![]()

by Sundance

This headline article from the New York Post caught our attention because it has the familiar ring of “51 former intelligence heads” in the 2020 election.

Previously the stacking of experts to create disinformation, was used to hide the truth within the Hunter Biden laptop, which was evidence of Joe Biden’s pay-to-play schemes. Now the “experts” are stacked to claim Joe Biden’s economic policy is better than Donald Trumps’.

I will ignore the article’s Freudian optic of the economist speaking at the globalist WEF event, and instead focus on the facts. We have an actual track record of President Trump’s MAGAnomic policies to review. We heard the insufferable “inflation created by tariff” arguments back in 2017; they were all false.

Wall Street loves to shout about looming damage that will come if anyone reverses the “service driven economy” policies they rely upon. However, none of their hair on fire arguments ever materialize because they are not accurate. These economists are politically motivated in their claims.

See below for real data on the outcomes of MAGAnomic policy as delivered in Trump’s first term.

This might be the cited data you want to bookmark for later reference.

Traditional Fascism was defined as an authoritarian government working hand-in-glove with corporations to achieve totalitarian objectives. A centralized autocratic government headed by a dictatorial leader, using severe economic and social regimentation, and forcible suppression of opposition.

That governmental system didn’t work in the long-term because the underlying principles driving free people rejected government authoritarianism. Fascist governments collapsed, and the corporate beneficiaries were nulled and scorned. Then along came a new approach to achieve the same objective.

The World Economic Forum (WEF) was created to use the same fundamental associations of government and corporations. Only this time the corporations organized to tell the governments what to do. The WEF was organized for multinational corporations to assemble and tell the various governments how to cooperate to achieve control.

Fascism is still the underlying premise, the WEF just flipped the internal dynamic.

The assembly of the massive multinational corporations, banks and finance offices now summon the government leaders to come to their assembly and receive their instructions. Some have called this corporatism. However, the relationship between government and multinationals is just fascism essentially reversed with the government doing what the corporations tell them to do.

…A massive multinational corporate conglomerate; telling a centralized autocratic government leader what to do; and using severe economic and social regimentation as a control mechanism; combined with forcible suppression of opposition by both the corporations and government.

This was our reality until we finally broke the glass, hit the emergency STOP button and elected Donald Trump.

It was the Fourth Quarter of 2019…..

Right before the pandemic would hit a few months later, despite two years of doomsayer predictions from Wall Street’s professional punditry, all of them said Trump’s 2017 steel and aluminum tariffs on China, Canada and the EU would create massive inflation – it just wasn’t happening!

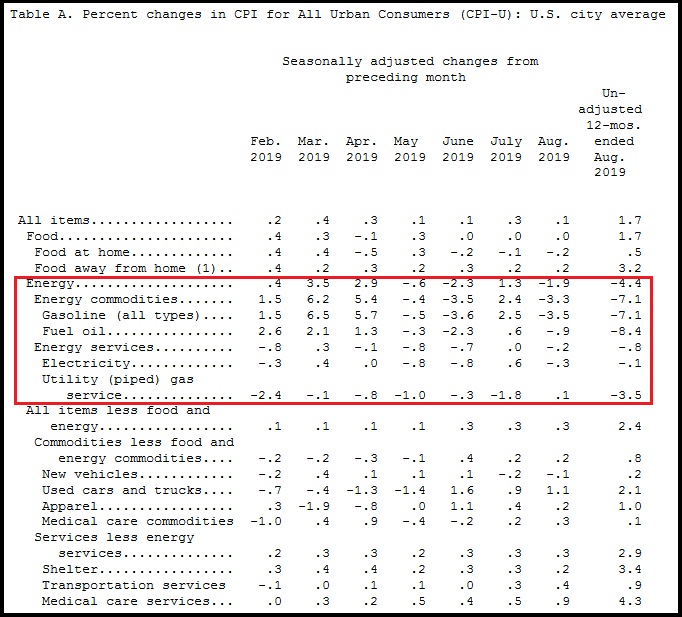

Overall, year-over-year inflation was hovering around 1.7 percent [Table-A BLS]; yup, that was our inflation rate. The rate in the latter half of 2019 was firmed up with less month-over-month fluctuation, and the rate basically remained consistent. [See Below] The U.S. economy was on a smooth glide path, strong, stable, and Main Street was growing with MAGAnomics at work.

A couple of important points. First, unleashing the energy sector to drive down overall costs to consumers, and industry outputs was a key part of President Trump’s America First MAGAnomic initiative. Lower energy prices help the worker economy, middle class and average American more than any other sector.

Which brings us to the second important point. Notice how food prices had very low year-over-year inflation – 0.5 percent. That is a combination of two key issues: low energy costs, and the fracturing of Big Ag’s hold on the farm production and the export dynamic:

(BLS) […] The index for food at home declined for the third month in a row, falling 0.2 percent. The index for meats, poultry, fish, and eggs decreased 0.7 percent in August as the index for eggs fell 2.6 percent. The index for fruits and vegetables, which rose in July, fell 0.5 percent in August; the index for fresh fruits declined 1.4 percent, but the index for fresh vegetables rose 0.4 percent. The index for cereals and bakery products fell 0.3 percent in August after rising 0.3 percent in July. (link)

For the previous twenty years, food prices had been increasingly controlled by Big Ag, and not by normal supply and demand. The commodity market became a ‘controlled market’. U.S. food outputs (farm production) was controlled and exported to keep the U.S. consumer paying optimal prices.

President Trump’s trade reset was disrupting this process. As farm products were less exported, the cost of the food in our supermarket became reconnected to a ‘more normal’ supply and demand cycle. Food prices dropped, and our pantry costs were lowered.

The Commerce Dept. then announced that retail sales climbed by 0.4 percent in August 2019, twice as high as the 0.2 percent analysts had predicted. The result highlighted retail sales strength of more than 4 percent year-over-year. These excellent results came on the heels of blowout data in July, when households boosted purchases of cars and clothing.

The better-than-expected number stemmed largely from a 1.8 percent jump in spending vehicles. Online sales, meanwhile, also continued to climb, rising 1.6 percent. That’s similar to July 2019, when Amazon held its two-day blowout Prime Day sale. (link)