![]()

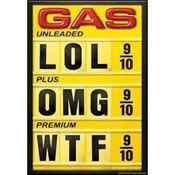

As Glenn Reynolds might say, “They told me that if I voted for John McCain the US would become even more dependent on foreign oil and they were right.”

Following the Deepwater Horizon disaster, Barack Obama put a moratorium on deep water drilling. Then he extended the moratorium and delayed the sales of oil leases in Alaska.

Federal Courts overturned the original moratoriums and Obama went ahead and issued another moratorium and has ignored the Court rulings since then.

Then in October Obama “lifted” the moratorium, or so it seemed.

A month later, not a single permit had been issued.

As gas prices continue to soar, the Obama administration finally got around to that issuance of permits.

They issued one permit this month. But the good news is that Obama is considering tapping into the Strategic oil preserve.

The Obama administration has issued contradictory statements on the high oil prices. On Friday the Obama administration appealed a judge’s ruling that the Department of Interior stop holding up the application process of several deepwater drilling permits. The move effectively continues the de facto ban on deepwater drilling in the Gulf. On Sunday however, White House Chief of Staff Bill Daley said the Obama administration is considering tapping into the U.S. Strategic Petroleum Reserve as one way to help ease soaring oil prices.

So that would be using a reservoir of oil meant for a real crisis as a temporary means to slightly reduce oil prices.

Temporarily.

The Obama Surge in Foreign Oil Dependence Program is highly successful as it has reduced domestic oil production by 13%. Gas prices have risen 67% since Obama took office. Then again, Barack Obama did promise higher gas prices.

Except when he was lying to us about lowering gas prices:

[youtube]http://www.youtube.com/watch?v=dnLP12X3EgM[/youtube]

If you watch carefully you can tell when Obama is lying. (Hint: when his lips are moving)

H/T the Blog Prof

High gas prices are beginning to really hurt, and it’s being covered by…………no one in the legacy media.

There is good news- if you speak Portuguese.

Obama has loaned Petrobas of Brazil $2 billion to finance………oil drilling!

Obviously, Obama has decided to outsource oil drilling from US companies to foreign companies and stop drilling off one coast and begin drilling off another coast. At least that way any oil spill will take longer to reach our shores.

Great guy that he is, Obama has issued another permit to…………wait for it…………….

Petrobas!

to drill REALLY deep (8,200 feet) and IN THE US WATERS OF THE GULF OF MEXICO.

The approval marks the first time FPSO technology will be used in U.S. waters of the Gulf of Mexico. The oil and gas project is about 165 miles off the coast of Louisiana in 8,200 feet of water. The FPSO has a production capacity of 80,000 barrels of oil and 16 million cubic feet of natural gas per day.

So for the slower ones (i.e. left wingers) out there, this means that Obama has shut down US drilling in the Gulf but has granted a permit to a foreign nation to drill in our own waters. One might wonder why Obama appears to be blocking competition for that oil. I think this might be a good time to have a really close look at the Obama bank accounts.

The good news doesn’t end there. Obama has pledged that the US will be a faithful buyer of Brazilian oil forever. Notwithstanding the argument Obama himself made that oil prices are not a function of supply problems consequent to his Libya adventures, Obama cited a litany of reasons the US should buy from Brazil which include the safety of the US not being at war with Brazil even though that doesn’t affect anything:

“which other country in the world has the oil reserves that Brazil has, that is not at war, that does not have an ethnic conflict, which respects contracts, has clear democratic principles and vision, is generous and in favour of peace?”

Obama’s highly publicized speech to be given in Rio De Janeiro was canceled due to security concerns.

Anti-US banners had been placed around the square by Thursday and some protest groups had declared Mr. Obama a “persona non grata” due to a “bellicose policy of occupation” in foreign countries.

Rep. Debbie Wasserman-Schultz (D-FL), who never misses a chance to look like a fool, availed herself of such an opportunity the other day. She and another dimly lit bulb (D-NJ) had this to say

Rep. Rob Andrews (D-N.J.) said that increasing oil drilling “off the coast” is “a problem, not a solution” to creating jobs in the United States. Andrews recommended that House Republicans bring legislation to the floor if they think more drilling will create jobs.

Appearing at a press conference with Rep. Debbie Wasserman Schultz (D-Fla.) on job creation, Rep. Andrews said, “I agree with my colleague and friend that drilling for oil off the coast is a problem, not a solution, but let’s get back to the main point here that if the Republicans really believe that was really a job-creating idea, why don’t they put it on the floor?”

In the perverted logic of Democrats, additional jobs brought by more rigs and more drilling and more ancillary economic activities do not constitute “more jobs.” Thus, utilizing that same bizarre thought process, having between 8,000 and 23,000 fewer jobs in the Gulf consequent to the Gulf drilling moratorium must not constitute job loss either. And in the mind of the Democrat, having fewer jobs is not the problem, but is the solution. Being more oil-independent is a problem, not a solution.

So the high gas prices you see now are only the beginning until we get near the election. Then Obama will promise once again to lower them- probably in the same manner as he promises to cut the deficit, i.e. quadruple it and then promise to cut it in half. And we see how our dependence on foreign oil is reduced by shifting from one vendor an-………….never mind.

DrJohn has been a health care professional for more than 30 years. In addition to clinical practice he has done extensive research and has published widely with over 70 original articles and abstracts in the peer-reviewed literature. DrJohn is well known in his field and has lectured on every continent except for Antarctica. He has been married to the same wonderful lady for over 30 years and has three kids- two sons, both of whom are attorneys and one daughter on her way into the field of education.

DrJohn was brought up with the concept that one can do well if one is prepared to work hard but nothing in life is guaranteed.

Except for liberals being foolish.

Larry, you have been incorrect in both your #27 and #33. You have repeated the same drj phrase I have. However no where in there did he say that Obama is to blame for the rising cost of gas at the pump. You, yourself, admit it is “implied”. That may very well be… were I able to read drj’s mind. Since I can’t, and neither can you, I can only read it as any logical person would. That “a” happened” and “b” happened. It is not constructed to read that “b” occurred because “a” did.

Sorry… wrong, wrong, wrong accusation. You should simply drop that tactic of debate.

Woof… ain’t that a mouth ful of non relevant stuff. I’d really like to know why it is you want to limit speculator’s assessment of futures to what the statistical increase was over that period? Do you not think that the two huge Brazilian oil fields that are in the process of being developed are not taken into consideration for futures? Certainly they won’t be ready for a while, so it depends upon how far into the “future” the futures are gambling on. But had Brazil did an E&P rejection of both those discoveries, that sure would have had an effect.

I think your problem is you confuse how they view futures as opposed to current yields and demand. To illustrate my point, if right now all rigs stopped drilling, and everyone took an Obama/Pelosi/Reid “no more oil” stance, prices would skyrocket. Are we out? And are rigs still producing? But of course. The key word is “futures”.

As for your points 1-6: #1 amuses me the most. US oil doesn’t cover US needs, so we depend upon imports. And you also forget, if I might add, “shipping/handling”, so to speak. There is the base cost of oil. And then there is the price to get that oil to the US… whether via around the Cape, or thru the Canal. Don’t know if you’ve checked into the price of supertankers filled with oil lately, but I assure you, it ain’t cheap transport that’s included in the price per barrel.

This is one of our problems with shale and natural gas supplies in the northern west. We have no pipelines for what is being produced, so added expenses for refineries for shipping/delivery to get those resources to coast cities from ND etal is reflected at the pump.

As for the rest of your bulleted points. It’s inane to argue that increased US production of domestic resources has no effect on our own fiscal situation. If nothing else, we shave the “shipping/handling” charges, which is quite hefty.

And if energy independence is dismissed so easily by you, why the hell are we striving for energy independence with any types of energy? Or is it only about AWG with you?

Mata, I give up.

As always.

You win.

Winner, and still champ.

Oh, and by the way…

– Larry

I see you’re still in “snark” mode, Larry. But I give you a “like” thumbs up for the pretend effort anyway.

@openid.aol.com/runnswim:

And so you did. However, I disagree that it strongly supports your point. If we assume that the U.S. is the baseline(done because that is the country we are concerned with), then there are bigger differences than you imply.

The U.S. is at $1.55 on that graph.

-Ireland is at $1.66, or……………a 7% increase over us.

-France is at $1.76, or……………a 13.5% increase over us.

-Mexico(one of our biggest suppliers) is at $1.79, or………….a 15.5% increase over us.

-Italy is at $2.18, or…………….aa40.6% increase over us.

Now, not only are those significant differences(and I allowed that Germany was not), but those are 2005 prices. The price then, total with taxes, was $2.01. As I stated above, today it is $3.56. Most of the taxes, including in other countries, is a set amount per gallon of fuel. My guess is that while the percentages might stay relatively constant, the actual dollars and cents differences would become much greater than they are.

None of what you have stated anywhere in this thread topic has caused any second thoughts for me that we should develop more of our own domestic sources of oil. The simplest argument to your assertion that an increased U.S. oil production would have little effect on worldwide prices is to look at the unrest in Libya and the prices of oil prior to and following.

Remember, above I stated that if ANWR were opened to production, that we could expect to see 1.5Million bbl/day. Libya itself produces near 1.5Million bbl/day of oil, but only a portion of their output was affected. Yet, the price of a barrel of WTI crude oil rose from $86.19 on Jan. 25 to $105.52 today. And fuel itself rose from an average of $3.08 or so, to $3.56 or so today.

I think you can see that a 1.5Million bbl/day production increase by opening ANWR would significantly affect oil prices, and subsequently, the price we pay at the pump for a gallon of fuel. And the price we pay for groceries. Sure, with unrest in other parts of the world we may see more fluctuating prices, however, those fluctuations would be at lower oil prices, and not as significant as we are seeing now.

But let’s get back to Obama. The forecast, by the EIA, back in 2007, was for the U.S. to see production increase to around 850 million bbl of oil for 2010. The actual production was 714 million bbl of oil for 2010, and Obama’s actions have largely been responsible for that. That is a difference of 136 million bbl of oil, or 372,602 bbl of oil per day. And 2011 will start a steep decline in U.S. oil production, making us even more dependent on foreign oil sources. That is not a good thing. Obama has been responsible for a part of the price increases we’ve seen at the pump, no matter how you look at it.

@openid.aol.com/runnswim:

Or, around 3.78cents per gallon. The U.S. consumes roughly 140 billion gallons of gas/year. If we remove Canada, Mexico and the U.S. from our total oil usage, that leaves roughly 40% that we import on tankers. 40% of 140 billion is 56 billion. At 3.78 cents per gallon that is $211.7 Billion dollars spent by U.S. consumers on transportation costs for oil to the U.S. We certainly wouldn’t reduce all transportation costs as we would still be relying on oil from other countries to make up for domestic and Mexican/Canadian oil, however, I am sure that you can see that more money might then be applied to our own economy. Or is my math wrong?