![]()

As Glenn Reynolds might say, “They told me that if I voted for John McCain the US would become even more dependent on foreign oil and they were right.”

Following the Deepwater Horizon disaster, Barack Obama put a moratorium on deep water drilling. Then he extended the moratorium and delayed the sales of oil leases in Alaska.

Federal Courts overturned the original moratoriums and Obama went ahead and issued another moratorium and has ignored the Court rulings since then.

Then in October Obama “lifted” the moratorium, or so it seemed.

A month later, not a single permit had been issued.

As gas prices continue to soar, the Obama administration finally got around to that issuance of permits.

They issued one permit this month. But the good news is that Obama is considering tapping into the Strategic oil preserve.

The Obama administration has issued contradictory statements on the high oil prices. On Friday the Obama administration appealed a judge’s ruling that the Department of Interior stop holding up the application process of several deepwater drilling permits. The move effectively continues the de facto ban on deepwater drilling in the Gulf. On Sunday however, White House Chief of Staff Bill Daley said the Obama administration is considering tapping into the U.S. Strategic Petroleum Reserve as one way to help ease soaring oil prices.

So that would be using a reservoir of oil meant for a real crisis as a temporary means to slightly reduce oil prices.

Temporarily.

The Obama Surge in Foreign Oil Dependence Program is highly successful as it has reduced domestic oil production by 13%. Gas prices have risen 67% since Obama took office. Then again, Barack Obama did promise higher gas prices.

Except when he was lying to us about lowering gas prices:

[youtube]http://www.youtube.com/watch?v=dnLP12X3EgM[/youtube]

If you watch carefully you can tell when Obama is lying. (Hint: when his lips are moving)

H/T the Blog Prof

High gas prices are beginning to really hurt, and it’s being covered by…………no one in the legacy media.

There is good news- if you speak Portuguese.

Obama has loaned Petrobas of Brazil $2 billion to finance………oil drilling!

Obviously, Obama has decided to outsource oil drilling from US companies to foreign companies and stop drilling off one coast and begin drilling off another coast. At least that way any oil spill will take longer to reach our shores.

Great guy that he is, Obama has issued another permit to…………wait for it…………….

Petrobas!

to drill REALLY deep (8,200 feet) and IN THE US WATERS OF THE GULF OF MEXICO.

The approval marks the first time FPSO technology will be used in U.S. waters of the Gulf of Mexico. The oil and gas project is about 165 miles off the coast of Louisiana in 8,200 feet of water. The FPSO has a production capacity of 80,000 barrels of oil and 16 million cubic feet of natural gas per day.

So for the slower ones (i.e. left wingers) out there, this means that Obama has shut down US drilling in the Gulf but has granted a permit to a foreign nation to drill in our own waters. One might wonder why Obama appears to be blocking competition for that oil. I think this might be a good time to have a really close look at the Obama bank accounts.

The good news doesn’t end there. Obama has pledged that the US will be a faithful buyer of Brazilian oil forever. Notwithstanding the argument Obama himself made that oil prices are not a function of supply problems consequent to his Libya adventures, Obama cited a litany of reasons the US should buy from Brazil which include the safety of the US not being at war with Brazil even though that doesn’t affect anything:

“which other country in the world has the oil reserves that Brazil has, that is not at war, that does not have an ethnic conflict, which respects contracts, has clear democratic principles and vision, is generous and in favour of peace?”

Obama’s highly publicized speech to be given in Rio De Janeiro was canceled due to security concerns.

Anti-US banners had been placed around the square by Thursday and some protest groups had declared Mr. Obama a “persona non grata” due to a “bellicose policy of occupation” in foreign countries.

Rep. Debbie Wasserman-Schultz (D-FL), who never misses a chance to look like a fool, availed herself of such an opportunity the other day. She and another dimly lit bulb (D-NJ) had this to say

Rep. Rob Andrews (D-N.J.) said that increasing oil drilling “off the coast” is “a problem, not a solution” to creating jobs in the United States. Andrews recommended that House Republicans bring legislation to the floor if they think more drilling will create jobs.

Appearing at a press conference with Rep. Debbie Wasserman Schultz (D-Fla.) on job creation, Rep. Andrews said, “I agree with my colleague and friend that drilling for oil off the coast is a problem, not a solution, but let’s get back to the main point here that if the Republicans really believe that was really a job-creating idea, why don’t they put it on the floor?”

In the perverted logic of Democrats, additional jobs brought by more rigs and more drilling and more ancillary economic activities do not constitute “more jobs.” Thus, utilizing that same bizarre thought process, having between 8,000 and 23,000 fewer jobs in the Gulf consequent to the Gulf drilling moratorium must not constitute job loss either. And in the mind of the Democrat, having fewer jobs is not the problem, but is the solution. Being more oil-independent is a problem, not a solution.

So the high gas prices you see now are only the beginning until we get near the election. Then Obama will promise once again to lower them- probably in the same manner as he promises to cut the deficit, i.e. quadruple it and then promise to cut it in half. And we see how our dependence on foreign oil is reduced by shifting from one vendor an-………….never mind.

DrJohn has been a health care professional for more than 30 years. In addition to clinical practice he has done extensive research and has published widely with over 70 original articles and abstracts in the peer-reviewed literature. DrJohn is well known in his field and has lectured on every continent except for Antarctica. He has been married to the same wonderful lady for over 30 years and has three kids- two sons, both of whom are attorneys and one daughter on her way into the field of education.

DrJohn was brought up with the concept that one can do well if one is prepared to work hard but nothing in life is guaranteed.

Except for liberals being foolish.

…..When George Soros controlled $900 million of PETROBRAS.

But now Soros has sold all that.

Just one year later. (August 2010)

And how much did Soros make on just that in the one year?

Millions!

And who was at one of the very first Obama fund raisers ever?

Soros!

http://state-of-the-nation.com/wp-content/uploads/2010/11/obama-and-george-soros.jpg

(To find George Soros, just look for the one person not worshipfully gazing at Obama.)

And to think, Chu or whatever his name is yesterday said they were”working to take the sting” out of rising energy prices. I assume that means they are going to let them get so high folks won’t even be able to afford to get to work?

NanG, when Soros sold his Petrobas stock, he had already taken a hit of around 24% as he bought around $64./share. He lost around $200 million from his initial investment of $811 million.

Couldn’t have happened to a nicer guy.

Brazil is the second biggest producer of ethanol, AND ethanol is seriously discredited as the panacea to replace oil given it costs almost as much to make as it sells for and its environmental impact is being swept under the rug by the likes of Obama and Democrats. Brazil is heading for an ecological disaster.

I’m sure we’d enjoy hearing what lies Obama and Dilma Rousseff lathered themselves with over oil and ethanol.

Regarding “drill baby, drill”

Obama is doing it. Domestic production has had a steep upward trajectory since his inauguration, even as oil prices have continued to rise. Domestic production would be great, were it reserved for Americans only. But producers want to get the most they can; so it will always be sold at world market prices, with rises in such prices being driven by rising demand in China, India, and elsewhere. Obama has no control whatsoever over global oil consumption.

Source: Financial Times (Their statement and link reference below):

– Larry Weisenthal/Huntington Beach, CA

@openid.aol.com/runnswim: #5

“Obama is doing it.”

Larry, come on now. This is an outright lie, that surely must undermine your credibility around your own dinner table.

He and his Administration have done their level best to strangle the oil industry. The increases in output have been a result of new technological advances.

The U.S. sits on massive untapped oil reserves. All of these have been taken off the table by the government, . . . . not by industry, or by foreign cabals, but by Washington as it repeats the refrain from misguided environmentalists. Nice job.

Can you image for a moment what would happen if President Vote-Present were to announce the opening up of National fields for exploration and drilling? The oil futures market would be tripping all over itself to drop prices by at least 50%.

@James:

The point is that you can’t blame today’s rise in oil costs to Obama’s oil policy.

The facts are that US oil production is at its highest level since 2002 and that increases in world oil production levels are largely attributable to increases in US output. And — yet — oil prices have increased strikingly.

It’s because of increasing demand, over which neither Obama nor anyone else has any control.

It’s not credible to claim that oil futures would fall 50% were all national us oil fields to be opened up to exploration and drilling. US output will, as stated, always be sold at world market levels. Our potential production will always be but a fraction of that of Russia, Canada, Brazil, Venezuela, Mexico, the Middle East, etc.

If increased US production would really drive down prices, then prices should have been falling, since the spike in production which began in 2009.

What impact did 8 years of GOP Presidency have on oil prices? I don’t blame Bush for oil prices and I certainly can’t blame Obama. The President is important, but the President has no control whatsoever over world oil prices.

P.S. I do agree that any release of US petroleum reserves for the purpose of modulating the pump price of gasoline would be a really bad idea.

P.P.S.S. It certainly wasn’t a “lie” to state that Obama is drilling (so to speak).

http://www.guardian.co.uk/environment/2009/oct/20/us-shell-drilling-arctic

He was also poised to end long standing bans on off shore drilling elsewhere, although the BP oil spill (understandably) slowed this down:

Note, in the above linked article, he was, as usual, skewered by both Left and Right.

But the central point is that world oil prices are negligibly affected by US drilling policy. We’ve got 2% of the world’s oil and we, until recently, burned 25% of it. I think that we are now down closer to 20%, because of increasing demand in China, India, and elsewhere, and it’s this latter reality which will continue to drive the increase in oil prices. The US will never be able to drill enough oil to supply the needs of China, and US-produced oil will always be priced at world levels.

– Larry Weisenthal/Huntington Beach, CA

Ummmmm Larry, read and weep.

Larry, your mindless whoring for obama is really getting old. You took their BS propaganda and swallowed it unquestioningly. Like I have said before, you are delusional.

@Hard: The point is not that Obama isn’t doing all the drilling possible. But he has tried to increase overall drilling, while protecting the most environmentally sensitive areas. And it’s a fact that his efforts to open both Arctic and Eastern US waters to drilling have inflamed his environmental base. And he didn’t run on a platform to increase drilling. So he’s taking a middle of the road approach.

The point was this: Whomover gets the credit, US production his increased since he took office, while US demand has gone down. Yet oil prices are skyrocketing. So oil prices have nothing whatsoever to do with US production.

Again, we’ve got 2% of the oil. We burn 20% of the oil (down from 25%, as our usage declined and Chinese usage increased). The reason oil prices have gone up (and will continue to go up) has nothing to do with Obama and everything to do with world oil consumption, which will continue to go up, as China and India further increase their GDP.

And President Romney or President Pawlenty or even President Palin won’t be able to do a darn thing about it.

So here’s to the success of the Volt; here’s to nuclear; here’s to solar; here’s to wind; here’s to conservation.

We are going to need all of them. We are never going to be able to drill our way to energy independence, because the producers will always sell oil at world market levels.

Would you be in favor of a law which said that all US drilled oil must be burned in the USA and had to be traded in a domestic market, firewalled from the rest of the world? That’s the only way that drill baby drill makes any sense whatsoever.

– Larry Weisenthal/Huntington Beach, CA

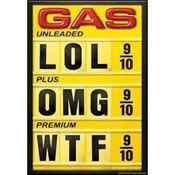

LOVE the featured thumbnail, drj. :0)

@Hard Right, #8:

Obama hadn’t been in office long enough to have accounted for such a 2010 reduction. This makes about as much sense as blaming him for an economic crash that was well underway before he was even sworn in.

Of couse that hasn’t stopped anyone from doing so.

Hard Right, CANADA have lots of oil,

bye

OIL Guy From ALBERTA, this one is for your expertise,to come ,

as I said, CANADA has lots of OIL bye

@Larry, Larry… sigh

The 2009 increases in US production were due mostly to drilling investments made in 2008, and highly attributable to the deepwater GOM reserves.

And who put the kabosh on deepwater drilling? ah… ahem….

Thus, the DOE forecasts falling production over the next two years.

Even the liberal St. Pete Times Politifact notes these details, rating the WH claims as half truths at best. Most certainly taking credit where none is due. They are, however, inordinately kind not to attribute the ensuing decline to his anti-oil policies.

How nice that Brazil will be doing tremendously, thanks to permits by this admin that they can drill where the US cannot…. and in 8200 depths. Considerably deeper than the Deepwater Horizon.

That your hero sauntered into office just in time to benefits from 2008 investments, granted by his predecessor, then destroy that potential in the wake of the DH, must escape you. But that means he also gets to enjoy the dwindling US production during his second term, should he win.

But by then, why should he care. He’s already sucked up all the power he can enjoy in that office via Constitutional mandates.

@MataHarley: Love ya, babe! 😉

@Nan G: He made a crapload of money, Nan. He sold out just after the loan was awarded.

@mata (#14). Sigh.

This is the issue. Yet another claim to blame Obama and the Democrats for absolutely everything.

Financial meltdown? It’s because of Community Reinvestment Act.

Debt crisis? It’s because of Obama’s “stimulus”

Unemployment? “Uncertainty” engendered by the “threat” that the Bush tax cuts will be allowed to expire.

Libyan intervention delay? Obama

Libyan intervention without congressional approval? Obama (Catch-22)

Health insurance rate increases? Obamacare.

And now, ta da, gasoline price increases? Obama’s drilling policy.

Here was the precise claim made, in this very blog post:

What’s wrong with this? First of all, it’s wrong. Domestic oil production hasn’t been reduced since Obama took office; it has increased. Second, the rises in oil prices have nothing whatsoever to do with domestic oil production.

I never claimed that Obama’s energy policy should get the credit for the increased production. I merely corrected the misimpression (as stated in the blog post) that domestic oil production has fallen under Obama and that this is responsible for the increase in gasoline prices. This I explained in comment #9 on this thread.

With regard to Obama’s actions relating to drilling:

1. He curtailed some domestic drilling in environmentally sensitive areas (i.e. some public lands in Utah)

2. He opened up some areas in Alaska.

3. He opened up a large offshore area in the Eastern USA.

He royally pissed off the environmental segment of his base with #s 2 and 3.

Then the Deep Horizon oil disaster happened.

From wikipedia:

What happened to the Deep Water Horizon rig was a fluke. What happened in Fukushima was a fluke.

Flukes happen.

Of course Obama’s drilling policy will never please the hard Right.

Obama didn’t run on a platform of drill baby drill. That would be the side that lost the election in 2008.

When the side that lost in 2008 wins in 2012, they’ll have the opportunity to provide Americans with our inalienable right to lost cost gasoline, a utopia free of government regulations, where every kid can grow up to be as fat as he wishes to be, where no freedom loving American need ever be constrained by limits on the size of magazines for semi-automatic weapons, where everyone pays no more than 10% of income in taxes and where everyone pays the same percentage of income in taxes, where there is no more death tax and we can all live in a grand, to-the-manor-born society, where no fertilized egg or fetus is ever destroyed, for any reason, where abortion is again criminalized, where stem cell research is criminalized, where unions are busted for good, where all “illegals” are rounded up and deported (try selling that one to agribusiness America and small business America and construction business America and hotel and restaurant America and needing nannies and gardners America), and Social Security and Medicare are defunded, and defense spending is tripled, and corporate America’s inalienable right to pollute and mislabel products is protected, and on and on and on.

But what we’ll really enjoy is all that cheap gasoline we are going to pump out of the National Wildlife Refuge.

And preserve for our exclusive use. Priced well under world market oil prices.

We love free trade, except when it comes to oil. We’re going to pump it, reserve it for ourselves, and put it in a lock box, safe from contamination by world oil markets.

That will be the sweetest thing of all.

– Larry Weisenthal/Huntington Beach, CA

Larry, you spout political horse manure about Obama’s glorious energy policy, I point out facts (oh, BTW, never attributing oil prices to Obama…. your paranoid delusion alone), and you return with a political and philosophical lecture on how I am suffering from ODS, and we are an irresponsible generation for technological advancements that require the use of oil.

Hit a nerve, did we, Larry? They make drugs for that, ya know…. In the lib/prog world, it’s called prozac.

In the meantime, maybe you’d like to turn in about 3/4s or so of your lab equipment, using oil as it’s foundation of creation?

Added:

Domestic oil production is indeed forecast to fall under Obama’s regime, and very specifically as a result of his drilling policies. In a counter point of reality, any increase under his regime is due to Bush’s drilling policies.

Your point again?

Mata your probably right about Obamas involvement in Libya, maybe Obama himself would mourn Gaddafis passing, maybe Gaddafi will not get hit by a missile, maybe Gaddafi will win a nobel prize for his foreign policy. All of us, especially our enemy’s have gone a long time now without seeing much backbone in the white house. My being naïve is maybe a way to address my concern for the US and its leadership problem. That’s why I want to see a great outcome from this; I want to see leadership but like I said your probably right. I only hope this guy gets thrown out in 2012.

Oh is see you interrupted Jim Hlavacs discussion with himself.

“When the side that lost in 2008 wins in 2012, they’ll have the opportunity to provide Americans with our inalienable right to lost cost gasoline, a utopia free of government regulations, where every kid can grow up to be as fat as he wishes to be, where no freedom loving American need ever be constrained by limits on the size of magazines for semi-automatic weapons, where everyone pays no more than 10% of income in taxes and where everyone pays the same percentage of income in taxes, where there is no more death tax and we can all live in a grand, to-the-manor-born society, where no fertilized egg or fetus is ever destroyed, for any reason, where abortion is again criminalized, where stem cell research is criminalized, where unions are busted for good, where all “illegals” are rounded up and deported (try selling that one to agribusiness America and small business America and construction business America and hotel and restaurant America and needing nannies and gardners America), and Social Security and Medicare are defunded, and defense spending is tripled, and corporate America’s inalienable right to pollute and mislabel products is protected, and on and on and on.”

“But what we’ll really enjoy is all that cheap gasoline we are going to pump out of the National Wildlife Refuge.”

*Larry I don’t get it, what’s the downside of all this?

@openid.aol.com/runnswim:

So what are you saying? That increased domestic production will not have any effect on oil prices worldwide?

I guess the economic law of supply and demand doesn’t hold true for oil prices in your world. The fact of the matter is that true increases in domestic production mean the importation of less oil needed to fill the needs of the U.S. Because of that, domestic oil companies do not need to jump on the first offers to come along, with regards to oil futures, and prices drop. Worldwide.

Another bonus is that smaller incidents in ME oil disruption, such as Libya, have less effect on oil prices than they did before.

Of course, your narrative of U.S. oil production increasing under Obama is laughable under the facts presented by HR and Mata. If that were truly the case, we wouldn’t be having this discussion now.

@johngalt and @mata:

I am, for the umpteenth time, simply stating that the first blog post in this thread was incorrect in asserting that there has been a decline in US oil production under Obama and that this decline is the cause of the rise in gasoline prices at the pump.

Once again, as quoted in the Financial Times article I linked:

The U.S. has about 2% of the world’s known oil reserves. We are burning through our domestic oil faster than any other nation, currently producing about 9% of the world’s total oil output.

Last year’s oil production rose 3%. Of course, this was not the result of Obama’s policies. But they still rose 3%. They did NOT fall (as asserted in the original blog post). The US was the largest contributor to the total rise in the world oil production. During the same time (owing to the recession) US oil consumption dropped. According to the reasoning of JohnGalt, oil prices should have fallen, but, instead, they have risen to near record levels. This shows that the price we pay for gasoline at the pump is not related to fluctuations in US oil production.

At 9% of total world production, even a 10% increase in US oil production would only increase world oil supplies by 0.9%. And US oil will ALWAYS be priced at world levels. So the idea that increased US oil production will have a different effect on oil futures than domestic production has on current oil prices is fanciful.

http://www.eia.doe.gov/energyexplained/index.cfm?page=oil_home#tab2

The US currently produces 5,400,000 barrels per day.

The US imports 9,000,000 barrels per day.

World oil supply is 89,000,000 barrels per day [March 15, 2011]

Note that world oil supply is currently at all time record levels, even as gasoline prices have skyrocketed at the pump.

Let’s say that we increase US production by 10%. This raises world supply from 89,000,000 to 89,540,000.

Let’s say that we DOUBLE US production. This raises world supply from 89,000,000 to 94,400,000. This is a 6% increase. But gasoline prices have risen 74% in the last year. We increased production by 3% and gasoline prices went up 74%. We double production and increase world oil availability by 6% (and US oil is always priced at world levels, because oil is a global commodity) and then gasoline will cost — what?

And, of course, we can’t double oil production in one year. In fact, we’ll never be able to double oil production. Not even close. We could drill baby drill until kingdom come and all that drilling would have a truly negligible effect on the price we pay for gasoline.

If the price of gasoline at the pump were related to domestic crude oil production, then US gasoline should be massively cheaper than British gasoline or German gasoline or Czech gasoline or Korean gasoline. Instead, the cost in the US is about the same as in all these other countries (not including taxes), which have comparatively minuscule domestic oil production.

But never miss the opportunity to blame Obama for anything and everything.

I personally agree with Obama’s approach to energy. Cautiously increase drilling, realizing that domestic oil production has no meaningful effect whatsoever on the price which we pay for petroleum products, including gasoline. Foster the long term transition to non-petroleum based energy.

Of course, conservatives do not agree with Obama’s energy policies. But lack of agreement on policy doesn’t mean that it’s correct to blame Obama for the price of gasoline at the pump.

– Larry Weisenthal/Huntington Beach, CA

@ Larry

Why not? That’s what you guys did with Bush.

Actually it is correct. If you consider non-private production (corporate), it has gone down.

You also repeat the lie that we only have 2% of the world’s oil supply. Like I said, you are parrotting obama’s BS talking points.

Larry, there is not just one type of oil. Refineries are designed to refine specific types of oil. US Oil is priced on the World market, because oil is a world commodity. That doesn’t mean the oil is actually sold on the world market. Some US oil is sold on the world market because it is cheaper to buy foreign oil than to transport US domestic oil to refineries. The free marked does work. You try to make a simple issue into something more complex. The more oil that can be put on the world market, the cheaper the price as long as there is a surplus of oil. Demand determines the price. More oil surplus equals lower demand.

Well, Larry. Then I shall have to point out, for the umpteenth time, that you are incorrect. First of all, drj did not state that the decline in US oil production is the cause of the rise in gasoline prices. No where did he relate the two. I might also add that he did not say Obama was responsible for the price at the pump, but noted that Obama is on record advocating high prices at the pump to effect behavioral change. That is inarguable.

In fact, since the economy is so deplorable, the demand for oil is down, and the prices are not due to supply/demand, but to speculation. In fact, there is no supply problem globally. However to not ramp the US up in tapping our own energy reserves of oil, shale and natural gas is just another can kicked down the road.

INRE the oil production, you continue to press a losing proposition, and play a word parsing game instead. The key words here are “under Obama”, yes?

For Obama’s first two years, he enjoyed the benefits of Bush’s relaxed oil production regulations, where our oil production increased… mostly from the GOM deepwater wells that began when the Oval Office was a gleam in Sen. Obama’s eyes. Another valuable source increase was the shale oil reserves in North Dakota, which the EPA studies deemed safe in 2004… again pre Obama.

A year and a half into the “under Obama” period under discussion, he reversed that increasing trend with moratoriums on permits and shutting down GOM wells in progress…even those pumping. The Dakota reserves have the added expense of no pipelines to carry the production oil, and they have to truck it to refineries.

This very real decline due to O’energy policies is why drj linked the WSJ article stating the same thing that both HR and I have attempted to tell you at every avenue… that “under Obama”, oil production that Bush put into place is now declining.

Now if you want to parse the “under Obama” facts as going up the first year and a half, and ignore why they were going up, and how his policies affected that increase, you’re certainly welcome. You are using a snapshot in time to bandy about political talking point. Yet you would not use that same trick when discussing a declining economy, and would be quick as a bunny to blame that on the previous admin’s policies.

Selective much with your analogies?

I look at overall policy effects. And it’s as simple as this. Under Bush policy, US oil production increased, and slid over into Obama’s opening year in office. Under Obama policy, US oil production reversed, and is projected to decrease… as confirmed by the DOE.

Spin it any way you want, but the fact is “under Obama”, the trend reversed for the US to be more independent in oil production.

From the first link in my comment about about the Bakken shale reserves:

Oil imports, using the Bakken shale gas reserves, could be slashed by as much as 60%. That would be nice.

But Obama’s admin was slow on the uptake with permits there too. There were 1043 permits for the gas and oil drilling there in 2008. Obama’s first year? A pathetic 623. However, post Deepwater Horizon, they did… to their credit… get on the stick and issue 1676 in 2010.

To get the 160-200 rigs working in 2011 they want, they will need another 2000 permits this year approximate. According to the DOE, these take about five years or more to construct and get on line. So far, they’ve issued about 359 permits as of March 11th. They may have to step up the pace of paper pushing. Because the increased Bakken activity, combined with the additional costs of transport sans a pipeline, do not substantially offset the loss in the GOM.

@mata:

For the umpteen + 1 time, here’s what the dude said:

Most literate English speakers would read that statement two clear ways. First, oil production has decreased by 13% under Obama. No, it didn’t. It increased. Now, it may or may not decrease in the future, but it didn’t decrease to date. It increased. Second, the above statement strongly implies, to most literate people, that the increase in gas prices was related to the phantom decrease in production.

I’ve already stated that I strongly support Obama’s oil drilling policies. I do not subscribe to the drill baby drill hypothesis that pumping every last drop of oil out of the ground is in any way healthy for the US economy — either short term or long term. In my comment #21, I carefully went through the math.

The idea of the US being “more independent” of foreign oil is a very misleading concept. We will always pay world prices for the oil we use. Let’s say that we double our production (which will never happen and, even if it were possible, it would take a decade or more to do this) — this would simply increase world production by 6%, which would have a negligible effect on the price of world oil, which, as stated, will always be the same as the price of US oil, because US oil is priced according to global levels.

Our gasoline costs the same as Germany’s gasoline (pre-tax), even though Germany has negligible oil production and we produce 5 million barrels per day. All we accomplish by rushing to exhaust our own oil reserves is to slightly decrease to price of oil to the world — we get no special advantage in pumping more of our own oil out of the ground — all we do is hasten the day when we have exhausted our reserves, putting us in the same boat as Germany and Japan. The only sector of our economy which benefits from increased domestic oil production is our domestic oil industry. Exxon Mobil and Haliburton clearly benefit; General Motors, Ford, and Google don’t benefit. Neither do the rest of us. We will still be paying exactly the same price for oil as the rest of the world.

So I think Obama’s policy is spot on. Don’t drill in the most environmentally sensitive areas. The oil will always be there. It may be exploited by future American generations, using safer technologies, and hopefully used more for petrochemicals and less for combustion. Buy the oil we need on the world market — encourage other countries (e.g .Brazil) to produce more. Every bit of increased production does increase global oil supply and moderate costs. But let other countries to the heavy lifting, production-wise. Drill baby drill helps the whole world (albeit marginally) — it provides no special advantage to America, and US drilling will never have a significant impact on the price the world pays for oil or the price that we pay for oil.

What will help our economy is to reduce oil addiction (from whatever source the oil is derived).

John Anderson (a GOP congressman) ran for President as an independent in 1980 and did the best of any independent candidate until Ross Perot in 1992. Anderson’s platform included raising the gas tax by 50 cents a gallon, which would be like raising it by $2 a gallon today. It was a great idea then and it’s a great idea now. But it’ll never happen. Pity.

@ hard: the US has 2.4% of the world’s oil reserves and we have 9% of the world’s production and 20% + of the world’s consumption. It is obvious that we are exhausting our own reserves at a markedly more rapid rate than the remainder of the oil producing nations. http://www.eia.doe.gov/international/reserves.html

– Larry Weisenthal/Huntington Beach, CA

@openid.aol.com/runnswim:

A couple points of contention here, Larry, and it might just be that you have been snowed over by Obama’s spin.

You have listed a somewhat accurate total of proven oil reserves based on current economic climate(important based on the cost of getting the oil vs. the cost of the oil on the market) and current wells in production. It is not even close to the total amount of oil the U.S. has access to. It does not include the 10+Billion barrels of recoverable oil in ANWR. It does not include most of the 86Billion barrels of oil on the continental shelf. It certainly doesn’t include the 800Billion barrels of oil estimated locked up in oil shale in the western U.S. Just the oil in ANWR, based on production estimates, could supply the U.S. with a large portion of oil needs for 25-40 years, depending on actual oil recoverable.

You did. However, that math is based on a static market, where new influx of oil into the market, and it’s resultant effect on oil futures trading is not taken into account. Simply put, your math is worthless. Remember, when OPEC decides to increase production by even the slightest amount, prices on a barrel of oil drop significantly. Just the oil in ANWR, if topped out at estimates of 1.5Million barrels a day, reduces the amount the U.S. needs to import down to around 7Million or so. Given the current makeup of import countries supplying us with oil, with Canada at over 2Million and Mexico at 1.25Million, that would virtually eliminate oil imports from the ME. No one can say for certain what world oil prices would do, particularly given that some of the lost OPEC exports would be made up by China, and/or how low in production OPEC would drop to.

Oil prices are not set based on some set world market price. For example, futures traders may agree to amounts of oil from Mexico at $90.00/BBL while another Mexican oil importer might agree to higher or lower pricing, depending on their bargaining position(total oil imports, tarriffs, etc.). We don’t necessarily pay the same as every other country that imports oil, whether higher or lower. With more production at home, adding to the supply worldwide, prices will fall, just as lost production(like Libyan oil), natural disasters or man-made disasters will cause supply to drop compared to demand, and prices will rise. So, while your math is correct based on your assumptions, your assumptions are completely wrong.

In fact, most of your assumptions are quite wrong, when you get down to it.

You’ve also neglected to qualify the spin you’ve presented us with. Fortunately, someone else has:

http://naturalresources.house.gov/News/DocumentSingle.aspx?DocumentID=228625

While you may be correct in stating that production has increased during Obama’s term thus far, you are quite wrong in attributing it to Obama and his policies. Indeed, Obama’s policies are set to cause large drops in domestic oil production, even as early as this year, meaning the U.S. will import more oil, and our dependence on other countries will go up, putting us at the whims of OPEC and other actions(Libya), all increasing oil prices.

And, on top of that, Obama’s advisors are hinting at pushing up the federal gas tax, requiring Americans to pay even more at the pump, and that is particularly troubling based on the current economic climate.

@johngalt: In addition to this good information, Obama and the administration (Salazar) is trying to place massive amounts of federal land into new parks and mostly wilderness land designation. That not only will remove federal lands from energy production, but also from harvesting the timber resources.

Randy, that should be moniter because I don’t think they are so much incline to preservation of the wilderness, there might be some other reason, hopefully they are not selling those vast lands abroad to

COUNTRY THEY WANT TO PLEASE OR APPEASE. OR PAY A DEBT TO

BYE

@johngalt (#28):

I’d like you to work with me some more.

For starters, can we both stipulate the following?

1. US domestic oil production has not decreased by 13% under Obama, as stated in this blogpost. It has increased by 3%.

2. Of course Obama gets no credit whatsoever for this increase. I never stated or implied that he did. What Obama did do (pre-Deep Water Horizon), was four things. First, he stopped the planned opening of the federal lands in Utah to drilling (these had been planned to be opened up by Bush). Second, third, and fourth, he planned on opening up “vast areas” of the East Coast and Eastern Gulf of Mexico and North Coast of Alaska to drilling. This infuriated Obama’s environmental base, but did not satisfy Republicans, who said it should have gone further.

Then Deep Water Horizon came.

Now, I will stipulate that Obama is not a supporter of massively increased domestic oil drilling. He did not run on a platform of Drill Baby Drill. He did, however, move more in the direction of Drill Baby Drill from his campaign platform. Prior to Deep Water Horizon.

As far as all the “spin/rinse” stuff goes (in your comment), it’s a straw man. I wasn’t giving Obama credit for the increased production. I don’t believe that the Obama administration was taking credit for the increased production. All I was doing (and all the Obama administration was doing) was simply making the point that it is utterly wrong to blame the Obama administration for the recent surge in oil and gasoline prices (which many of Obama’s opponents, including the author of the above blog post) have attempted to do. Domestic oil production has, to date, gone up under Obama; it did not go down.

Can you stipulate that the rises in world oil prices (and rise in cost of gasoline at the pump) have nothing at all to do with Obama’s energy policies and oil drilling policies? If you won’t so stipulate, can you provide an explanation of why Obama’s policies caused the rise in oil prices, at a time when domestic production was not decreasing but was, in fact, increasing?

Now, let’s move on to the crux of the issue — this being the ability of the USA to moderate gasoline prices through increased domestic drilling.

Can you also stipulate to the following?

1. The price of gasoline in Europe and in the USA has been, over the past 20 years, almost identical (leaving out the taxes imposed by the Europeans to — intentionally — make driving more expensive, to encourage fuel economy and alternative transportation and to raise revenues).

2. Most of Europe (e.g. Germany) has no domestic oil production. Despite having no domestic oil production, they pay exactly the same price for gasoline (pre-tax) that we here in the USA pay.

3. Whenever the world price of oil goes up, US gasoline prices immediately go up, despite the fact that the gas currently being sold was refined from oil purchased at prior (lower) prices.

Now, here’s how I see things. Oil produced domestically has always been priced according to world levels. The only way that increased domestic production will lower the price of gasoline in the USA is if the increased domestic production lowers world oil prices.

For the sake of a thought experiment, let me accept that the US really does have massive, untapped reserves. Presumably, the rest of the world also has similar massive, untapped reserves.

What do we gain by putting massive efforts into increasing domestic production?

Well, we currently account for 9% of the world’s oil production. We account for 20 – 25% of the world’s oil consumption. The only mechanism whereby we moderate world oil prices (to which the price of gasoline at the pump is inextricably and directly tied) is if we produce enough oil to float not just our own boat, but also the world’s boat.

We, here in the USA, gain no special advantage over the rest of the world by rushing to exhaust our own oil reserves (however large they may or may not be). You say that ANWR production would relieve us of the need to import mid-East oil. Let’s say I agree with you. But what you don’t say is that US produced oil will still be sold to us for the exact same price that (similar grade) oil from the mid-East would be sold to us. We aren’t getting any sort of special deal on buying our own oil. Our oil is priced at the same levels that the rest of the world is paying. So if we pump all the oil out of ANWR, then the rest of the world will say “thank you very much,” because the rest of the world will get the same benefit from our drilling that we get. No more/no less. We’ll moderate our own costs only by moderating world costs. We benefit China and Japan and Germany just as much as we benefit ourselves. We actually benefit China more than we benefit ourselves, because they will shortly be burning quite a bit more oil than we do.

But, truly, the US share of the world oil reserves is very small, whatever the actual number. Our ability to moderate world oil prices substantially is very limited, no matter how much we drill.

I strongly support Obama’s approach to this. Don’t go the Drill Baby Drill route. Just buy the oil we need from the world markets. Encourage the world to increase its oil discovery and production. I like the idea of Brazil taking some environmental risks to contribute their fare share to the world’s oil supplies, as their own economy (and consumption) continues to grow.

Let’s save our own oil for future generations of Americans down the road. Hopefully, as I said, they’ll have better and safer drilling technologies and they’ll use that oil more for petrochemicals and less for combustion.

– Larry Weisenthal/Huntington Beach CA

Mind pointing that out to me in the original post, Larry. I seem to be missing that…

@Mata:

As I wrote before (#27):

Here’s what the dude said:

Most literate English speakers would read that statement two clear ways. First, oil production has decreased by 13% under Obama. No, it didn’t. It increased. Now, it may or may not decrease in the future, but it didn’t decrease to date. It increased. Second, the above statement strongly implies, to most literate people, that the increase in gas prices was related to the phantom decrease in production.

– Larry W/HB

openid.ayol.com/runnswim, you have to take into context that AMERICANS NEED JOBS,

and need their own oil, there is enough for centurys, so with the tantrums going on in ARABS AND NEIGHBORLY COUNTRYS, It should be clear enough for anyone to make the addition, and substraction,

if they decide to freeze or take advantage of us here. The jobs would be tremendous boost to start drilling,

and there is no more time to dither over that fact,

@bees (#34):

I agree that domestic oil production does benefit some people. For starters, it benefits Exxon Mobil and Haliburton. Therefore, it benefits workers and shareholders in the domestic oil industry. Second, it benefits Alaska, California, North Dakota, and Texas, to the extent that these states collect oil royalties. But most people don’t look upon domestic drilling as a jobs program or as a way to enhance the revenues of a few fortunate states. The general concept which is sold to the public is that we will benefit from lower costs for gasoline, diesel fuel, heating oil, and jet fuel. The former benefit is real (jobs program; Haliburton profits; Alaska royalties). The latter are illusory.

And, as previously explained, whatever minor benefits we may or may not get, regarding reduction of pain at the pump (see graphic on original blog post on this thread, which was the price of gasoline at the pump and not a line of unemployed workers), these are benefits which will flow to a greater extent to the other nations (e.g. China) which currently consume 75% – 80% of the world’s oil.

– Larry Weisenthal/Huntington Beach, CA

@openid.aol.com/runnswim: Domestic oil producers pay US taxes. Also, domestic oil production affects the balance of trade. Those are very important issues you have not addressed.

@Randy:

Perfectly valid points. The thrust of the blog post, however, was the cost of gasoline at the pump.

– Larry W

openid.ayol.com/runnsiwm, yes that what I was mentionning would have, should have imply

that this oil is for AMERICA ALONE; It’s time now that every one concerned to live in AMERICA ,

and that mean everyone, should priotoryse this COUNTRY over any other, that include the job of the GOVERNMENT TO SERVE THE AMERICANS WELL OVER OTHER COUNTRYS WHERE WE SEE MANY HATE US EVEN IF THEY ARE GIVEN THE HELP FROM THE GOVERNMENT AGENCY FAVORING THEM UNDER THE COVER OF COMPASSION, I say, drill baby drill and keep it home,

the other COUNTRYS ARE NOT OUR PROBLEMS, THEY ONLY BECOME PROBLEMS WHEN WE GET INTO THEIR BUSYNESS, THE JOBS DIRECT OR INDIRECT OR SUBINDIRECT FROM DRILLING OUR OIL WOULD BRING BACK THE LOST FOR MANY CREATIVITY, THAT IS WHEN THE WEALTH

COME BACK TO ELEVATE THE PEOPLE TO A STANDING UPWARD WITHOUT GOVERNMENT CONTROL IN ANY WAY,

@bees (#38):

Your solution would work in Venezuela, where the oil industry is nationalized, but not in the USA, where oil production is a capitalist enterprise. Exxon Mobil wants to make as much money as possible on each barrel it produces; therefore it is priced to be competitive with the competition, which is the global cost of oil. No more. No less. That’s how capitalism works.

– Larry Weisenthal/Huntington Beach, CA

It seem to me that a larger and stable supply of oil from the US would result in less speculation-driven high prices.

DrJohn, yes I beleive what you wrote, it is the logic, but are they logical, no, not at all,

and they are the same in all their agenda, bye

Anything which makes the supply of oil to the world larger and more stable will moderate prices — for everyone who consumes oil, from America to China. Iraqi oil. Libyan oil. US oil. Brazilian oil. Venezuelan oil. Norwegian oil. Russian oil. Emirates oil. etc. All increased production would be equally beneficial, with regard to price of gasoline at the pump — to every oil consuming nation.

I’ve agreed that increased domestic production does have some special benefits to the USA: jobs, state royalties, federal taxes, trade balance. However, these provide a less compelling narrative to support domestic drilling than the up close and personal price of gasoline at the pump. The ability of domestic drilling to moderate world oil prices will always be limited, because the USA is already overproducing, as a share of oil reserves, relative to the (much larger) production from the rest of the world.

A nation with 9% of the world’s oil production (and a much smaller share of the world’s reserves) is going to have a limited ability to keep the lid on the price of gasoline, and, even to the extent that it can do so, this will not be a unique benefit to the USA, but will be an equal benefit to the rest of the world, including China, India, Japan, Europe, North Korea, etc., which currently consumes close to 80% of the world’s oil production. In other words, 80% of the price moderation benefit of US oil production goes to the other 80% of the world.

Here’s an interesting statistic which may explain France’s unusual current enthusiasm with respect to military actions, as well as China’s passive support: Libya extracts a 90% royalty on oil produced by the French based Total oil group, as well as CNPC China.

I think it’s reasonably obvious that certain dictators (Saddam, Gaddafi) had/have more to fear, outside militatry intervention-wise, than others (Meles/Ethiopia, Assad/Syria).

– Larry Weisenthal/Huntington Beach, CA

openid.ayol.com/runnswim, that tell me, that again we must drill for our oil to break that dependancy from forehein oil, more than ever, and keep it to our own needs alone, and break that global exchange dependancy ,so to recover from our economy ‘s failure to recover, just like in a houshold does,

when things are low, we restrain the charity and focus on our family alone, it has nothing to do with

capitalist , and there is a lot more we can do to promote our job market also by supporting our entrepreneurs and busyness at 100 percent compare to the mentality now of favoring those who don’t

produce nothing to society which has to support their own plus they support the non active part of this country which don’t lift a finger to help this economy, and are more likely to support a GOVERNMENT WHO PAY THEM TO DO NOTHING; WHILE OUR PATRIOTS ARE SPILLING BLOOD FOR THEM

@openid.aol.com/runnswim:

You misunderstand the point of my post #28.

You said this:

The oil futures market is not based on any set price. When traders for U.S. oil companies buy set amounts of oil for a certain price, the rest of the world doesn’t necessarily purchase it for the same price. The price also goes up the farther out these traders purchase the futures, as well as any world issues that affect the production of oil, such as Libya or a spill, or OPEC limiting their production. It is wrong to say that U.S. oil companies pay the same price as the rest of the world. It is also wrong to state that the U.S. oil companies pay the same for a barrel of oil imported from Mexico as it does for a barrel of oil imported from Saudi Arabia. Yes, it is a worldwide market, but it is based on negotiating contracts and futures purchases where the prices differ based on any number of factors.

At our current use, where roughly 1.5Million barrels/day are imported from the ME, the futures market has a big impact on the average price per barrel of oil whenever something happens in the ME. With ANWR, and the ability to forego any oil purchased from ME countries, nothing there will force mad dashes by the commodities traders to buy up more futures, at higher and higher prices, and we in the U.S. won’t feel the hurt as will other countries that purchase most of their oil from the ME.

One must understand the market in order to discuss it, and I’m sorry, but you don’t understand it well enough.

On to another. You said:

Just the amount of oil locked up in oil shale here vaults the U.S. up to the top, or near the top of the list of nations with oil reserves. The other areas mentioned in #28 certainly help out as well. I do not know about other countries and their untapped reserves. Some might have huge amounts, while others have none. Your implication is that the U.S. would remain near the 2% mark if the rest of the world’s untapped reserves were taken into account. You cannot know this, as I cannot either. My guess, though, is that the U.S. would become a much larger portion than just 2%, although certainly not close to the 20% or so that we use. What it could do is put our production and use closer together, where we don’t rely on any but truly friendly nations for the imports the U.S. requires.

On to another. You said:

Obama should get much of the blame for higher gas prices. Because of certain actions by his admin, such as moratoriums, the actual U.S. production of oil is well below the forecasted production. Because of this, the U.S. is more susceptible to outside influences on oil than it otherwise would be, thus, the prices we see for oil, and subsequently, for gas, is higher. Obama has caused our fuel prices to increase. The amount is indeterminate, as the magnitude of the effect of an increased oil production by the U.S. on the world oil markets is unknown.

Much of the rest of what you’ve stated in your response is based on the premise that all countries pay the same for a barrel of oil as every other country that uses oil. I told you how you were wrong, both in #28, and above in this post. We don’t pay the same as Germany. We don’t pay the same as Russia. We don’t pay the same as China. And on and on for the rest of the oil consuming countries.

Also, you seem to be of a mind that we should let the rest of the world use up it’s reserves while we, the U.S. keeps back reserves for a rainy day. Now, I may just be reading something into your comments that are not there, but it certainly seems as if that is what you are intending. That kind of thinking, while on some levels seems smart, on others doesn’t seem intelligent at all, but that is for another discussion entirely.

Oil is the lifeblood of the U.S. economy. It has been for quite awhile now. The increased oil prices affect not just the price for gasoline that we put in our vehicles, but also affects every other thing we buy. The food prices go up as oil prices go up. The prices we pay for other items, such as those we might purchase at a Wal-mart or the mall goes up as oil prices go up. Medicines, services to our homes, entertainments, etc. all go up as oil prices go up. The less we rely on outside influences, particularly in disruptive regions like the ME, to supply the oil we consume, the better off we will be. If you believe we can move away from oil in the near future, and move to other sources of power for vehicles, fine, I don’t believe so. For the near future, and until such time as a truly cost-effective alternative source of energy for vehicles is found, oil is of the utmost importance in allowing our economy to continue to move forward, and as such, needs to become more of a domestic driven source of energy than it is right now. The only way to do that is to open up areas that are closed at this moment.

One last thing. You want to claim an increase of U.S. oil production. Fine. But you must define it further. U.S. oil production is based both on publicly owned land(federal lands and state owned lands), and privately owned lands. The increase in total U.S. oil production is based on more privately owned lands producing oil, and all this while production on public land has fallen. Prior to Deepwater, the gulf of Mexico had 55 rotary drill rigs operating. Now, particularly due to no new leases and many leases not renewed, there are only around 26 or so rigs operating in the gulf, and none are of the kind able to reach the deep depths where much of our oil reserves are at. U.S. oil production on public owned land has declined, and will decline further unless they are opened up.

@johngalt: Larry, you basically dismissed balance of trade as a factor in reducing the cost of gas to us here in the US. Isn’t an out of balance trade inflationary? So, if the balance of trade has an effect on the dollar value to US citizens, wouldn’t that affect the cost of world oil? Since the world oil market is determined also by the value of the US Dollar, wouldn’t that affect the cost of gas here in the US?

@johngalt: I’ve literally only a minute; so I’ll address one point now and the rest later. You say:

Here are the ugly facts which ruin this particular beautiful theory.

Number one, the price of gas at the pump is always tied to the CURRENT price of world oil. When world oil price goes up, the price of gas immediately goes up, even though the gas being sold may have been purchased at futures prices long in the past and actually delivered well into the past. Number two, as I wrote before, US gas prices at the pump are always almost precisely those of European prices. We pump mega-barrels of gas; they (save for Norway) pump virtually none.

And, once again, whatever benefit (with regard to cost of gasoline) we in the USA may or may not derive from increased domestic production, it’s not a unique benefit to us. 80% of the benefit goes to the rest of the world.

With regard to different oil traders being able to negotiate or obtain different futures prices, this simply goes into different profit margins of the different traders. If an oil trader gets a good deal on futures, he just makes more money. He’ll still sell the oil at current world market rates, which is why gasoline costs pretty much the same in countries which drill a lot of oil (e.g. us) and countries which drill no oil (e.g. Germany).

Bees is in favor of price controls. He/she says that our oil should only be used by us (and I think that we actually do export something like 2 million barrels of oil and/or petroleum products each day) and that it should be sold to us for less than current market rates. I think that most readers of this blog recognize that this would be the antithesis of capitalism.

– Larry Weisenthal/Huntington Beach, CA

@openid.aol.com/runnswim:

That is funny. I don’t consider it a beautiful theory, but rather the hard truth.

You said:

Have you ever ran a business? Probably not, otherwise you wouldn’t make the statement above and use it as your proof that I am wrong. Prices for goods and services are based on what one pays for bulk materials to make the goods, or deliver the services. Gas is no different. However, how one prices their goods or services, in relation to when they purchase them, is different, including within the same market.

Some gas stations pay for the gas delivered, when it is delivered. Some pay for past deliveries at the time of the next delivery, meaning they have to make up for the cost of the fuel they will purchase in the future, and apply that cost to what they have in their tanks at the time. Some gas stations, the independent ones who purchase gas from several different suppliers, have to contend with both of those scenarios, sometimes paying for the incoming gas when they have not yet paid for the gas from the previous delivery.

It is a game of futures pricing. Have you noticed how when oil prices drop that gas prices do not drop immediately? That is because they are still trying to make up for the increased cost of the fuel they sell from previous oil prices.

But none of what you state really has any bearing on the truth of what I posted. I’m talking oil prices. When something happens that lowers world output of oil, futures traders try to buy up future production lots of oil due to the uncertainty of when the production will rise again. This causes runs on supplies, future supplies, and increases the price on a barrel of oil. If the production goes up sooner than forecasted, the traders who didn’t make the big runs on oil supplies are able to purchase oil at lower prices, and different lots of oil, even if drawn and imported at the same time, will have different prices on the oil. I don’t understand why it’s so hard for you to understand this. We aren’t talking about getting a quart of oil at your local NAPA, where every customer that day pays the same price for that quart of motor oil.

Again, you don’t understand business very well. Companies use set percentages for profit margins above the cost of the raw materials, labor costs, and cost of energy to produce their goods. When they are able to purchase the raw materials at lower prices, it most certainly affects their selling price. You may be able to show a handful of examples to the contrary, but overall, companies deal fairly with their consumers, and only charge prices based on their true costs. What you insinuate is that oil companies are all evil and out to gouge their customers as much as they can, as quickly as they can. The problem with that is that they soon price themselves out of the market, and no matter what they charge, they don’t get the money because they aren’t selling product. The market will fluctuate, and they had better stay with it if they want to continue to be competitive.

If what you said was true, then gas prices would be the same across the board for every gas station in your local area, but it isn’t, is it? And, they all don’t change prices, either up or down, at the same time either, do they?

Now, and this is another discussion entirely, the fuel purchased in LA doesn’t cost the same as southern IN, which doesn’t cost the same as Chicago, and on and on and on. Mostly, that has to do with fuel types and additives required for certain areas of the country as opposed to others, as well as the proximity to refineries or fuel dumps. But as I said, that is a different discussion entirely.

You said:

That isn’t an absolute. The amount of consumption certainly has an effect on benefit, but so does the relationships between oil companies and the countries producing it. The effectiveness of the oil traders themselves in their negotiations plays a large part, as well as future promises for purchases. The U.S. might get more than 20% of the benefit, and it might get less, it all depends on the countries we are importing oil from at the time, and who else is importing oil from them compared to us. Competitors for ME oil might not be our competitors anymore if we became independent of ME oil, and as well, some competitors might have more influence in Canada or Mexico based on that as well. I only understand the basics of the relationships between the oil companies, producers, trading, etc. You seem to know nothing of it, but try to apply simple market understanding to it when it doesn’t work the same at all.

You said:

You are wrong though. Here is a list of current gas prices for worldwide cities, based on USD.

http://money.cnn.com/pf/features/lists/global_gasprices/

Compare that with the average price in the U.S. at 3.564USD. Also, note the bottom three countries are all large oil producing countries, and there prices are very cheap. I do not know where you got the idea that we pay nearly the same price for gas as other countries, but you had better check your source again. Keep in mind too, that fuel is refined differently, for different mixtures of fuel based on a country’s current environmental regulations and the cost it adds to make the fuel according to those standards.

You can try to discuss this more, but until you understand the basics you won’t be able to discuss it effectively, and your assumptions will continue to be wrong, as will your conclusions.

@johngalt:

1. The actual price of gas in the USA is the same as the price of gas at the pump in Europe, despite the fact that we drill megabarrels of oil and they drill none (save Norway). I provided a link for this in a previous post. The differences in costs to the consumer are simply differences in taxes (or, in the case of Venezuela, government subsidies), as I explained before. European taxes are vastly higher than ours, to encourage fuel efficiency, use of mass transit, car pooling, and use of alternative fuels. But the actual cost of gasoline (before taxes), at the pump, is, averaged over time, virtually identical in the USA as in, for example, Germany (which pumps virtually no oil).

2. I never said that oil companies or anyone else, for that matter, were “evil.” I’m a believer in capitalism (as well as being a self employed small businessman who’s been meeting payrolls in my 10 worker sole proprietorship for the past 19 years, after having previously founded, directed, and been on the board of a 60 employee venture capital backed biotech company for the prior 5 years), and I certainly understand the workings of private business. In your examples, you are looking at microeconomics. Short term fluctuations. On a macro scale (and averaged over time), oil prices and gasoline prices seek and reach a common world level. Prices are moderated only by sustained production increases and/or by sustained decreases in demand. US demand is relatively flat. China’s demand (and India’s demand) is exploding. The Chinese and Indians will benefit vastly more from increases in US oil production than we here in the USA will benefit. And our true benefit from increased production, at the level of the consumer, will be truly minuscule, as the impact of any increase in our production will be massively diluted, as it all just goes into the same global pool of oil, with regard to impact on price of oil to end consumers, including us.

I’ll get back to the other points in present and prior comments tonight.

– Larry Weisenthal/Huntington Beach, CA

@openid.aol.com/runnswim:

I believe you are wrong one this. The wholesale price of fuel, or gas at the pump, is different nearly everywhere you go. I understand your comment about the taxes, and although correct in your assertion that taxes make differences in the retail price, gasoline commodities do not start out at the same prices per gallon everywhere in the world.

Peruse these two sites to get a better idea of gasoline pricing.

http://www.urban.org/publications/1000845.html

http://www.nacsonline.com/NACS/Resources/campaigns/GasPrices_2009/Pages/HowRetailersGetSellGas.aspx

The first site shows a graph of gasoline prices broken down by wholesale cost and cost to consumer with taxes. I realize it is a 2005 report, however, the idea is the same for 2011 as it was back then.

The second site explains the pricing by retailers on gas sold at the pumps.

Your assertion that we pay the same at the pump as Germany, as far as wholesale pricing goes, might be true, but that assertion does not hold true for every other country consuming gasoline. Much of that depends on cost to refine the oil, including wages and cost of chemicals used in the refinement process, as well as whether or not it is a private or government owned or subsidized industry for the country in question.

Despite your assertion, after your bio of business experience, that I am only looking at the microeconomics of the oil industry, your assumptions that you have presented in your numerous posts are not quite right. Even in your post #48, you support my assertions more than your own. Yes, China and India have rapidly increasing demands for oil, and any increase in U.S. oil production will most certainly benefit them, however, it won’t necessarily benefit them any more or less than it will the U.S. Indeed, for most other countries that produce oil, if the U.S. was to increase production by opening up ANWR, they would be hurt in the short term, and have virtually no benefit in the long term. And that wouldn’t be because the U.S. is upping production, but rather that the total world production would be increased. Those countries that rely heavily on oil sales for their national treasuries would most certainly be hurt by lowering crude oil prices, which would most definitely happen when world wide supply increases.

You are still operating under the assumption that all oil is traded at identical prices regardless of country of production or country of import. You are completely disregarding the commodities trading regarding oil and gas, and the differences in pricing for lots of wholesale oil purchased at different times by different customers from different countries. This is not a static entity. Nor is it one world supply where everyone draws their oil from.

You discount too much the effect a U.S. increase in production would have on us.

Only time to address a single issue.

I provided the exact same link in my comment #21. I believe that this strongly supports my point.

Confine your view only to the left-most, dark gray area of each horizontal bar. You’ll note that there are trivial differences, in a given three month period, between the cost of gasoline at the pump and how much oil (if any) a given nation produces. I can easily find more variability between pump prices on a given day in Southern California than is shown in the above graph, demonstrating average pump prices, in a given quarter, between widely disparate nations of the world. This is because the cost of gasoline is inextricably linked to the global cost of oil, and not to where in the world the oil is produced.

The US has only a small fraction of the world’s oil production. Even with massive increases, we’ll still have only a small fraction. Thus, our ability to moderate oil prices by increasing production is very modest, and we’ll get no special advantage, at the level of the consumer (of gasoline, heating oil, diesel fuel, or jet fuel) over what China gets, from increasing our own oil production.

The second of your links (how retailers get/sell gas) is simply about microeconomic fluctuations — it has nothing at all to do with the macroeconomic price of gasoline at the pump, averaged over the entire nation and averaged over time. The first link proves that there is no significant advantage at all, price at the pump wise, from being an oil producing nation versus being a non-producing nation, and it shows that increasing our oil production (let’s say, from current 9% of the world’s output to 13.5% of world output (i.e. a 50% increase, which will never happen)) would have a trivial effect on the price of gasoline, diesel, heating oil, and jet fuel.

– Larry Weisenthal/Huntington Beach, CA

I’m still reeling that you, Larry, have not corrected your claims that either the original post (or someone in comments) blamed the rising costs of gas at the pump on Obama. This is patently false.

drj’s original post states:

This is true in the aspect that while oil production was on the rise in the first year and a half the Zero’s term (due to prior policies and permits issued under the Bush admin), the Obama oil policies have effectively reversed that growth.

However the accusation that the blame for the oil prices on Obama is also patently false. Rather it is an observation that Obama’s oil policies are resulting in a decreased production. The otherand second ensuing observation that is stated is that gas prices are increasing.

Related? Perhaps in the realm of supply/demand and it’s effect on how speculators respond. No future supply is certainly going to affect prices now. But this becomes even more interesting that there is no “supply” problem, and demand is actually decreasing because of the economy’s stagnation and regression. Even China is in the reversal growth mode. Japan may provide a boost… hard to say at this moment. No sense importing oil for power when they are unable to provide it via damaged and non existent grids.

However, tho the Dem partisans did blame Bush for oil prices for political election advantage, no one here has directly, and unequivocally, blamed Obama for the current oil prices and price at the pump.

Reality dictates you recognize that Obama has done nothing to improve the ability for prices to be reduced, however. That’s entirely different from blaming him for the price at the pump. Making the environment unfriendly for speculation does, indeed, contribute to how speculators respond.

Yet, Larry, you repeatedly mischaracterized the US oil production as being on the increase by parsing sentences, and ignoring the projected losses that are a direct result of Obama policies. Do you deny this has an effect on speculation? It seems so, from your previous responses to others.

As for the erroneous accusation that there has been a direct blame on Obama for the prices at the pump, you’ve repeated that here multiple times. And I have asked you exactly where that specific blame has been stated.

Answer the others as you wish, and in your time frame. I do know you’re a busy man, doing very important work that I respect. However it’s beneath you to sidestep the issue with false accusations and parsing in order to avoid that Obama’s oil policies are genuinely reducing the US oil production… which will, even if not directly attributed by anyone here (as you ascertain as “blame”), how speculators respond in kind in today’s market.

@mata. I’ve responded — TWICE.

See #33

See #27

With further regard to blaming Obama and the Democrats for price of oil at the pump, see:

http://www.usnews.com/opinion/blogs/peter-roff/2011/03/10/obama-is-to-blame-for-soaring-gas-prices

and, as a counterpoint:

With regard to Democrats blaming Bush, previously, well that’s totally wrong, also. I never myself made that accusation or supported that accusation. It was wrong and very unhelpful to the task of developing a coherent national energy policy; just as blaming Obama now is equally unhelpful.

With regard to the rest of your comment (#51), my response is in #31, and following replies to JohnGalt.

It’s ludicrous to blame the rise in oil prices to concerns by speculators that US oil production will decrease. The net increase (as a result of Bush’s policies, if you want to give Bush credit) was 3%. US share of global oil is 9%. So Bush (if you want to give him credit, though others have argued — to me, when they thought I was trying to credit Obama with the increase, which I wasn’t) that the increased production was owing to more/better drilling on private lands) — So Bush increased US drilling by 3% which increases our contribution to the world’s oil from 9% to 9.27% and increases total world oil production from 100% to 100.27% (do the math) and now Obama threatens to “reverse” this back down to 9% and this is supposed to freak out the world’s oil speculators and hedgers?

Once again, here are the relationships:

1. US oil is sold at the price of world oil, no matter where it is drilled (adjusting for grade or quality of oil).

2. Cost of gasoline, diesel, heating oil, and jet fuel is directly related to price of world oil.

3. Countries that produce huge quantities of oil (e.g. the USA) have the same price of gasoline at the pump (excluding taxes) as countries which produce no oil (e.g. Germany).

4. The US consumes 20% of the world’s oil and produces 9% of the world’s oil.

5. Increasing US oil production would/will have a trivial effect on world oil production and it is world oil production which determines both the cost of oil and the cost of gasoline at the pump.

6. Any benefit to increasing US oil production, at the level of the consumer of gasoline, diesel, heating oil, and jet fuel will flow both to the USA and to the rest of the world. As China currently consumes more oil than we do and as they are rapidly increasing their consumption, while we are flat, China will benefit more from increased US oil production than we’ll benefit, though the benefit to both of us will be trivial.

– Larry Weisenthal/Huntington Beach, CA

– Larry