![]()

The United States is in the midst of an economic malaise. 92 million Americans are out of work. 35% of the population is on welfare. The economy is barely growing. While incomes for the richest have been skyrocketing, the middle class has seen their incomes decline by 5% in the last 5 years. The federal debt stands at $17 trillion, up $6 trillion since Barack Obama became president. All of this while the Fed has been pumping tens of billions of dollars a month into the economy for years…

Although Barack Obama has made much of this worse, the truth is, things have been going the wrong way for half a century and rather dramatically for a quarter century. Of all of the problems that exist today – and their numbers are legion – there are two that are most troublesome: regulations and taxes. These two things have hammered the fount of American prosperity, the middle class.

First is the regulatory state – particularly federal regulations. Being an entrepreneur, running a successful small business (from whence 2/3 of all new jobs emerge) takes a great deal of work, tenacity and effort. Unfortunately however, the cost of complying with regulations has skyrocketed over the last 40 years. From the EPA to OSHA to the NLRB to HHS and a seemingly endless array of acronymmed bureaucracies come regulations that strangle job creation, and in the process, prosperity. According to the US Chamber of Commerce – no friend to small business – the cost of complying with government regulations at all levels has almost quadrupled since 2000… and all of those increasing costs contribute to the growing death rate among small businesses, which in turn take jobs with them.

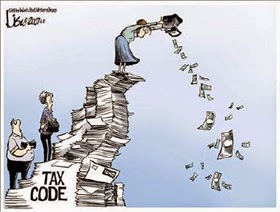

Then there are taxes, again, particularly federal taxes and the insane complexity of the IRS tax code. This can be summed up in one measure: According to the Tax Foundation’s 2014 International Tax Competitiveness Index the United States ranks 32 out of 34 developed countries in terms of the competitiveness of our tax system – and if it weren’t for our relatively low consumption taxes, ranked 5 out of 34, we’d be dead last. That means, for companies seeking to invest their money, of the 34 OECD nations, only 2 of them have tax structures that are less inviting than the United States, Portugal and France. Imagine that, that the United States tax system is less attractive to investors – and prospective employers – than Turkey, Estonia, Chile… and even the dysfunctional Greece! While the United States does have advantages… for investors, tax consequences are an extraordinary driver of their choices. And unfortunately for American workers, the government is making the choice to invest in the United States less and less appealing every year.

Then there are taxes, again, particularly federal taxes and the insane complexity of the IRS tax code. This can be summed up in one measure: According to the Tax Foundation’s 2014 International Tax Competitiveness Index the United States ranks 32 out of 34 developed countries in terms of the competitiveness of our tax system – and if it weren’t for our relatively low consumption taxes, ranked 5 out of 34, we’d be dead last. That means, for companies seeking to invest their money, of the 34 OECD nations, only 2 of them have tax structures that are less inviting than the United States, Portugal and France. Imagine that, that the United States tax system is less attractive to investors – and prospective employers – than Turkey, Estonia, Chile… and even the dysfunctional Greece! While the United States does have advantages… for investors, tax consequences are an extraordinary driver of their choices. And unfortunately for American workers, the government is making the choice to invest in the United States less and less appealing every year.

Despite what you might hear on the Sunday morning news programs or read in the NY Times, this new American malaise is not an intractable problem, is not an unsolvable problem, in fact, the solution is rather simple. Fix those two problems. “How?” you say.

First, sunset every federal regulation on the books. If necessary, pass a Constitutional Amendment that states that every federal law has an implicit sunset provision of 10 years unless it passes each house of Congress by at least 60%. It would also stipulate that all federal regulations sunset after 10 years, regardless of the margin of passage of the underlying law. If such regulations demonstrate themselves to be effective and necessary, they can be renewed. If a regulation were deemed or proven to be sufficiently important to be granted permanent status it should then be passed as a law rather than remaining a regulation.

Second, implement the Fair Tax – although a 10% flat tax might be a distant second suggestion. In 2014 investors have the world at their fingertips. Choices abound from Estonia to Singapore to Switzerland to Canada. If the United States were to implement the Fair Tax, not only would the economy be jolted by an immediate influx of an estimated $2 trillion from the offshore holdings of American companies, it would likely experience an additional annual influx of hundreds of billions of dollars of direct investment from foreign companies seeking to set up shop in the United States. Those additional trillions of dollars would result in the creation of millions of jobs – and these would be real jobs in the real economy, unlike the boondoggles inflicted on the country by President Obama’s “Stimulus”. In addition, the resulting savings of the hundreds of billions of dollars wasted each year simply trying to comply with the incomprehensible IRS tax code could be spent on useful things – or just fun – and the hundreds of millions of hours saved could be spent on work or leisure.

Of course it’s one thing to point these things out and another to actually get them done. So, as in an effort to demonstrate the potential effectiveness of the above I’d like to suggest using Wayne County, Michigan – where the disaster area known as Detroit is located – as an “Enterprise Zone” proving ground. This demonstration would turn Wayne County into a federal tax and regulation free zone. Eliminate all federal regulations within the county and eliminate all federal taxes save a 23% embedded tax.

This wouldn’t impact public safety or individual rights as public safety and law enforcement are state and local functions while citizens’ rights don’t come from regulations but from the Constitution… which would still be in force.

Creating a county wide Enterprise Zone centered on the country’s most economically dysfunctional city would be a perfect opportunity to demonstrate the potential prosperity free market competition can create. Massive amounts of investment would take place and a cacophony of companies would be started, sometimes built on nothing more than an entrepreneur’s idea and a willingness to take a risk. And at the same time, jobs would be created… lots of jobs would be created, with employers competing for the best workers.

Creating a county wide Enterprise Zone centered on the country’s most economically dysfunctional city would be a perfect opportunity to demonstrate the potential prosperity free market competition can create. Massive amounts of investment would take place and a cacophony of companies would be started, sometimes built on nothing more than an entrepreneur’s idea and a willingness to take a risk. And at the same time, jobs would be created… lots of jobs would be created, with employers competing for the best workers.

While there would be some logistical challenges to implementation due to the fact that the proving ground would be surrounded by non participating counties and cities, at the end of the day the results would demonstrate clearly the potential benefits of dialing back the twin garrotes of federal action that have been strangling American prosperity for half a century. With actual data in hand then the debate over applying the same to rest of the country could begin. Maybe then the country could get back on the road to prosperity where a rising tide lifts all boats rather than today’s perpetually receding tide that leaves most American boats slowly sinking in the mud of the exposed sea floor.

See author page

Sorry, Vince, but I am not a fan of the Fair Tax. I find it convoluted and confusing. I am a proponent of the Flat tax when it comes to federal income tax. No deductions. You make X, you pay Y.

The Fair tax also works on the assumption that there would no longer be any local, county and state taxes, except for sales tax. Localities are not going to give up that cash cow.

@retire05: I find the “prebate” part of the fair tax proposal to be problematic. I wish they’d come up with some other way to exempt the tax on expenditures up to the “poverty level”. But I like the idea that the fair tax hits visitors to the country and the “underground economy” as well as working folk… and the rich living off savings instead of income.

Seems to me that the flat tax also works on the assumption that local taxes would go away… that seems just as unlikely for either proposal.

@Jim+S:

”.

First, you have to accept that the “poverty level” classification only applies to those who don’t work and in fact, earn more in in-kind contributions than most low income families and even those low income families are eligible for dozens of in-kind contributions (food stamps, housing, Medicaid, et al) including EIC.

Everyone should have to pay something in taxation. When you give the keys to the car you paid for, a kid doesn’t show the same responsibility for it as he would if he had paid for it.

States, and municipalities, are not going to give up that cash cow. And can you imagine the process of trying to get them to do that? What a nightmare.

Detroit’s been bailed and failed!! Time to waste money elsewhere!!

Too true.

I ran across this chart the other day:

http://static1.businessinsider.com/image/542abe11ecad04ee50618978-1200-900/cotd-age-private-fixed-assets.jpg

The average age of private fixed assets is at a 50-year high.

In other words, corporate America’s capital equipment is getting old.

If businesses didn’t have to replace broken fixed assets there would be no growth in our economy whatsoever!

Consumption growth has slowed this year, and tight credit has led to disappointing housing activity, but businesses do have to replace what breaks or go out of business.

More here:

http://www.businessinsider.com/average-age-of-private-fixed-assets-2014-9

We now own four square blocks adjacent to one another in Detroit.

Paid less then $1000/per property, some for as little as $300.

IF that place ever does take off, we are ready.

Otherwise it goes to our heirs.

Whenever obama reads stuff like this, he says to himself, “Mission accomplished!”

@retire05: #1

Anyone who wants to learn about the Fair Tax should read the book. To read about it on their web site you have to keep going to different links.

You said the Fair Tax it convoluted and confusing. All it amounts to is you buy something, a percentage tax is put on it, and that is it. How much simpler could it be? Anybody who buys ANY NEW ITEM is paying their taxes AS THEY BUY THE STUFF. No tax forms to fill out. If the states would do the same, that would mean that NOBODY has to fill out any income taxes forms any more.

The Flat Tax would be better than the tax code now, but you would still have the IRS. Also, the ones who are being paid in case (illegals, mob members, etc.) still won’t pay any taxes on income.

Your saying that the Fair Tax works on the assumption that there wouldn’t be any county or state taxes tells me you haven’t read the book, because the book says that the Fair Tax will only work down to the state level.

Keep in mind that the Fair Tax also takes care of the low income people, so that they get their money, but they could then make as much extra as they want to, thus giving them a reason to make as much MORE as they can, instead of not making enough to kick them off of welfare.

Two of the best reasons to go to the Fair Tax would be:

(1) Eliminate the IRS.

(2) Eliminate all of the welfare agencies. Nobody even knows how many agencies there are that give welfare to people, and none of them knows how much the individual is getting from the other agencies.

One way to tell if the Fair Tax would work is to look at the states that don’t have an income tax. You will find that most, if not all of them are doing better than the states that do. When a state taxes what a person spends, instead of what they make, the politicians of that state care more how their state’t economy is doing.

@retire05:

And why would anyone in their right mind want all the tax money laundered through the District of Criminals? — The locals can screw up just as bad — but much harder for them to hide!

@Budvarakbar: #8

What a fitting name; just like the Internal Redistribution Service.

@Smorgasbord: There are also “District of Corruption” and “Infernal Revenue Service”

@retire05: #1

The Fair Tax has nothing to do with state or local taxes. Nada. Zip.

State and local taxes would not be affected.

As for convoluted, I would rather deal with a simple point of sale tax whenever I go shopping than the massive, truly convoluted Federal tax code and it’s concomitant life-destroying penalties for simple errors.

As a bonus, Libs wouldn’t have to worry about their politicians being outed as tax cheats in charge… Al la Timothy Geitner, at Treasury…