![]()

This President has said for months that jobs and the economy are his number one priorities. ObamaCare has demonstrated his sincerity… just not in the way we might think. While American shores are littered with the carcasses of millions of octopi who sacrificed their lives so that their ink might be used to expound upon the disaster that is ahead, one of the most damaging elements of ObamaCare doesn’t have anything to do with healthcare in the first place. It really belongs amongst the 2,300 pages of economic malpractice known as Dodd-Frank. We are of course talking about Section 9006.

This President has said for months that jobs and the economy are his number one priorities. ObamaCare has demonstrated his sincerity… just not in the way we might think. While American shores are littered with the carcasses of millions of octopi who sacrificed their lives so that their ink might be used to expound upon the disaster that is ahead, one of the most damaging elements of ObamaCare doesn’t have anything to do with healthcare in the first place. It really belongs amongst the 2,300 pages of economic malpractice known as Dodd-Frank. We are of course talking about Section 9006.

What is Section 9006? It is nothing less than a bullet aimed at the foot of the American economy as it competes in the race out of our economic malaise. Up until ObamaCare, businesses were required to provide 1099’s (the miscellaneous income form from the IRS) to individuals who provided them with services (via an other than employee relationship) if the total amount spent was in excess of $600. As such, consultants, freelancers and temporary help are often paid for their services this way. It keeps companies from having to collect and track taxes for short term relationships and it lets individuals who may deal with numerous clients during the year handle their own taxes.

Unfortunately, thanks to Section 9006 of ObamaCare the Dr. Jekyll 1099 we’ve all come to know and love is going to become the Mr. Hyde 1099 that will cause many businessmen to head for the exits. Beginning in 2012, 30 million businesses in the United States will have to begin issuing 1099s as if they were Internet diploma mills sending out bachelor degrees. In addition to everyone they already are required to issue 1099s to, ObamaCare will require them to issue 1099s to every single entity with which they do in excess of $600 in business in the calendar year. Buy a computer at Best Buy? Issue them a 1099. Buy 5 cases of $12 wine from Vinnie’s Wine shop? Issue them a 1099. Pay PG&E $100 a month for electricity? Issue them a 1099. Large companies with internal accounting staffs will be able to add another desk in the department to handle the extra work. Small businesses don’t have that luxury.

Of all of the lunacy that the Democrats have engaged in over the last 18 months, this may well be the most Bellevue worthy. Imagine you are a trucker who drives 2,000 miles a week, stops for gas 3 times a week and spends $200 each time. At the end of the year that trucker will have to go through 150 gas station receipts, find the station matches and figure out at which of those he spent over $600. (Of course it’s not quite as easy as it might sound as some branded gasoline stations are franchises and others are company owned while some companies own stations carrying different brands… but I digress.) Once they navigate through all of that mess, they then have to contact each company, find the correct person and ask for their Federal Tax ID. Then they have to issue to each of those companies a quad form 1099 – One for them to keep, one for the IRS, one for filing with the state and a fourth for any possible local taxes.

And of course this is only for their gas. There are a plethora of other services for which our intrepid trucker may have to issue 1099s. If he spends $25 a week at McDonalds in 15 states, he may have to provide them with a 1099 if half of the stores are company owned. (Good luck keeping track of that…) If he buys two tires from a service store in Mustang, Oklahoma he’ll need to send them a 1099. If he gets a paint job in Bollingbrook, Illinois or a few tune ups in Macon, Georgia he’ll better make sure he gets the Tax IDs.

Unfortunately for many of the tens of millions of small businesses across the country this trucker story is no fantasy. It is reality and they will be feeling the pinch just as badly. A real estate agent who drives 30,000 miles a year and fills up at 5 different gas stations will need to add a new file to her Rolodex. A plumber who buys piping at Home Depot, tools at Sears and work boots for his crew at Wal-Mart will be adding some numbers to his accountant’s check. Then there is the phone company, the office supply store and even their insurance companies. I can’t even get my phone company to figure out what all the fees mean on my bill and now I have to depend on them to provide me with the correct Tax ID information and address information for the IRS under the penalty of jail… for me, not for them. That’s comforting…

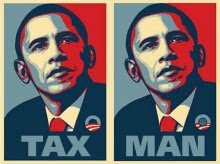

As small businesses across the country seek to find their footing and get back on the growth track, the last thing in the world they need is another stream of government regulations that force them to divert their attention from actually running their businesses. This is of course no surprise as it’s just another example of what happens when Americans put people with virtually no private sector experience and who are hostile to capitalism in charge of the government.

The bottom line however is that they are sticking to their word and indeed jobs are priority number one. Unfortunately in this case the jobs belong to the IRS agents who will be ensuring compliance and postal workers who will be delivering the millions of 1099 forms. Now that’s change we can believe in…

See author page

What better way of doing the two things the left wants to do: keep track of how Joe the Plumber spends his business dollars (being then able to question the judgement behind his spending) and adding thousands of bureaucratic jobs at the IRS.

All those 1099s will have to be filed with Joe’s income tax filing. Then the friendly neighborhood IRS agent can ask Joe “Did you really need all that gas? Can you justify those purchases? Well, we are going to disallow that gas because we don’t think you really needed it.”

This is Big Brother on steroids.

Bloated government.

As a tax accountant, this is going to boom my business! Sad part is, it will cripple all of the small businesses I handle. I don’t know how they are going to afford the services this will require. I also have a picture of Obama on my desk so when people ask “why are you doing this?” or “why is this happening?” I love point to it.

Shouldn’t be too long before Odogma gets to it’s last important necessary regulation. That being a regulation to be filed yearly by individuals itemizing dates, times, and number of toilet paper squares used to wipe our butts. I WILL NEVER EVER VOTE FOR A DEMOCRAT AGAIN!!!

Excellent post Vince, I considered this one myself, but you have done an excellent job, please keep us current on this particular situation.

Of course many businesses will be forced to operate on a ‘cash only’underground type of commerce, the resulting massive taxation and hiring of an infinite number of bookkeepers and accountants will strengthen and tighten the ligature around the neck of non-monority owned businesses.

Now you Liberal minded people will say, “Skook, how can you make such a statement that is loaded with audacity and racism?”

I base it on Eric Holder,

Obviously Holder can’t be considered a coward for promoting his own type of racism. Eric Holder and Obama have made the entitlement and prejudice of race a part of our judicial system by ordering the Justice Department Lawyers not to prosecute Blacks. The requirement of 1099’s for every sale over $600 will be another way for this most blatantly racist of all presidents to control White businesses, the logic is in the fact that Holder has ordered that Blacks not be prosecuted.

With the most massive tax system in the world and the largest arm of bookkeepers, accountants, and IRS ‘Goons’ in the world, the Dystopian World of Obamanation plans to control and tax; unfortunately, the paper men produce nothing. An economy is based on real production, an area America has excelled in for decades, at least until Obama began kicking the legs out from under the producers. While our economy wilts and dies under excessive control and taxation, Obama plans to golf, play basketball, vacation, and put on parties while he destroys the most powerful economy in the world and promotes racial strife in the United States.

Can you say black market economy?

Minuteman that comment was racist! =8^)

Great post, Vince.

Oh my, Brother Bob! That was White of you. You caught me sleeping with that one, well done, well done indeed.

Somebody didn’t think through the real-world implications of 9006. It’s a crack-brained idea that obviously isn’t workable. I’d expect zero resistance on either side of the aisle when someone points this out and introduces legislation to deep-six it.

There could be problems, however, if someone tries to use the issue politically by combining legislation correcting 9006 with something very unlikely to have bipartisan support. Given the nearness of the 2010 elections, that sort of strategy wouldn’t surprise me at all.