![]()

Yesterday, lurching in the wake of the latest Trump tweet, CBS charged up its newest Affordability story headlined, “Trump urges credit card companies to slash interest rates to 10% for one year.” Nearly none of the corporate media stories dished the real dirt; granted, we had to do a little dot-connecting. It was simple enough that Big Media should have done it. But of all the big players, CBS —bless its new tone— got the closest.

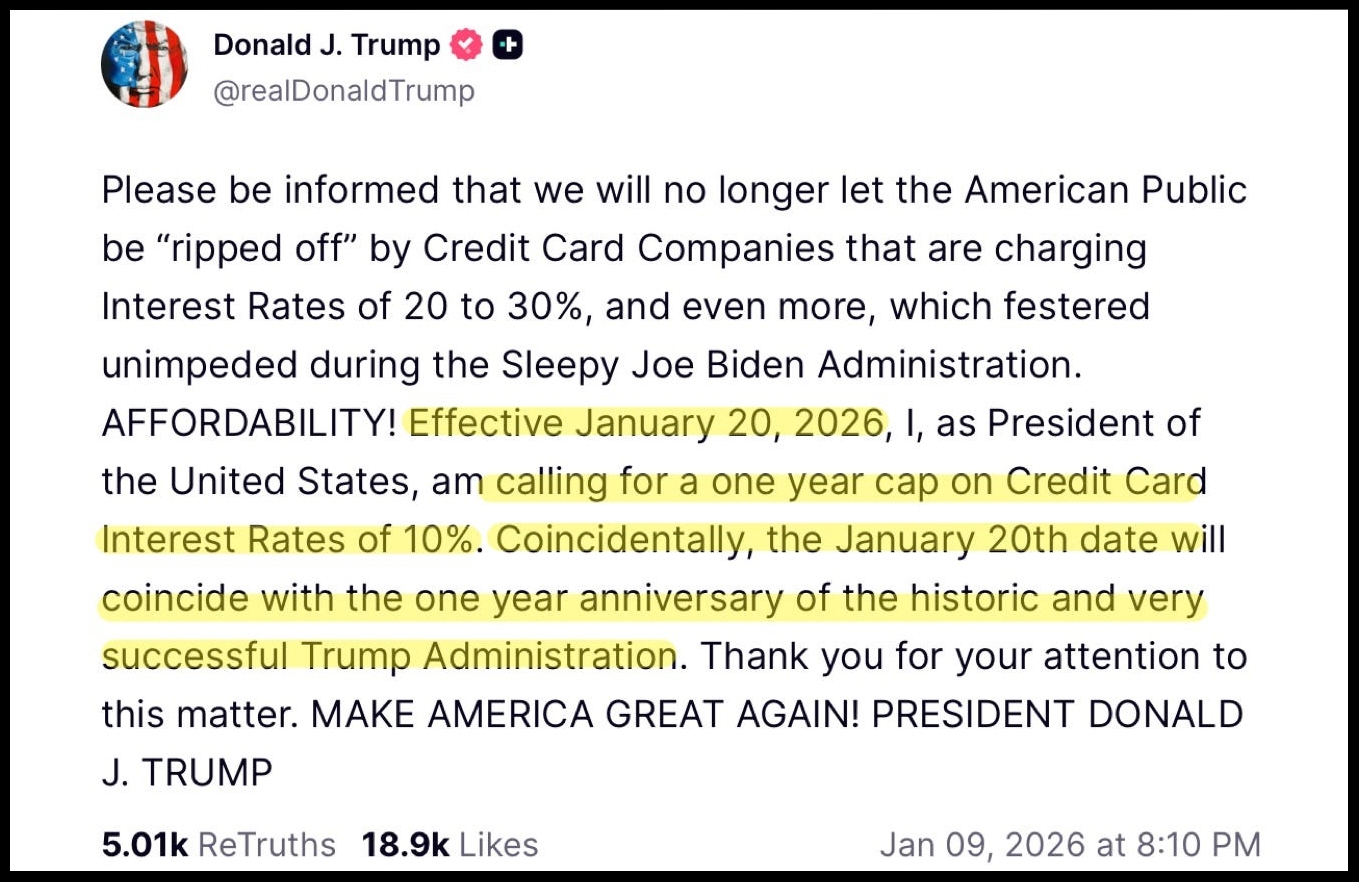

Yesterday, the President of the United States savaged credit card companies and called for what appears to be a voluntary ten percent (10%) cap on credit card rates starting January 20th— the one-year anniversary of Trump’s second Inauguration. My spider senses are tingling that we should expect some pretty ripe progress leading up to that memorable date. But I digress. Here’s what President Trump actually said. Note the word affordability in all-caps:

Trump is playing the Democrats like a banjo. Trump’s missive appeared mere hours after the Angry Old Socialist of the Senate Bernie Sanders tweeted a routine complaint about the President referring to credit card interest:

It’s going to be darned difficult for Sanders to complain about Trump’s tweet now. Do not be naive. Trump’s social media knee didn’t jerk just because Sanders tweeted something. In other words, this probably isn’t an accidental timeline.

There’s a lot that could be said, but we are moving fast this morning to cover as much ground as possible. There’s a reason I suspect coordination.

Last March, Republican Senator Josh Hawley (R-MO) co-sponsored a one-year credit card cap bill with Bernie Sanders, himself, and over in the House, progressive darling Representative Alexandria Ocasio-Cortez (D-NY) and Republican Representative Anna Paulina Luna (R-FL) co-sponsored a matching version. In other words, the whole bill —effectuating both Sanders’ and Trump’s tweets— is teed up and ready to go. And has been, for almost a year.

Here’s the thing: those bipartisan bills (S.381 and H.R. 1944) were quietly put on ice in committee since they were filed. Not tabled, discharged, or amended into oblivion. Just … held. Until perhaps now.

Senators Sanders and Hawley explicitly framed their bill as fulfilling Trump’s 2024 campaign promise to cap rates at 10% to provide “immediate relief” for Americans facing high debt and costs. Yesterday —without even mentioning the pending bill— Sanders resurrected the issue, and Trump closed the deal.

It’s a political master stroke. The bipartisan bills can now advance in committee, and who can oppose them? Thanks to Democrats, the top issue in the country is affordability, and this bill is explicitly linked to that issue. There will soon come a day when corporate media starts asking why Democrats picked this issue to be their flagship for the mid-term elections. Mark my words.

🔥 Normally, I oppose government price-setting, like with rent caps. Interest is just another price— the price of borrowed money. So, to be consistent, you’d think I should oppose interest rate caps. But interest is a special case.

For most of American history, every state enforced usury laws— hard caps on interest rooted in English common law, Biblical prohibitions, and the ancient Code of Hammurabi. Charging excessive interest wasn’t clever finance; it was a crime with criminal penalties, including prison.

That thousands-year-old law changed in the late 20th century, when the Supreme Court ruled that a national bank could charge customers anywhere in the country the interest rate permitted by the bank’s home state. In 1981, Delaware promptly saw the opening, became the only state to strip away its interest-rate limits, and the credit-card industry stampeded in. Overnight, one small state’s policy nullified the usury laws of 50 states, and ancient protections against predatory interest vanished without a single national vote.

Put simply, credit card companies are exploiting a legal loophole to get away with something that 49 states consider to be criminal conduct, justifying prison sentences, and which common law for thousands of years considered unethical and corrosive.

Not everyone is on board with this ancient logic. Credit card companies protest that if they’re forced to comply with usury laws, people with poor credit will lose access to credit altogether. Others reply: that’s the point. Usury laws exist precisely to protect desperate, vulnerable people from predatory interest rates— not to guarantee banks a revenue stream at any price.

I’d be satisfied with returning to the status quo ante— just put credit cards under the same usury laws that bind everyone else, with no special bankster exceptions or criminal carve-outs.

Short of that, interest rate price caps work fine. Despite my libertarian leanings.

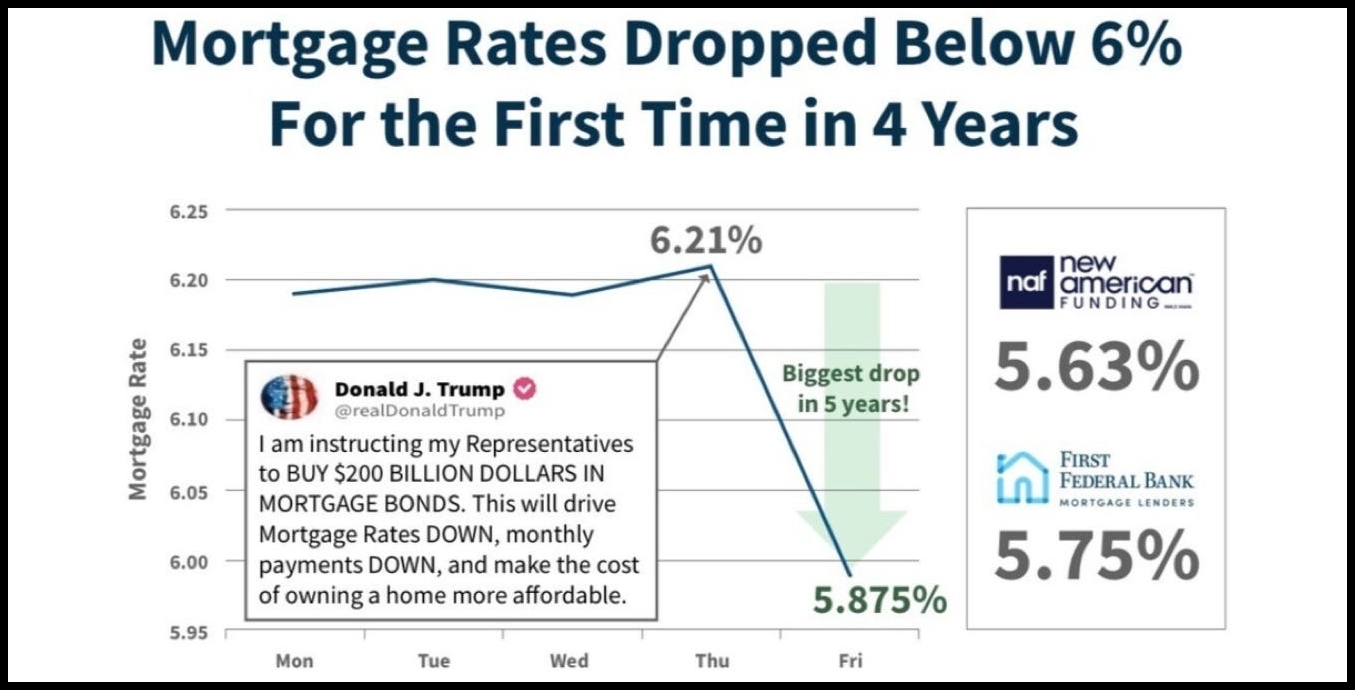

📉 In related news, a single day after I told you that if Trump’s mortgage bond buyback could press rates under 6% then a major psychological barrier would fall —and one day after the experts pooh-poohed Trump’s proposal— guess what happened? This:

Mortgage rates just slipped under 6% for the first time in four years. Without any help from the Fed. With no bonds purchased yet. With no new program rolled out. Just a single Truth Social post from Donald J. Trump— and the market skipped like a new lamb in Springtime.

What can I say? I’ve burned through the usual adjectives—historic, unprecedented, record-shattering— and once again, the experts are left looking like complete asses. Obviously, the markets aren’t listening to experts anymore.

At this rate, Congress may not even need a credit-card-capping bill at all.

📈 Speaking of skippy stories, yesterday Reuters reported that, “Bessent says US Treasury can easily cover any tariff refunds.” He referred to Trump’s plan to send refund checks to lower- and middle-income Americans, using money collected mostly from foreign exporters. If it happens, a tariff refund would pile on top of what could be the largest income tax refunds most Americans have ever seen.

🚨 BREAKING: In a nightmare scenario for the Left, Scott Bessent just confirmed that 2026 will be the LARGEST tax refund year in American history.

Affordability is now a top priority of the White House. More money back in Americans’ pockets. Less pressure on families. Fewer… pic.twitter.com/lXwLLte5fq

— ⁿᵉʷˢ Barron Trump 🇺🇸 (@BarronTNews_) January 2, 2026

Reuters reluctantly conceded that the Treasury is flush, sitting on roughly $774 billion in cash, more than enough to cover all the described refunds. Bessent put it more bluntly. The Treasury Secretary asked —obviously rhetorically— whether companies like Costco, which is now suing to block the tariffs, plan to refund customers themselves?

This is an affordability neutron bomb. How naive are we? Do we think the Treasury built up that massive refund war chest in just another happy accident? Was it merely good timing? Or was it part of the plan from Day One? TAW.

Experts were hardest hit. Tariffs were supposed to make prices skyrocket; instead, they’re paying Americans back with interest, while the experts rummage around the kitchen junk drawer for a new scare story. As I said, Democrats will rue the day that they picked affordability as their keystone issue. Probably sooner rather than later.

Don’t believe me? There’s more.

📈 On Wednesday, Politico ran an unintentionally encouraging story headlined, “Trump team drafting executive order on affordability.” According to people familiar with document, “The White House is drafting an executive order targeted at frustration with the cost of living, including allowing people to dip into their retirement and college savings accounts for down payments on homes.”

Don’t miss this: The Trump Administration’s messaging discipline is airtight. If “people familiar with the document” leaked, it was intentional.

Senator Josh Hawley (R-Mo.) explained the elegant logic in allowing Americans to use their own retirement savings to fund home purchases. “For years, Wall Street has used your 401k money to buy single-family homes,” Hawley tweeted. “We should ban them from doing it – but allow you to use your 401k to help you buy a home, without penalties or caps or taxes.”

Trump just snatched another affordability issue away from Democrats. “Senate Democrats tried to do this last year. Republicans blocked it,” Senate Minority Leader Chuck “Chuckie” Schumer (D-N.Y.) complained, uselessly, confirming only that Democrats once talked about it while Trump is now doing it.

Who knows what else might be in that same executive order?

Reuters is starting to see the looming peril. “Trump’s political stance on these matters,” the news service blandly said, “could scramble Democrats’ messaging heading into the 2026 midterm elections.” That is the whole point. Historians will look back and most of all wonder how Trump tricked the Democrats into choosing affordability as their cornerstone.

Now the whole building is coming down around them. Their injuries are purely self-inflicted.

Thinking that if a 10% cap is enacted say goodby to frequent flyer points and cash back deals.