that the rich do indeed pay far more than their oft cited “fair share” of income taxes. Not only that, it also shows that the bottom 40% of wage earners actually have a negative tax rate and get money back from the government in the form of income tax credits!

Another of the left’s arguments is that the lower income wage earners pay a disproportionate amount of the Social Security / Medicare tax. That too is false. The second chart states that the top 10% of wage earners pay 43.5% of all social insurance taxes while the bottom 40% pay just 15%.

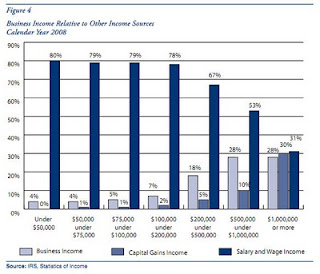

Why does any of this matter in the first place? The third chart (taken from a 2010 report from the Tax Foundation) demonstrates why…Jobs. It compares wage & salary, capital gain, and dividend income for all income earners. As you can see, for the 80% of income earners below $200,000 per year, wages (i.e. a job) make up almost their entire incomes. Without jobs that someone else creates they would have no income… except government transfer payments.

Why does any of this matter in the first place? The third chart (taken from a 2010 report from the Tax Foundation) demonstrates why…Jobs. It compares wage & salary, capital gain, and dividend income for all income earners. As you can see, for the 80% of income earners below $200,000 per year, wages (i.e. a job) make up almost their entire incomes. Without jobs that someone else creates they would have no income… except government transfer payments.

At the $200,000 and above level, business and dividend income starts to take off and by the $1,000,000 and above level the three are almost equivalent. Those are the telltale signs of success. Those people earning those $200,000 and above incomes are the people creating the jobs that employ most of the remaining 80% of the population.

Put another way, jobs are not created by wage earners. Jobs are created by entrepreneurs risking their capital to start businesses… And those entrepreneurs are the usually found in that $200,000 and above group. The businesses they start generate 65% of all new jobs created in the United States.

While the first two charts debunk the myth that the rich do not pay their “fair share” the above chart demonstrates why it matters: The rich are the ones starting small businesses and creating jobs and prosperity.

While the first two charts debunk the myth that the rich do not pay their “fair share” the above chart demonstrates why it matters: The rich are the ones starting small businesses and creating jobs and prosperity.

Myths die hard, particularly when their proponents willingly ignore the facts. The myth that the rich don’t pay their fair share should soon be headed the way of the global warming hoax. Clearly it is the people at the upper end of the income spectrum that are being treated unfairly. They are not paying their fair share… They are paying more. Not only are they responsible for 2/3 of all new jobs created, but in return they are rewarded with being allowed to keep even less of their income as they become more successful. Perhaps as more Americans examine and understand what it takes to generate and sustain a dynamic and growing economy the “tax the rich” cries will begin to fall on deaf ears. That’s exactly what America could use right now, a reinvigorated entrepreneurial class striving to put more money in their pockets… and generating millions of jobs in the process.

See author page

Can’t emphasize that enough!

When we started our business we were both wage earners.

BUT…..we were wage earners who had scrimped and saved and accumulated almost one full year’s worth of income in the bank so, IF the business failed completely we could still eat and pay the rent while finding new jobs working for someone else.

We’ve had really good years and many lean ones, too.

The risks were all ours.

But the rewards were shared with employees who made them possible.

During those good years equipment was upgraded, new people were hired, people got raises as well as year-end bonuses.

But in recent years (Obamatime) no new hires, attrition is thinning the ranks, equipment is only replaced if it cannot be repaired anymore, customers owe us a lot of money and taxes as well as regulatory costs have gone up so no raises or bonuses.

I retired.

But hubby plugs away even though he is old enough to retire.

He feels a responsibility to those loyal employees he has had for so many years.

Now post income distribution. Your charts don’t even begin to tell half the story. Post sales tax as a % of income.

It all depends on how you want to define “fair share”. Some suggest–with perfectly straight faces–that taxing everyone at the same percentage without regard for total income would be fair. I’m inclined to think that one’s ability to pay is a factor.

As of 2002, the bottom 40 percent of U.S. households had only a 12.2 percent share of total U.S. income. The top 20 percent had a 49.7 percent share of total U.S. income, with that being further concentrated into the topmost 10 percent.

The 10 percent on the pie chart up above pay a greater share of total federal taxes because they receive a significantly greater share of the nation’s total income.

(See U.S. Census Bureau publication Income in the United States, page 25, chart A-3, year 2002, Share of aggregate income.)

Just as the nation’s wealth has been redistributed upward over recent decades, so has the nation’s income. You can see the steady gains of the highest quintile and the steady declines of everyone else by examining the percentage shares of total income on chart A-3 from 1967 through 2002.

It will be interesting once data has been compiled for 2003 through present as a result of the most recent census. That should provide a clear picture of the effect the Bush tax cuts have had on the distribution wealth and income in America.

Yeah Yeah Yeah…. we know…. “Tax the evil rich”… we get it Obama, I mean Greg!

Well, according to many, the fair share of the rich (but not anyone who is employed in Hollywood and Sports or other entertainment) is everything they earn.

The problem is, once you have determined “a fair wage” for someone, they will only work to attain that wage. What is the incentive to create more if the ROI is lower? And that’s idea here.

The problem in America is that we’ve turned from a “pull yourself up by the bootstraps” country who created many of the greatest inventions of all time to a “you are a scourge on the planet because you are successful” country. The CEO of Intel recently said that building a new plant in the US costs $1 billion more because of the government regulations, NOT BECAUSE OF THE COST OF LABOR.

In some low skilled jobs, yes, cheaper labor can be obtained and if it is a significant cost to the business, they are remiss not to maximize profits. However, in skilled positions the US workforce still competes until you add the added regulations, at which point it is cheaper to educate and develop skills for another workforce.

As a company, are you going to spend $1,000,000,000 more to build a plant here or somewhere else? If it is your money, what would you do?

Maybe the top 20% spent a good deal of money to get an education and they actually have a job Greg. No one should have to pay for people who make poor decisions in life but the people who make poor decisions.

The rich pay most of the taxes because they hold much of the wealth. Their taxes haven’t gone up, it’s just that their income has compared to everyone else. There is a simple explination for that and it’s based on how compound interest works. They have more discretionary income that the average person which is invested to create more discretionary income.

Part of the problem is wages and average costs have not kept the middle class going. In the 1960s housing was 5 times more than average wages. Even with the housing price drop, it’s still 7 times that of the average wage. Wages have not kept pace with inflation since the mid ’80s. When compared to the rest of the world the average citizen is still rich. Even though China is the second largest economy in the world, 800 million to 900 million people live in households that make $1 or less a day. If you live in a building with a working refrigerator, you are among the top 20% in terms of world wealth.

Another problem is people look outward for help. Fewer people are making things on their own including meals. They don’t build and repair their own stuff either. Getting others to do it costs money. The amount of new products that people are inventing on their own is very low. People talk about Walmart, Starbucks, American Eagle Outfitters, Hot Topic and Apple as if they were new companies even though they are decades old. There hasn’t been a major movie franchise based on something new since Jurrasic Park which is basic on probably the last book that “everyone” just had to read. There is no new major comic like Garfield or Calvin and Hobbes. There hasn’t been a “new” major non computer related toy since the Cabbage Patch Dolls. The Elmo doll, which was a huge hit later, was based on a decades old character (his birth year is 1979). The top part of the music business is a wasteland (although I consider some alternative acts as some of the best music ever done). The list goes on. People are living off of old companies and old ideas and then wonder why these founders (or their relatives) are getting all this money. Even when people had good ideas, like a burger joint I loved, they never expanded into a franchise or large company. The middle class needs to be more creative and stop complaining about the rich while handing their money over to people that dared to spend their money on making money.

@Greg

And why is that, Greg? We all would love to hear your actual reasoning for this.

And your point is? Apparently a how a person works, what they labor at, and the successes they acheive matter very little to you, if they make more than others. Apparently, a person who undertakes more risk and receives reward for it, matters very little to you. Someone could just as easily sit on their a** at home, and should receive income for it, taken from those who actually do work, just to make things “fair”. One thing you definitely do not take into account in that above paragraph is the amount of work done, type of work done, risk involved either with their own capital, or others, and their ingenuity to create their own slice of the American dream.

And now we come to the most important statement you’ve made. You call it “the nation’s income”, Greg, but you are wrong. The nation does not undertake the financial risks of those 10%. The nation does not work the long hours trying their damnedest to see those 10% succeed. The nation doesn’t use it’s collective mind to come up with new, or better products or services to help those 10% succeed. It is the individual that does that. Sure, they may have employees that help them, but that is a far, far cry from “the nation”. The nation doesn’t have any income. The nation is a collection of individuals that have income. The nation owns no part of an individual’s income, hence the nation does not have income.

Your “fair share” argument does not hold any water when one considers how much of the government’s tax revenue is generated by the high income earners. One could even argue that the share of taxes they pay is much higher than the graph indicates, because many of those high income earners actually provide the jobs that lower wage earners work at, and pay taxes on. And still, it can be argued that it’s even higher due to all the investment monies into other companies, that provide jobs for those lower wage earners. Do you wonder where the country would be if their weren’t any high income earners? It certainly wouldn’t be the Utopia your dreaming of.

You are showing your true colors with this sentence, Greg. I’ve explained previously about “the nation” not having any income. That phrase belies a socialistic tendency, if not outright statist mentality. In those, one believes that all wealth, and the generation of wealth, belongs to the state. That is exactly what you are saying by that particular sentence. No denying it, Greg. You are a socialist.

So, according to greg #3*, if I, or anyone else can account for every penny earned as needed to be spent on necessities, then I should not have to pay any taxes, right?

That boils it down rather nicely.

The OLD commie saw:

From each according to his ability, to each according to his need…

Popularized by Karl Marx in his 1875 Critique of the Gotha Program.

The biggest issue with that philosophy is it robs all people of incentive.

Without incentive who bothers to make a dime more than he needs?

You cannot confiscate what is not there.

The old USSR learned that the hard way.

North Korea is a living example.

Right now around $1.3 trillion is sitting on the sidelines while we await more certainty in our economy.

Obama goes in front of the US Chamber of Commerce and says,

“GAMBLE!

Ignore your fears and spend, spend, spend!”

Successful business people know better than to follow him over the cliff.

Maybe if he had made a payroll even once in his life…..

(We wouldn’t be where we are today, if he had, though.)

*one’s ability to pay is a factor

@gregory_dittman: You said:

The best way for this to be achieved is to get the government out of the way.

@johngalt: You said, emphasis mine:

Couldn’t have said it better myself, john!

@Greg: You said:

And I am inclined to agree with johngalt on this one, please explain your reasoning Greg. Maybe you can convince people better if you supply more than just liberal soundbites.

@johngalt, #8:

Because if the same tax rate that might cause a high-end earner to forego some discretionary luxury were applied to a person on the low end of the earnings spectrum, it could result in that low-income person having to forego something essential to a far more basic lifestyle. A lot of people worry from one paycheck to the next how to pay the bills.

Consider Figure 6 on this web page, which shows the percentage of income various income quintiles pay in various taxes. For bottom 20 percent earners, taxes absorb around 16 percent of their meager income. They couldn’t be expected to pay more and make ends meet. For the second 20 percent, the total tax burden is even worse.

Taxes obviously have to be paid by someone. Which quintile is it fairest to require the greater percentage from? Bear in mind, too, that everyone is subject to the same progressive tax schedule. Higher income people pay no more than anyone else on that portion of their total earnings that come before each percentage breakpoint. (Some pay lesser rates, if their income takes the form of something other than wages–15 percent on short-term capital gains, for example. I suppose we could argue that low income folks could benefit from that too, but the truth is that capital gains don’t figure large into their total income. They don’t have much to invest.

Horse hocky. That income is largely dependent on the working and middle classes, which are actually making the products and performing the services that someone else’s business is totally dependent upon. The extent to which this simple fact is often totally ignored astonishes me. It’s sometimes so bad you’d almost think that the working people who keep all the wheels of the national economy turning are nothing but ungrateful parasites, totally dependent on the largess of investors, financiers, and business owners. In fact workers and owners (two descriptive words that don’t appear only in marxist dictionaries) are dependent on each other, and each is entitled to a fair and reasonable return on the contribution they make.

As I’ve noted before, it’s also consumption by working and middle class people that creates much of the demand for the goods and services they produce. The highest income quintile profits from that consumption. If you don’t pay working and middle class people enough, or place too large of the tax burden on them in comparison with their income, their level of consumption declines and economic activity progressively slows. It also becomse increasingly difficult for them to provide for their own long-term economic security.

Red, I presume? Not so.

More is being read in to a couple of short phrases than their simple, straightforward meaning. If we were talking dollar values and referred to “the total income of the household” or “the total wealth of the household”, it would be pretty clear what was meant. Same thing here–no more, no less.

@Greg: I was wrong when I said:

While you did part from short soundbites, you borrowed heavily from Karl Marx and from his Communist Manifesto:

Hello, Greg. Thanks for adding that important contextual information.

I have been, and in some ways still am, a member of the working poor. My parents were working class. I have worked every day of my life. If you want to argue against Marx’s point about the exploitation of the working class, you are going to have to close your eyes to usurious creditors (look that up in the Bible, that goes back way before Marx), payday loan schemes, and old ladies paying for their prescription drugs with Visa, thereby paying 20+% interest on their medicines. Even at the above minimum wage rate of 10 bucks an hour, the average worker would have to work more than two weeks full time to pay for one emergency room visit. Taste the reality. It ain’t pretty.

If you want to take a look at the misery of the working poor, look no further than our enlisted military members. Go to any Military base and see the exploiters waiting just outside the gates to prey on their low-wage distress. But I guess they work for the government, eh? Just sucking the rich man’s teat dry. Yet who will protect the rich man’s ASSets against foreign invaders? Hmmm?

I would also point out that many of the rich came to their riches through inheritance. They aren’t this “golden class of producers” that you like to imagine. The founding fathers wanted to prevent a financial aristocracy, and that is why they wanted a heavy estate tax, and also a limit on the lifetime of a corporation (having been exploited by the East India Company). Look it up. And the rich would be nothing without the roads, infrastructure, both transportation and communication, built, subsidized, and maintained by the state. They reap more benefits from this infrastructure in conducting their business, and should be taxed accordingly for its upkeep.

According to your argument, Paris Hilton brings more value to our society than a small businessman, working his ass off, or a nurse, or a nuclear power plant operator. That’s shameful. And being rich shouldn’t be shameful, but when you are getting richer and richer while others work their asses off and can’t even afford necessities, there is a problem, and it is bigger than just poor people being hungry, although that should be bad enough.

I, Michael Moore, being of sound mind and (strike that)…will be donating 100% of my financial assets to the middle class downtrodden to be named soon. Hold your breath. Or, to be honest, as my pithy Mom used to say, “Don’t hold your hand on your a** waiting. It will grow there.”

@Greg:

“because they receive a significantly greater share of the nation’s total income. ” Please, correct ‘received’ to possibly something more honest like ‘earned’ or ‘worked to earn’.

Greg

I think you are looking at this from the wrong perspective. Personally, I like the Fair Tax, but I’m not opposed to a Flat Tax. But the reason I believe you are looking at this from the wrong perspective is because I think you believe the Federal Budget is a fixed entity. It is not. If you are not paying much in the way of taxes, why would you care if the government continues to take money to fund things they have no business funding? Let everyone feel the same pain on April 15th and see how long we continue to have the National Endowment for Humanities. Let’s see how long we allow the Executive Branch to continue paying “Czars” or how long we continue to allow Congress to redecorate their offices every two years. If everyone feels the pain, I doubt we’ll hear much about how that portion of the budget or this portion of the budget is just $20 Billion. If you see a substantial part of your hard earned income being chewed up by medicare, medicade, and welfare fraud, I doubt you would say it’s just a small portion of the budget.

I spent 10 years in the Air Force as an enlisted man. I worked my butt off to get where I am only to see there is no real incentive for making more money every stinking April. Where is the incentive to do well in school if the government is going to ensure the person that did nothing in school is going to have just a comfortable life as you do? Where is the incentive to succeed? Why should I or anyone else work 70 hour weeks so the money we earned goes to people that have no desire to get ahead?

It is quite simple, you choose either freedom or equality of outcomes; you cannot have both. In a free society, if you give everyone the same amount of money to start, a week from now, they will have unequal amounts.

Sure, Ukraine, just like Paris Hilton and George W. Bush. The EARNED it, right?

Where are all these people who have NO desire to succeed? I have never met them. Do you believe that only money can motivate people? History proves you wrong. There are millions of people who work 70 hours per week in this country and barely eek out a living. There are thousands who have millions who did nothing to earn it other than being born into the right family, at the right time. Is that a meritocracy?

Gary, not everyone has to be equal, but everyone has to eat.

JC – It’s Fair to use Bush and Paris Hilton, but are you aware of what % those people make up the Top 1%? Are you also saying that because someone in their family earned money (acquired wealth) that they shouldn’t have the benefit of their families wealth? So, we should all start fresh, without the benefit of our families sacrifice and start from the ground up?

Ukraine, I’m not saying that they should start with nothing necessarily, but if they had to work for a living, it would be for their own good, yes? If money is the incentive, doesn’t it kill theirs more certainly than food stamps and unemployment benefits kill the ambitions of the poor, at least in RW rhetoric?

They make up only a tiny part of the population, it’s true, but again, look at how much of the wealth they have, comparatively speaking. Paris Hilton will spend as much on a pair of shoes as a working stiff, making minimum wage, makes in a month. And as for money as an incentive, if it worked to make people better at their jobs, why do the bankers seem so crappy at theirs, and why do they get bonuses? Why does a teacher like me bust my butt when I haven’t had a raise in five years? Some of us are motivated by feeling that we are useful and productive. We like to work, and like to feel like we are contributing. Don’t we deserve to be able to eat?

And wouldn’t it be better for the economy (and capitalism) overall if millions of people could shop for reasonably-priced shoes, rather than a few heiresses paying stupid money for one pair?

Sure, but let us not be so dogmatic in thinking that because you have money that the desire to be productive and be successful is gone. Donald Trump, for this example, came from money and he appears to continue to work. Work Ethic is what we are really discussing, and that has to do with parenting, not as much to do with money. We have kids from all tax brackets that never grow up with the proper work ethic.

I also do not believe that because the ‘Rich’ have so much of the ‘Wealth’ that their isn’t enough to go around. Bill Gates having his Billions is not hindering my success, unless I want to compete against Microsoft and then I have major issues.

I’m a business owner and my costs for my materials have gone up 20%, but with the market and economy I’m in a position to where I have to reduce my prices (cut profit) in order to sell, or stick to my prices and HOPE people see value in my products and services, which is getting harder and harder with the economy. My wife is a physician who has not seen an increase in reimbursements from any insurance company, nor Medicaid, and she still works 70+ hours a week and her services are the same, if not more. She is a Neonatologist and can not, nor will not, turn children away. Her services are not based on choice, but driven by the patient, and she has to do what is needed. She can’t ‘Strike’ because she makes less now and allow a child to die. She can’t refuse to go in a 3am when it’s 10 degrees to take care of a 25 week baby. We always talk about Teachers giving and Civil Service workers, which is fine, but we also see teachers and Unions attack the ‘Rich’ as if we (Yes, we are in your ‘Rich’ category) woke up one day and my wife just happened to have: 1) 4 year degree, admission to med school, 2) a med school certificate for graduating, 3) a certificate for passing boards, 4) a 3 year certificate for finishing a Pediatric residency, 5) a certificate for passing Pediatric boards, 6) a certificate for finishing a 3 year Neonatal Fellowship, 7) a certificate for passing Neonatal boards and, 8) continued certificates for passing both pediatric and neonatal boards every few years.

Yep, my wife just made one of those flippant choices and was LUCKY to be where she is today. ANYONE could have chosen this path, she was just LUCKY. No risks she took in life. No sacrifices. You know she’s just like everyone else that waited until she was 32 to be able to hone her career and put money, having children and some of the things other are doing on hold until she was in a position to have a secure and solid future for herself and her family. (sarcasm)

JC, First, Why is it any of Your Business how other people spend Their own Money or how they acquired it?

Second, What amount of assets constitutes “Wealth”? Wealth is a renewable resource and not a finite quantity. As long as the wealth is acquired by legal means how is that any of Your Damn Business?

Just asking. Redistribution of My acquired assets or wealth is akin to cattle rustling or theft. I don’t take kindly to that. As long as I meet My Tax requirements, I am head and shoulders above the likes of Geithner or others that are a part of the Current Regime that is both Economically and Constitutionally Illiterate.

Both Social Security and Veterans Pensioners have done without COLA increases for the past Two Years while Congress has received automatic pay raises. Lets start looking at Congress getting pay and benefit cuts or no raises until they can get a budget in place as opposed to cowardly continuing on CR Budget numbers that as fiscally unsustainable. How about that?

@ UkraineTrain

Simply fricking awesome!! If there was a standing ovation smiley, I’d fill the board.

Old Trooper is right. If a someone makes a million times more than someone else, what does it matter if both are better off?

I heard someone comment about the difference between the difference between what employees and CEOs make today vs. earlier, say 1965. Apparently in ’65 CEOs made 12 times more than the average employee while today that number is 263 times. One cannot argue that the average American is not better off today than they were in 1965. A simple example. (From “Time Well Spent – The declining cost of living in America” by the Dallas Fed in 1997) In 1955 it cost the average American 1638 hours of work in order to afford to purchase the average new car costing $3,030; By 1997 the average worker would have to work only 1365 hours in order to purchase the average new car at $17,995. In 2011 it takes the average worker just 1222 hours (@$22.87 per hour) to purchase the average car at $27,950. Not only that, the cars are better cars. They get better gas mileage, they have more options, more safety features and come in a much wider variety of colors, sizes and styles. This same dynamic holds true for everything from telephone calls to TVs to air travel to food to medicines.

Why should anyone other than the person writing the paycheck care who earns what? Let someone earn what someone else is willing to pay them. That is how the market works and how Americans of all stripes have benefited. Liberals want to impose some arbitrary measure as to what someone should earn. Who decides? Barack Obama? George Soros? Charlie Sheen? If the goal is to have equality, or something close to it, let the government decide how much people can earn and we will quickly achieve that Nirvana. Unfortunately however the equality will be one of poverty. It has been tried before… in the Soviet Union and is currently in place in many places in Europe. If you want a real lesson in how to kill a golden goose, look at Western Europe over the last 25 years.

The bottom line is that the market is the best arbitrator of what workers should earn, both at the CEO level and the employee level. No system is perfect, but the American capitalist system has produced by far the greatest increase in the standard of living in human history. To borrow Winston Churchill’s observation about Democracy: Capitalism and free markets are the worst form of economics except for all the others that have been tried.

@JC: So, are you saying that the Hilton family didn’t earn the money they passed to their heirs? The just found it lying on the street somewhere? Now, I expect that they effort I am making working past an age where I could retire so I can make sure my sons inherit some money is not earning the money?

You also said you “Where are all these people who have NO desire to succeed?” Those are the people who drop out of high school and college. They are the people who are always late for work and get fired. They are the people who steal from their employer. They are the people who can not get off their couch in front of the TV to improve themselves and their job prospects. They are the people who pay no taxes and continue to vote for politicians who will continue to provide them with free hand outs at the expense of others who pay taxes. I am currently in dowtown Denver and can show you a considerable number of those. Maybe you should get out more if you have never seen any one who didn’t want to succeed.

@Old Trooper 2: Right to the point as usual!

You yahoos have no idea what poor is. I have no sympathy for someone with two color TV, cable, a microwave oven, two cars and gaming divices. In the US today, these people are considered poor. You say they need to eat. What they did is make poor choices with the money they did have while others used their money to improve their station in life. It is long past time for individuals to take responsibility for their own actions in life.

@ Randy

Exactly right. However, when you have Obama out there saying it is a “right” to have broadband internet access, and Jesse Jackson Jr. saying it’s a “right” to have an i-pad and laptop for all school children, the libs rally to the banner.

I honestly believe we are coming to a period in our history where we will have to split the nation. Allow those that believe they have the right to other peoples income go their way and let the rest of us go ours.

America is probably the YOUNGEST nation on earth. Yet , we rose to be the GREATEST faster than any other nation has. No one has been our equal in ability of ANYONE to “make it to the top! Now, Greg, you can say “Look at CHINA”! Well ok, LETS take a look!! China was an ARMPIT until MAO died, and his hard line Commie Dictatorship went with him! (by the way, MAO was ALSO a CommieFraud…forced Communism on the “masses”. while HE lived in palaces!) China now has risen to Fiscal power and Prominence…by going to CAPITALIST TRENDS and business policies! They now lend US money?? WHY?? What happened HERE??

Well, Since LBJ and his “Great (welfare) Society intiatives, we’ve been on a downwards spiral…Franklin is attributed this quote….

“When the people find that they can vote themselves money from the treasury, that will herald the end of the republic.”

It’s THAT point we are suffering thru now…. the LOWER classes you champion, are electing bums, like Charlie RANGEL,and Democrats in General…. who pay off in non-stop Social Programs… hence “voting themselves money”.. Add to that, the SAME deal we now see manifesting itself in Wisconsin, where the Democrats, PAID FOR by the Unions, put in their “Union Friendly” pals, who voted to give the UNIONS large payouts (more than can be gotten elsewhere in a “free market” ) from the “public Treasury”… and you have now COMPOUNDED the issue! Add in Unions OVERPRICING themselves… and you have the exact formula for economic COLLAPSE! I will go ahead an Lump in things like the Community Investment Act etc, as the lefts cover for giving away MORE PUBLIC MONEY as well!!

NOW you know WHY we’re in trouble fiscally as a nation.

Greg, you can spin it any way you want, but there will ALWAYS be “poor people”, always have been , always WILL BE! Some can’t help it, MANY Can! Education here is free! If you are TOO LAZY to get smart, so you can rise above, that’s just tough Schit! You HAVE the chance, you choose NOT to go for it, eat Alpo! I DON’T CARE! You made that choice. There are Charities to help the rest. So Greg, you like the “Communist model” so much, I suggest you move to a Socialist run country, WE are not going to allow it here, and we’re going to TAKE BACK America from the Demunists…… the Public Unions are going to get cut down to size, and a bit of REALITY is going to be put back into place! Like it or not. The door is always open, feel free to step thru it, on your way OUT. You know, North Korea might like a guy like you, who hates rich Capitalists. Can you Goosestep?? See ya!

We have a group of people who are literate, but ignorant or maybe just naive. Very few wealthy Americans store wealth; except for gold or diamonds, wealth is invested in the economy and has the possibility of creating more wealth. As wealth or capital builds in an economy, more wealth is created: as an example, a man has ten dollars and stuffs it in a rat hole; eventually he forgets about it and a rat uses the material to build a nest. That is ten dollars or a percentage of a nation’s wealth that is dead and lost forever. If that man buys a pair of shoes for two dollars, a meal for a dollar, and invests into a consortium to drill oil and gas wells with the remainder, he is providing jobs and wealth to many other people. Every time that money turns over in the economy, the economy grows and becomes more wealthy. Some of us control huge wealth: some of us deal with a paycheck ever week; none the less, the money goes back into the pool and increases the wealth and vitality of the country.

It works until you tax money from the economy, that deducts energy or wealth from an economy: tax too much and the economy dies. The economy also slows when people lose faith in the economy or their leaders. At that point they begin to stuff money in millions of proverbial ratholes. Americans, especially Americans with capital have lost faith with the amateurish antics and pretensions of expertise by the Obama administration; it is no wonder they are no longer to risk capital and spend money while facing the threat of a Marxist template for business, government control and regulation, and Redistribution of Wealth. The wealthy have far more dollars to contribute to the economy to maintain the steady turnover of dollars that breathes life into an economy. Then as you limit energy production, prices climb and another anchor is thrown to a drowning economy.

To a simpleton, the answer is easy: confiscate that money from the rich, they don’t deserve it, redistribute the money to all the working people and watch the economy slowly grind to a miserable death as investment dries up and jobs disappear. Even the government jobs like teachers disappear when the government runs out of people to tax, but we will have our Redistribution of Wealth and the end of coveting other people’s money. We will have the Primal version of a Socialist Dystopia. But they scream out, “Oh no, we can manage it so much better than that!” Yes, we have seen your management skills for thee last two years.

@JC: “Paris Hilton will spend as much on a pair of shoes as a working stiff, making minimum wage, makes in a month.” Are you f-ing kidding me? JEALOUSY? That is why I should want ‘the Rich” cut off at the knees? Here is the deal, Prog. I could give two shits what Paris spends for a pair of shoes, someone has a JOB making those shoes that would not otherwise. The amount she spends is plowed back into the economy. The old shibboleth of Scrooge McDuck swimming in his money vault full of bags of gold is complete and utter crap. If the best justification you have is that someone spends more on a single luxury item than someone else does for total expenses, you need to wake up and smell the envy. As for the canard that ‘someone needs to pay for Government’ I would suggest that what needs to be done is an overall lowering of the cost of government, so that less income from everyone is thrown down the governmental rathole.

@Greg:

What is considered essential, Greg? A place to call home? Food to eat? Heat in the winter? What else? There are things that people spend their earned income on that cannot be classified as essential, and just because one person has the ability to pay for them doesn’t make it a right for others to have as well. I know very well that I will never move into a house costing several hundred thousand dollars and be able to afford it, but I don’t hold it against those that can. What one earns, and spends their earnings on, has no bearing on what I earn, or spend my earnings on, nor do I think I deserve a slice of the pie someone else has carved out for themselves.

Your leaving quite a few things out of the equation, Greg. Who supplies the tools and machinery to make the products? Who supplies the networking, ads, and transportation for those performing those services? Who supplies the capital for the purchasing of raw materials that are made into products? Who supplies the access to continuing advancements in technology used to make new products? Who supplies the networking access to customers to sell the products and services? Whose idea, capital, and hard work built up the business that allows others access to the jobs they have? Etc., etc., etc.

Believe me. What you claim about those who labor at jobs isn’t ignored by myself. I work at one of those jobs. But I wouldn’t have that job if it weren’t for people before me using their ingenuity, capital, and customer access to create my job in the first place. What astonishes me, and other conservatives, is that you socialist liberals want to claim more responsibility for the success of the companies people work for than they really deserve.

Here’s a clue, Greg. Only the business owner and the worker can decide what is fair recompense for the labor the worker provides the business owner. If the owner thinks the worker wants to much, he won’t hire him/her. If the worker thinks the owner doesn’t pay him/her enough, there are other companies that will pay more. And the market, the free-market, determines the range wages that make sense concerning financial viability for the company. An owner isn’t going to offer such low wages that he/she doesn’t attract good employees, but they also aren’t going to offer such high wages that they price themselves out of the particular market they delve in. Neither you, nor others who aren’t connected to the company or the market they participate in, have any bearing on what the owner pays for wages, or what the workers accept as “fair” for their labor. It amazes me how much you talk about business but how little you actually know about it.

And this gets tied in directly with the taxation on the business owners and higher income earners who invest in business ventures. Without their direct action, or financial action, the jobs they might have created are not there, the jobs they do have they end up limited on how much in wages they can pay, and the offshoot businesses due to expansion that also create jobs are not realized. And the tax burden of working and middle-class? Please! When nearly half the workers do not pay any federal income taxes, your argument is a non-existent one.

Oh, your colors are quite rightly red, Greg. Any time you discuss “the nation’s” income, or “the nation’s wealth”, your meaning is clear as day. IOW, to you, everything made, everything sold, and the wealth generated by such, belongs to the state. That is a socialistic mentality, and the color socialists most generally associate with is red.

What you advocate is simply not freedom. It is of the served, and those who serve. Slave and master. And freedom does not play into the equation on little bit.

@JC:

And what has happened, in thinking that this is the government’s job to do this is, parents no longer take the responsibility to feed their own children, because of government breakfast and lunch programs.

At one time, people would have been embarrassed to take a government handout, unless they were starving. Now, even if the parents can afford to feed their children, they let the school do it.

If you want a strong, vibrant society, the wrong way to do that is to make everyone dependent upon the government for their needs.

@Randy:

You do not have a clue. The first house I lived in was occupied by a motorcycle gang before me, that had set up ramps up into the front door and down into the back yard from the back door. I am not sure what the walls of my shower were, but they were painted. Through most of my life, I worked 2, 3 and 4 jobs at a time. And for the first few years, it was a struggle to eat.

All that was good for me. I have no complaints of how hard I had to work. This is good. I also see people who’s lives are subsidized, and, in most cases, they are doing nothing to prepare their own children for the future. The government pays for their children’s food at school; the government pays for most of their rent, and they either don’t work, or they work a 20-30 hour/week job. That is bad for them and bad for their children and bad for society as a whole.

When 35% of our population get a check from the government, we are in serious decline.

@Gary Kukis, #36:

If 35% of the population weren’t receiving a check from the government, how would the private sector rearrange itself to make it possible for everyone to hold a living-wage job and to survive in old age?

@ Greg

He’s talking about welfare, not gummint employees.

http://www.cnbc.com/id/41969508/Welfare_State_Handouts_Make_Up_One_Third_of_U_S_Wages

@Aqua, #38:

Social Security payments are considered to be welfare? That seems as odd to me as including Social Security payments under the heading of wages and salaries. The linked article does both.

@ Greg

I think you miss the point. If 35% of the nation is receiving government checks, that means 65% of us are taking care of them. Of that 65%, how many pay no income taxes? Nevermind…you just want my money so you can go give it to someone you deem more deserving.

And speaking of these “poor.” I have been inside of their homes. They have children but no books; NONE. No magazines, no children books, no newspapers, nothing. But, what do they have? A big screen tv, without exception, and cable.

Again, when you support this lifestyle, you raise a generation accustomed to sloth and government provision.

Greg cited the prime example of this. Social security. At one time, social security was supposed to be some additional income to help older people. However, for many, they have chosen to make no other provision for their old age, and now SS for many is their only income.

The government, in its benevolence encourages sloth and reduces our desire to take care of ourselves.

@Greg

Actually, the question should be asked on why some 35% HAVE to receive checks from the government. It must be those evil corporations and business owners thieving what rightfully belongs to the people, right?

How about, it’s the thieving, overspending government, raising taxes in order to attempt to cover the overspending, stagnating the economy that, without government’s continual interference, might just actually create enough jobs that many, or most of that 35% won’t need a check from the government.

But we can’t have that, can we. I mean, that could lead to companies making even greater profits, and some people making even more money, and oh, oh, the government would lose control over the lives of citizens. I mean, we might actually regain some of our freedom and liberties, and we just couldn’t have that, could we?

Your tired rhetoric of blaming all the economic woes of the country on the “rich”, “wealthy”, and “high income earners” just isn’t flying anywhere. If you want to continue the movement away from the founding father’s ideals and the freedoms and liberties they imparted to us, then just take it somewhere else. I hear Cuba is great this time of year. Not only that, but your pal Mr. Moore says their healthcare is better than ours. Just leave us the hell alone and take your big government, economically illiterate a** to somewhere that appreciates socialism, or is too scared or stupid to know any different!

I’ll let the comments I made farther up the thread speak for themselves. People who care to read them can decide for themselves how radical or mainstream they sound.

Here’s an example of the working poor paying more than their share:

http://www.economist.com/blogs/freeexchange/2009/04/are_payroll_taxes_regressive

@JC: You said:

Nope, that is wrong.

@JC: You said:

What do you suppose those people work for? If they stopped receiving money for their labor, would they STILL work?

If 90% of their income was confiscated in taxes, would they STILL work?

Oh yes, we’ll all be millionaires someday.

Look, I’m not talking about people who have a million dollars. That could be one poor old lady who bought her house in San Francisco back in the 70’s. On paper, she could be a millionaire, while in reality, she could still be eating dog food.

I’m talking about the richest of the rich, and their hoarding of money. I’ve got no problem with some people being rich, and some poor, but the distribution is badly out of whack. And in America, working 40 hours per week, at any job, should earn you enough money to have a home, eat, and go to the doctor when necessary. That’s all I’m saying. Forget your welfare cheats (although that includes corporations that are subsidized). Let’s talk about the woman who takes care of our elderly in a nursing home and makes minimum wage.

A long time ago that was me, working for minimum wage, and you know what? 30 years ago, it was almost enough to survive. Nowadays, I know it is not. Yet I know how hard that person works, and what a valuable service they perform. Why should they live in constant stress, trembling at the thought of a dental emergency, or a car repair? Why do we not value their work enough to reward them with a living wage?

http://www.politifact.com/wisconsin/statements/2011/mar/10/michael-moore/michael-moore-says-400-americans-have-more-wealth-/

And the glorification of the super rich over the wage-earner is anti-democratic. We should respect the wage-earner, because he makes the money that makes the rich rich.

JC,

Who would the wage earner work for if there wasn’t someone who didn’t take a chance and put his/her money on the line so that someone would have a job?

You are forgetting that there’s this equation called supply and demand. For jobs that require little skill, the labor pool is large, and therefore the wage is lower. For other jobs, the pool of candidates is much smaller, hence the wages are higher.

A rational business owner will always pay an amount that gets them the best job candidates, otherwise they are not maximizing profits.

Should the person who picks carrots at a farm make the same wage as the surgeon who saves lives? Yes, it is possible that someone is living off of carrots and would not survive without the carrot picker, but there’s a much larger pool of people who can pick carrots.

And for the record, two things about minimum wage:

1. You are not intended to live off minimum wage. Think about it. Minimum wage is some arbitrary number. If you make minimum wage higher, all products will cost more. If changing minimum wage could fix all our problems, why don’t we make a minimum wage of $50,000 year? Wouldn’t it be nice to know that the person flipping burgers at McDonalds can finally have a couple nice things? Of course, the price of those burgers will need to go up substantially… And where are they going to get that money from? You.

2. Minimum wage jobs are supposed to be a stepping stone. Hence the reason why you really can’t support a family on minimum wage. You prove yourself in the job market, then you take a higher paying position. Some people don’t have the ambition for that next step. But, imagine a world where you can’t fire anyone and all wages are for a specific standard of living… What would happen? Look at France. Kids were rioting because jobs are hard to come by and they raised the retirement age by two years. This means there will be more workers for roughly the same amount of jobs. What happens to the youth? They don’t get hired.

Your perspective is telling. The rich are evil. In reality, the rich employ others who, while they may make money off it, also provide wages and wealth to others.

Side note… If everyone made the same wage, within a generation there would be “rich” and “poor” people. The difference between rich and poor people has a lot to do with how they spend money. This is why some people can never be wealthy. Think about all those entertainment figures who have filed for bankruptcy. I ask you… Who is better for society, a sports figure who makes $45 million during his contract (and employs no people directly) or the owner who pays the salary of everyone from the highest paid player to the guy who chucks hotdogs to patrons?

Yet one is typically a villain and the other a hero..

Indeed, and who would make the rich man rich if not for the worker? And who buys his goods? You forget that the worker must create the demand, and the supply. The capitalist is pulling the levers, for sure, but the workers are the machine that makes it happen.

I would refer you to Henry Ford on this matter. We are a consumer based economy (i.e. supply and demand), and no matter how decadent, the rich man just can’t buy enough by himself. 400 people cannot create enough demand to keep 155 million people employed. You get that? The worker is obviously necessary to create the goods, but ALSO to PURCHASE the goods. If you bankrupt him, you are a stupid rich capitalist sitting on a pile of unsold widgets, watching your fellow citizens starve. Sounds like the American dream?